4.3: Antitrust II: The Paradox

ECON 326 · Industrial Organization · Spring 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/IOs20

IOs20.classes.ryansafner.com

Antitrust II: The Paradox

Last class: The Laws, and evolution of legal & economic thinking

Today:

- Major areas of antitrust enforcement

- Monopolization

- Anticompetitive Agreements

- Mergers

- The Antitrust Paradox

- Antitrust as small-business protectionism

- Revisionist history of antitrust

Antitrust Areas: Monopolization

Monopolization

§2 of Sherman Act

Very rare for DOJ to bring monopolization suits, drag on for many years

Government must prove firm has:

- (a) power over price and output and

- (b) this comes from business decisions with the explicit goal to exclude competition

Monopolization

- Remedies:

- Horizontal divestiture: break up into separate horizontal competitors

- Vertical divestiture: break up into separate companies along supply chain

- Consent decrees: end anticompetitive practices like tying, predatory pricing, etc

- Sell off or license intellectual property (if this is the source of monopoly)

Monopolization

"The mere possession of monopoly power, and the concomitant charging of monopoly prices, is not only not unlawful; it is an important element of the free-market system. The opportunity to charge monopoly prices at least for a short period is what attracts business acumen in the first place; it induces risk taking that produces innovation and economic growth. To safeguard the incentive to innovate, the possession of monopoly power will not be found unlawful unless it is accompanied by an element of anticompetitive conduct.

Verizon Communications Inc., v. Law Offices of Curtis V. Trinko, LLP 540 U.S. 398 (2004)

Monopolization

"Firms may acquire monopoly power by establishing an infrastructure that renders them uniquely suited to serve their customers. Compelling such firms to share the source of their advantage is in some tension with the underlying purpose of antitrust law, since it may lessen the incentive for the monopolist, the rival, or both to invest in those economically beneficial facilities. Enforced sharing also requires antitrust courts to act as central planners, identifying the proper price, quantity, and other terms of dealing a role for which they are ill-suited. Moreover, compelling negotiation between competitors may facilitate the supreme evil of antitrust: collusion."

Verizon Communications Inc., v. Law Offices of Curtis V. Trinko, LLP 540 U.S. 398 (2004)

Monopolization

"Persons may unwittingly find themselves in possession of a monopoly, automatically so to say: that is, without having intending either to put an end to existing competition or to prevent competition from arising when none had existed: they may become monopolist by force of accident. Since the Act makes “monopolizing” a crime, as well as a civil wrong, it would be not only unfair, but presumably contrary to the intent of Congress, to include such instances. . . . A single producer may be the survivor out of group of active competitors, merely by virtue of his superior skill, foresight, and industry. . . . The successful competitor, having been urged to compete, must not be turned upon when he wins,"

United States v. Aluminum Company of America, 148 f.2d 416 (2d CIR. 1945)

Monopolization

"If that allegation states an antitrust claim at all, it does so under §2 of the Sherman Act, 15 U. S. C. §2, which declares that a firm shall not monopolize or attempt to monopolize. ... It is settled law that this offense requires, in addition to the possession of monopoly power in the relevant market, the willful acquisition or maintenance of that power as distinguished from growth or development as a consequence of a superior product, business acumen, or historic accident."

United States v. Grinnell Corp., 384 U. S. 563, 570571 (1966)

Recent Examples: United States v. AT&T

AT&T was protected as a natural monopoly through its Bell System network of companies for decades (another story for another lecture)

- sole provider of telephone service in nearly all of United States

In 1970s FCC suspected AT&T was using monopoly profits from its Western Electric subsidiary to subsidize the costs of its network

DOJ brought a monopolization case against AT&T in 1972

Recent Examples: United States v. AT&T

- 1982: AT&T and Government finalize a consent decree:

- Breakup of Bell system: AT&T's member telephone companies broke up into separate "Baby Bells" companies1

- AT&T keeps Western Electric, half of Bell Labs, and AT&T Long Distance

1 Most of which have since merged into Verizon, Sprint, and today's AT&T

Getting the Band Back Together

Recent Examples: U.S. v. IBM

U.S. filed antitrust lawsuit against IBM in 1969 under § 2 of the Sherman Act

Claimed IBM engaged in anticompetitive behaviors (among others):

- price discrimination such as giving away software services

- bundling software and hardware

- predatory pricing of specific hardware

30,000,000 pages of documents generated for the case, $200,000,000 spent, government dropped the case as "without merit" in 1982 (13 years later)

Recent Examples: United States v. Microsoft

Microsoft alleged to have bundled Internet Explorer with Microsoft Windows

- argued that IE was a feature not a separate product

DOJ disagreed, thought Microsoft violated §1 and §2 of Sherman Act

- sought to break up microsoft into two companies, one for OS, one for other software

Settlement in 2001: Microsoft must share its API for Windows, DOJ dropped its threats to break up

Antitrust Area: Exclusionary Agreements

Exclusionary Agreements

- The bulk of antitrust cases, §1 of Sherman Act:

"Every contract, combination in the form of trust or otherwise, or conspiracy, in restraint of trade or commerce among the several States, or with foreign nations, is hereby declared to be illegal..."

- Interpreted by courts as necessary to prove:

- Agreement, restraint of trade, unreasonableness

- Note without "unreasonableness" nearly all commercial contracts would be in trouble!

Exclusionary Agreements

Per se illegal: collusion, price-fixing, bid rigging, etc.

Rule of reason for everything else: price discrimination, resale price maintenance, exlusive dealing, tying, territorial restraints, etc

Recent Example: United States v. Apple Inc.

United States v. Apple Inc., 952 F. Supp. 2d 638 (S.D.N.Y. 2013)

Apple and 5 book publishers accused of ebook price-fixing

- Book publishers could sell on Amazon for $9.99, thought this was too low

- Apple launched its iBookstore and colluded with the publishers to charge $14.99 (same exact product, but group boycott of Amazon)

DOJ sued under §1 of the Sherman Act

- Publishers settled with DOJ, Apple went to court: $450 million fine

Predatory Pricing

Predatory pricing: firm charging below cost until existing competitors leave, then charge monopoly prices

- Limit pricing: pricing low enough to keep potential entrants out of the market

Areeda-Turner standard: price is predatory if it is below AVC

- They originally proposed short run marginal cost, but impossible to measure...

- Lots of economic debate about this, how to measure, etc.

Predatory Pricing: Problems

Predator needs to already have monopoly power ("deep pockets" or "long purse")

The predator loses a lot more than its competitors!

What about threat of "hit and run" competition? "Prey" simply leaves market until "predator" raises prices,

Cheaper to just buy your competitors instead of pricing them out!

Antitrust Area: Mergers

Mergers

Constant antitrust scrutiny by FTC and DOJ over proposed mergers and acqusitions over a certain size

- Clayton Act with HSR amendments

Mergers

Anti-competitive mergers: would substantially lessen competition or tend towards monopolization

- Two firms could make a collusive agreement to raise price OR

- One firm buys the other, then raises the price

Pro-competitive mergers: would reduce costs and prices, improve management, better bargaining power with suppliers, etc

- "Economies" (of scale) as a defense

Mergers

Key types of mergers:

Horizontal: between rival competitors in same market

Vertical: between firms along a supply chain

Conglomerate: between non-competing firms in separate markets

- Product extension: extends range of non-substitutable products a firms sells, "economies of scope"

- Market extension: extends markets of same good in different locations

- Pure: no obvious relationship

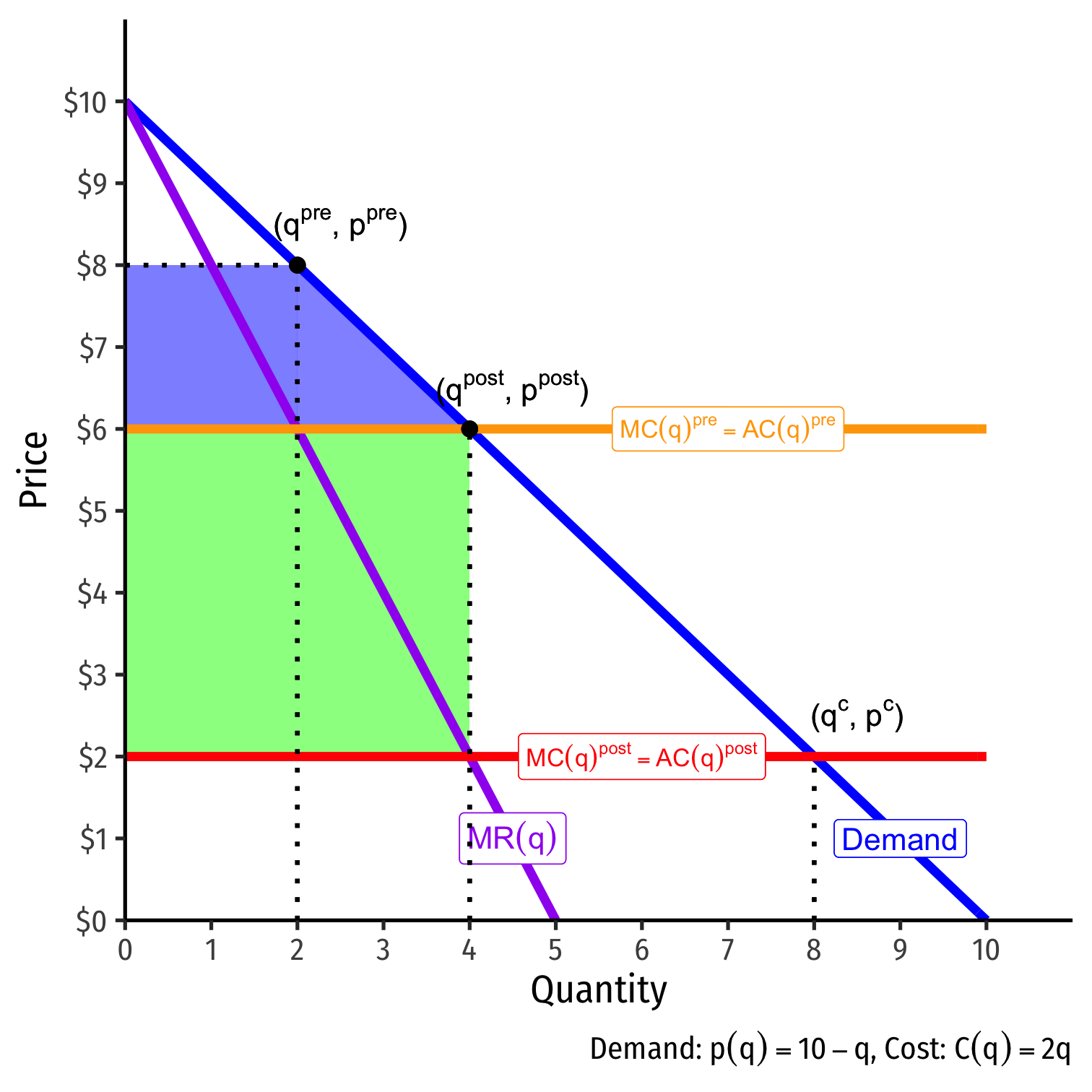

Pro-Competitive Merger Example

Merger may lower costs from pre-merger to most-merger levels

Increases profits to firm from cost savings

Increases consumer surplus

Reduces Deadweight Loss

Williamson, Oliver E, 1968, "Economies as an Antitrust Defense: The Welfare Tradeoffs, American Economic Review 58(1): 18-36

Merger Analysis

Consider two simple markets:

- Upstream Manufacturers, M1,M2,⋯Mn

- Downstream Retailers, R1,R2,⋯Rn

We will use this to consider the effects of various mergers

Start with competitive upstream and downstream markets

Vertical Merger

Vertical Merger between R1 and M1

- Legitimate reasons: asset specificity, postcontractual opportunism, etc

Still competitive in retail and manufacturing markets

Pro-competitive, probably approved

Horizontal Merger

Horizontal Merger between R1 and R2

- Legitimate reasons: economies of scale, cost reduction, bargaining power with M's

Still competitive in retail and manufacturing markets

Pro-competitive, probably approved

Horizontal Merger with Market Foreclosure

Horizontal Merger between R1 and R2

Leads to market foreclosure in retail

- Manufacturers only sell to R1+R2

- Other retailers can't get supply any more, go out of business

Anti-competitive, would be blocked

Vertical Merger with Market Foreclosure

- Suppose now there is market power in manufacturing, just M1, but competitive retail market

- (Ignore how the manufacturer got market power!)

Vertical Merger with Market Foreclosure

Vertical Merger between R1 and M1

Leads to market foreclosure in retail

- R1 only "buys from" M1

- Other retailers can't get supply any more, go out of business

Anti-competitive, would be blocked

Conglomerate Merger

- Now consider two different markets, A and B, each with their own

- manufacturers MA1,MA2,⋯MAn;MB1,MB2,⋯MBn

- retailers RA1,RA2,⋯RAn;RB1,RB2,⋯RBn

Conglomerate Merger

Conglomerate merger: two retailers RAn and RBn merge

- Legitimate reasons: expand to different (non-substitutable) products, expand same product to different territories, economies of scope

Still competitive in each retail and manufacturing markets

Pro-competitive, probably approved

Conglomerate Merger with Market Foreclosures

Conglomerate merger: two retailers RAn and RBn merge

Leads to market foreclosure in both industries

Anti-competitive, would be blocked

Mergers, A Summary

Not always obvious whether a merger is pro-competitive or anti-competitive!

Rule of reason, case-by-case analysis

Requires lots of data, forecasting, economic models and econometrics done by firms, consultants, and government agencies

Merger History and Merger Waves

The Paradox of Antitrust

Robert Bork and the Paradox of Antitrust

Robert Bork

1927-2012

U.S. Solicitor General (1973-1977)

Judge on U.S. Court of Appeals for the D.C. Circuit (1982-1988)

1987 nominee for U.S. Supreme Court (Senate voted down his nomination)

Influenced by (second generation) Chicago School of economics

Robert Bork and the Paradox of Antitrust

1978 Paradox of Antitrust

Antitrust law and enforcement consists of a conflict of interests:

- Consumer welfare

- Protectionism for small businesses

Antitrust law protects some businesses by restraining competition

- restraining largest businesses because they are "too big"

- might be that they are the most efficienct!

Robert Bork and the Paradox of Antitrust

"Antitrust is valuable because in some cases it can achieve results more rapidly than can market forces. We need not suffer loses while waiting for the market to erode cartels and monopolistic mergers," (p.311)

"The only goal that should guide the interpretation of the antitrust laws is the welfare of consumers," (p.405)

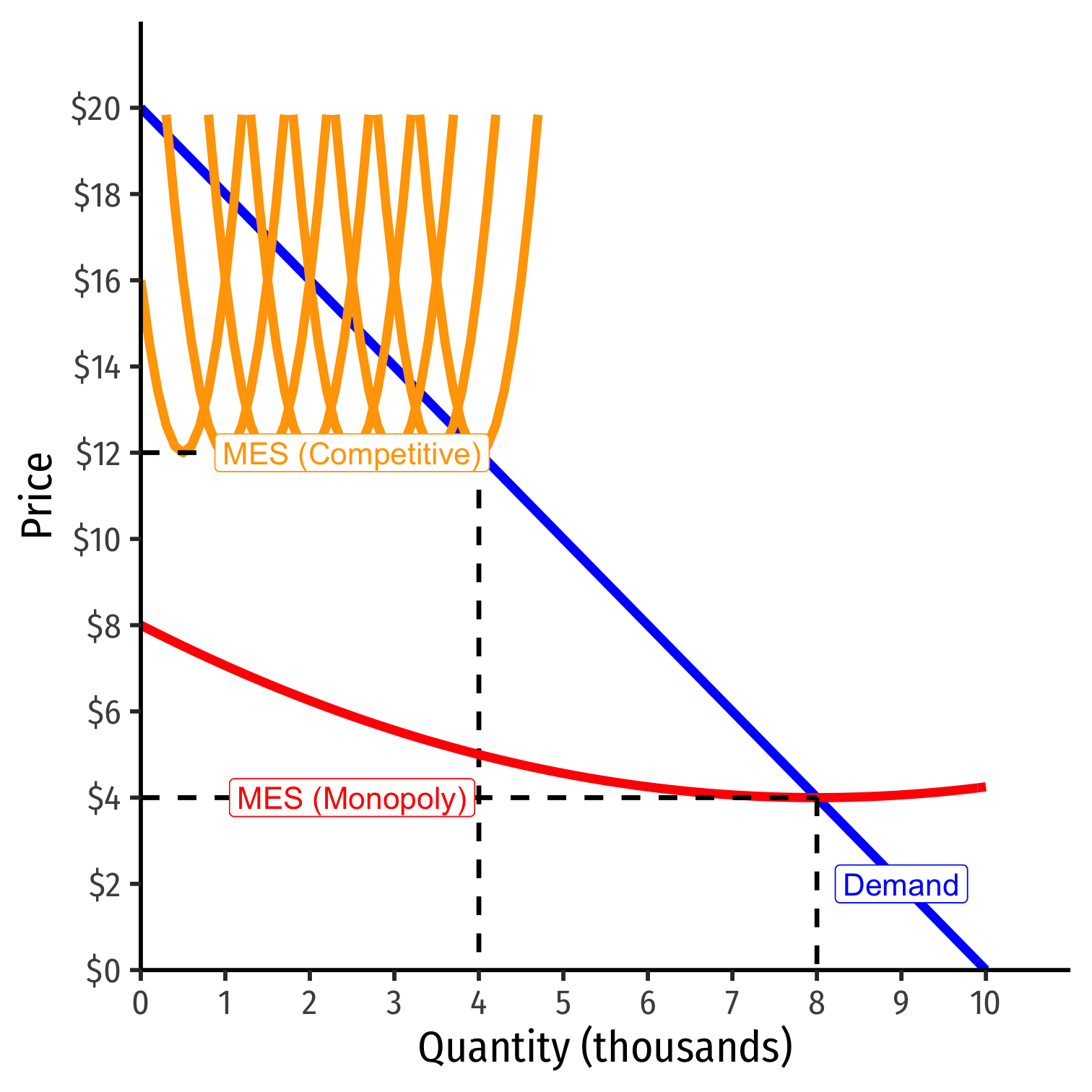

Minimum Efficient Scale

Industries with large minimum efficient scale (MES) and economies of scale, few large firm(s) can serve industry more efficiently than many competitive firms

Antitrust enforcement forces less efficient "perfect competition" on this industry by restraining the large firm(s)

Private Antitrust

Recall in private civil cases, a successful antitrust claim can earn the plaintiff treble damages against defendant

Strong incentives for firms to sue their competitors for antitrust violations!

Antitrust enforcement can be a form of rent-seeking by smaller firms against larger firms

Proscriptions for Antitrust Policy

Some practices (overt collusion or cartelization) clearly hurt consumers: price-fixing, geographic market division, mergers that create monopolies

But many seemingly anti-competitive practices are pro-competitive and benefit consumers:

- price discrimination, tying, bundling, vertical contractual restraints, etc.

- think of lectures 3.3, 3.4 for pro-competitive, efficiency reasons for these practices

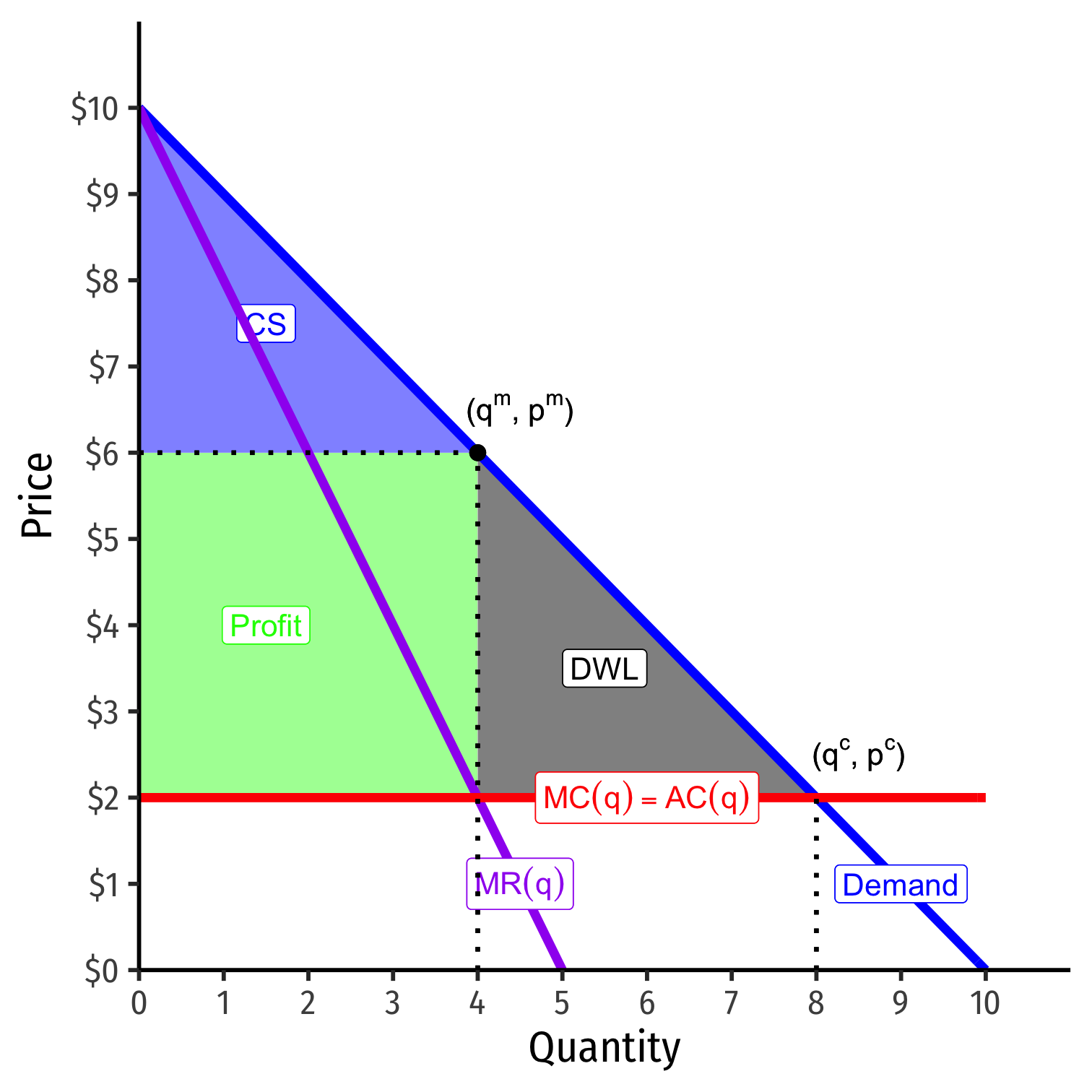

Consumer Welfare Standard

Think about the Supreme Court's test from Standard Oil Co. of New Jersey v. United States:

An "unduly" contract "in restraint of trade" results in "monopoly or its consequences":

- higher prices

- reduced output

- reduced quality

Not-Clear Cases

Suppose several firms launch a price war against one another

Probably bad for the competitors in the industry

- Could argue "predatory pricing"...

But are price wars bad for the consumer??

Antitrust should protect competition not the competitors!

Your Prescriptions Probably Come from Your Priors

A lot of answers in these less clear-cut cases depend on your priors:

Proponents of free markets: markets sort these things out through creative destruction, competitors will undercut big businesses, consumers will benefit, no need to intervene

Proponents of government intervention: markets often don't work well, big businesses will suppress competition, need to intervene to fix market failures

Historical Revisionism of the Gilded Age

Historical Puzzles

George Stigler

1911-1991

Economics Nobel 1982

"For much too long a time students of the history of antitrust policy have been at least midly perplexed by the coolness with which American economists greeted the Sherman Act. Was not the nineteenth century the period in which the benevolent effects of competition were most widely extolled? Should not a profession praise a Congress which seeks to legislate its textbook assumptions into practice? And with even modest foresight, should not the economists have foreseen that the Sherman Act would put more into economists' purses than perhaps any other law ever passed?," (1).

Stigler, George J, (1982), "The Economists and the Problem of Monopoly," American Economic Review 72(2):1-11

Quoted in

DiLorenzo, Thomas J and Jack C High, 1988, "Antitrust and Competition, Historically Considered," Economic Inquiry 26(3):423-435

"New Learning" in Industrial Organization

"A clue to a more satisfactory explanation may be found in the 'new learning' of industrial organization. Much of this learning doubts that antitrust law promotes competition. Brozen (1982, 14) for example, concludes that antitrust laws ' are themselves restraining output and the growth of productivty.' Harold Demsetz has said that if certain policies were continued, he would favor outright repeal of the Sherman Act...MsGee (1971,16) for example says, ' for a variety of reasons, it is simply not correct to assume that atomistic competition is the ultimate policy goal; or to regard departures from that kind of competition as necessarily bad."...Johnson (1983,3) writes '...the competitive model of economic theory not only offers littled guidance [for antitrust law], but actually points us in the wrong direction. The confusion arises because many economists fail to realize that the 'competitive model' is silent on the subject of competition,' (DiLorezno and High, 1988: 424)

"...the current empirical record of antitrust enforcement [in improving consumer welfare] is weak," (Crandall and Winston, 2003: 3)

DiLorenzo, Thomas J and Jack C High, 1988, "Antitrust and Competition, Historically Considered," Economic Inquiry 26(3):423-435

Crandall, Robert W and Clifford Winston, 2003, "Does Antitrust Policy Improve Consumer Welfare? Assessing the Evidence," Journal of Economic Perspectives 17(4): 3-26

Economists Were Skeptical of the Sherman Act

"There is no doubt that economists at the turn of the [20th] century looked upon competition as a process of enterprise and rivalry [rather than the 'perfect competition model'], and that they disapproved of antitrust law...If our thesis is correct, economists owe special attention to the meaning they attach to competition...[i]f these conclusions [based on perfect competition] are substantially different from conclusions based on rivalry, then the competitive model has very likely misdirected the profession, at least as far as antitrust policy is concernced" (p.432-433).

DiLorenzo, Thomas J and Jack C High, 1988, "Antitrust and Competition, Historically Considered," Economic Inquiry 26(3):423-435

The Standard Story: The Robber Barons

The Standard Oil Case

The Standard Oil Case

"The Standard Oil case of 1911 is a landmark in the development of antitrust law. But it is more than a famous law case: it created a legend. The firm whose history it relates to became the archetype of predatory monopoly," (p.137)

"According to most accounts, the Standard Oil Co. of New Jersey established an oil refining monopoly in the United States, in large part through the systematic use of predatory price discrimination. Standard struck down its competitors, in one market at a time, until it enjoyed a monopoly position everywhere. Similarly, it preserved its monopoly by cutting prices selectively wherever competitors dared enter...The main trouble with this 'history' is that it is logically deficient, and I can find little or no evidence to support it," (p.138).

McGee, John S, 1958, "Predatory Price Cutting: The Standard Oil (N.J.) Case," Journal of Law and Economics 1: 137-169

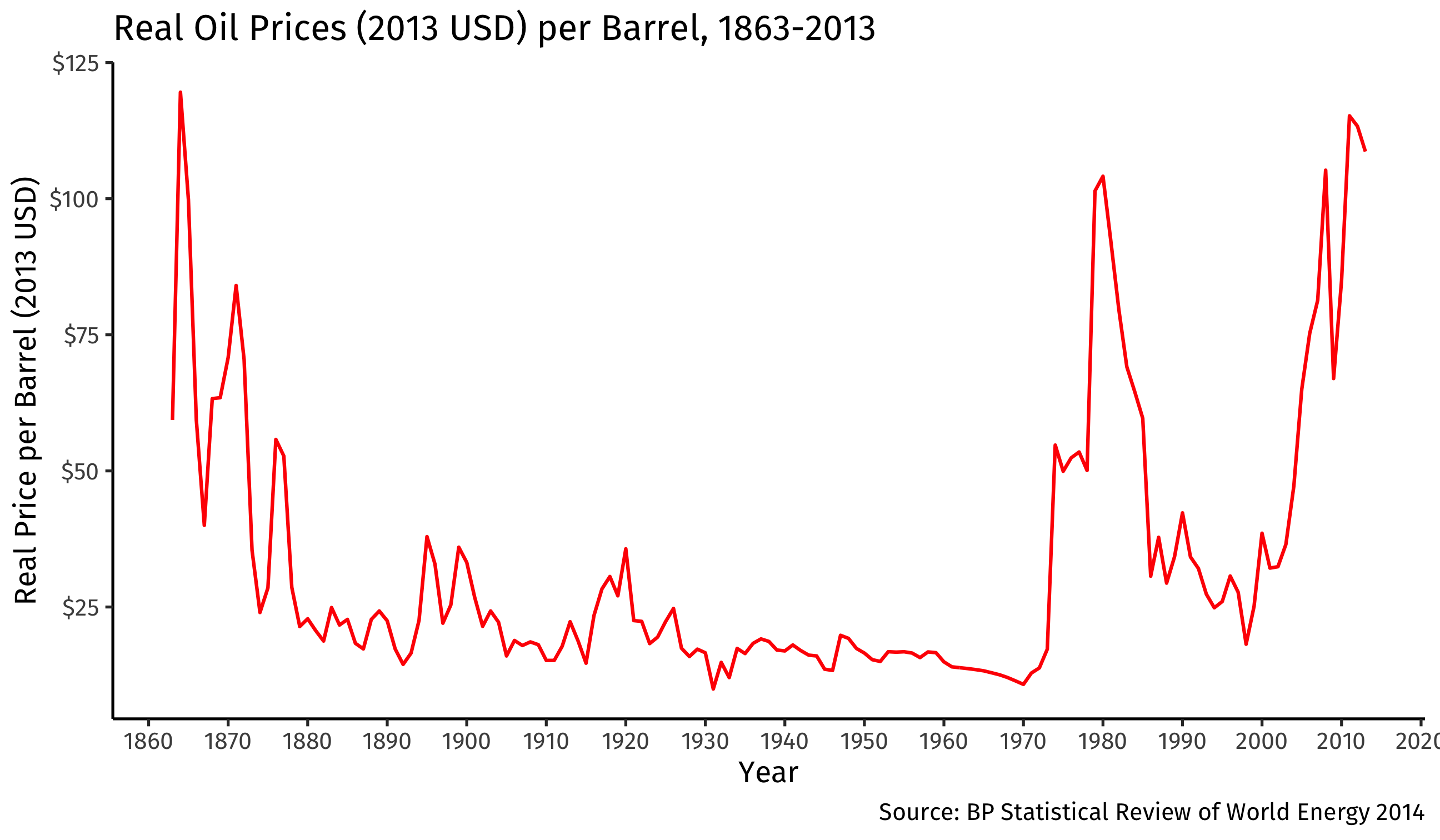

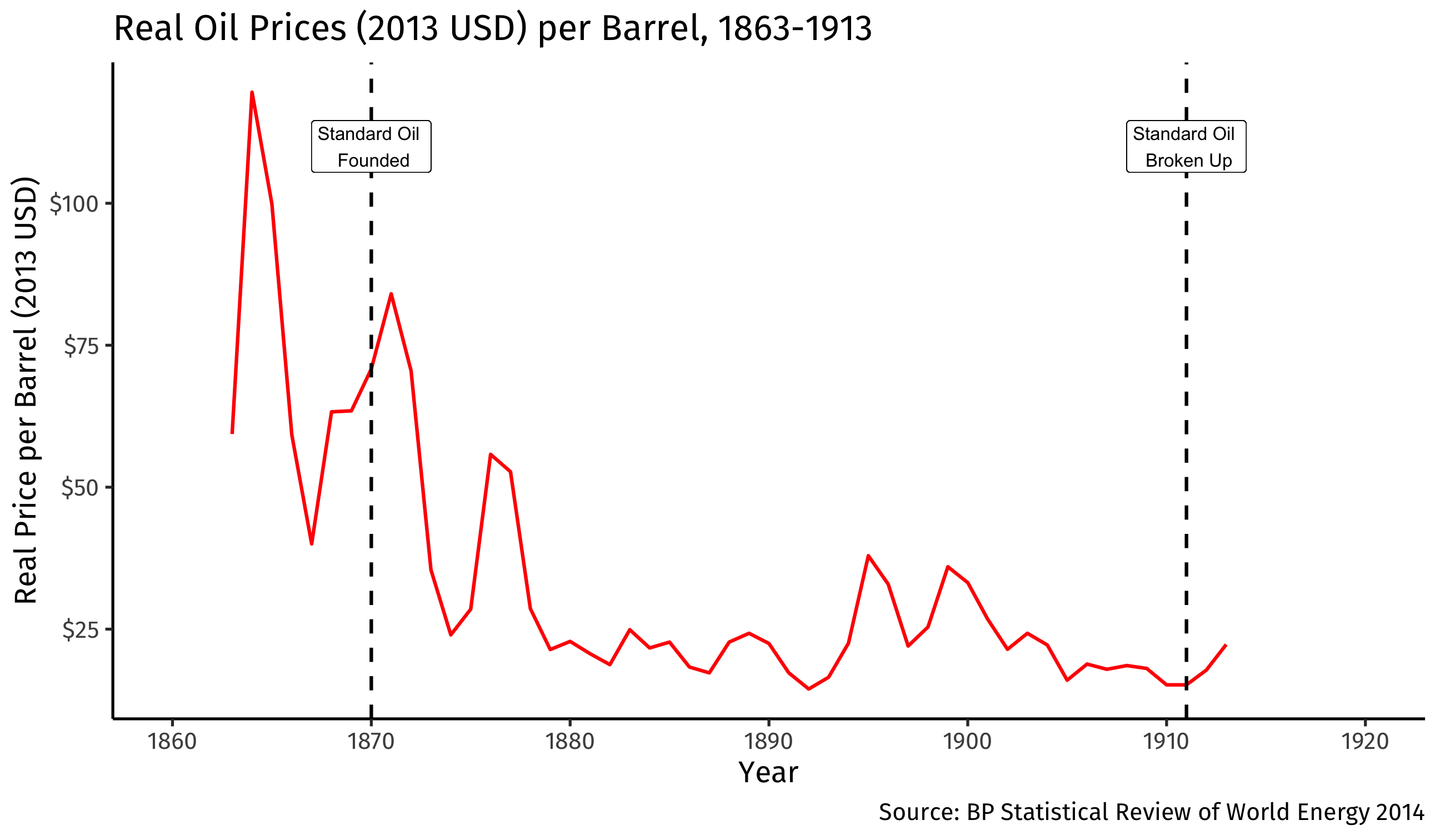

Real Oil Prices

Real Oil Prices

Changes in Price Under the Pre-Sherman Act "Trusts"

DiLorenzo, Thomas J, 1985, "The Origins of Antitrust: An Interest-Group Perspective," International Review of Law and Economics 5:73-90

Changes in Price Under the Pre-Sherman Act "Trusts"

DiLorenzo, Thomas J, 1985, "Competition, Except Where Prohibited By Law," Reason Magazine February

Changes in Price Under the Pre-Sherman Act "Trusts"

"...I compiled from the Congressional Record of the 51st Congress a list of industries that were accused of being monopolized by trusts. The graph...shows the industries for which data on output from 1880 to 1900 are available...of the 17 industries, there were increases in output...in all but two industries, matches and castor oil...In addition, output in these industries generally expanded more rapidly than output in other industries during the 10 years leading up to the first trust-busting legislation," (p.35).

DiLorenzo, Thomas J, 1985, "Competition, Except Where Prohibited By Law," Reason Magazine February

Changes in Price Under the Pre-Sherman Act "Trusts"

"And predictably, prices in these industries were generally falling, not rising, even when compared to the declining general price level. For example, the average price of steel rails fell from $58 to $32 between 1880 and 1890, or by 53 percent. The price of refined sugar fell from 9 cents per pound in 1880 to 7 cents in 1890 and to 4.5 cents in 1900; the price oflead dropped from $5.04 per pound in 1880 to $4.41 in 1890; and zinc fell from $5.51 per pound to $4.40...Perhaps the most widely attacked trusts were those in the sugar and petroleum industries. But there is evidence that the effect of these combinations or mergers was to reduce the prices of sugar and petroleum," (pp.35-36)

DiLorenzo, Thomas J, 1985, "Competition, Except Where Prohibited By Law," Reason Magazine February

Antitrust As Rent-Seeking

"The political impetus for some kind of antitrust law came from the farm lobbies of mostly midwestern, agricultural states, such as Missouri. Rural cattlemen and butchers were especially eager to have statutes enacted that would thwart competition from the newly centralized meat processing facilities in Chicago. The evidence on price and output in these industries, moreover, does not support the conjecture that these industries suffered from a monopoly in the late nineteenth century, if monopoly is understood in the conventional neoclassical way as an organization of industry which tends to restrict output and raise prices. These industries were fiercely competitive because of relatively free entry and rapid technological advances such as refrigeration," (p.93)

Boudreaux, Donald J and Thomas J DiLorenzo, 1993, "The Protectionist Roots of Antitrust," Review of Austrian Economics 6(2):81-96

Antitrust As Rent-Seeking

"...[F]or over a century the antitrust laws have been used to thwart competition by providing a vehicle for uncompetitive businesses to sue their competitors for cutting prices, innovating new products and processes, and expanding output," (p.93)

Boudreaux, Donald J and Thomas J DiLorenzo, 1993, "The Protectionist Roots of Antitrust," Review of Austrian Economics 6(2):81-96

Antitrust Abuses

Historical Revisionism of Antitrust and Progressive Era

"[B]ecause of their inability to maintain their cartels [prior to the ICC], railroads were big supporters of the [Interstate Commerce Act] because the newly-formed ICC could coordinate cartel prices...Using the new law as authority, the railroads revamped their freight classification, raised rates, eliminated passes and fare reductions, and revised less than carload rates on all types of goods, including groceries."

Kolko, Gabriel, 1963, The Triumph of Conservatism: A Reinterpretation of American History, 1900-1916

Historical Revisionism of Antitrust and Progressive Era

Gabriel Kolko

1932-2014

"[The Progressive idea was the] political rationalization of business and industrial conditions, a movement that operated on the assumption that general welfare of the community could be served best by satisfying the concrete needs of business...it is business control over politics (and by the 'business' I mean the major economic interests) rather than political regulation of the economy that is the significant phenomenon of the Progressive era." (pp.2-3)

Kolko, Gabriel, 1963, The Triumph of Conservatism: A Reinterpretation of American History, 1900-1916

Historical Revisionism of Antitrust and Progressive Era

Gabriel Kolko

1932-2014

"[T]he regulation itself was invariably controlled by the leaders of the regulated industry, and directed towards ends they deemed acceptable and desirable," (p.3)

"[C]ompetition was unacceptable to many key business and financial interests, and the merger movement was to a large extent a reflection of voluntary, unsuccessful business efforts to bring irresistible competitive trends under control," (p.4)

"[I]t was not the existence of monopoly that caused the federal government to intervene in the economy, but the lack of it," (p.5)

Kolko, Gabriel, 1963, The Triumph of Conservatism: A Reinterpretation of American History, 1900-1916

Historical Revisionism of Antitrust and Progressive Era

Gabriel Kolko

1932-2014

"the new laws attacking unfair competitors and price discrimination meant that government would now make it possible for many trade associations to stabilize, for the first time, prices within their industries, and to make effective oligopoly a new phase of the economy," (p.268)

Kolko, Gabriel, 1963, The Triumph of Conservatism: A Reinterpretation of American History, 1900-1916