4.1: Measuring Market Power

ECON 326 · Industrial Organization · Spring 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/IOs20

IOs20.classes.ryansafner.com

Measuring Market Power

Recall, market power is the ability of a firm to raise p>MC

Measures of market concentration

- Concentration Ratios

- Herfindahl-Hirschman Index

Measures of markup pricing

- Lerner Index

The New Empirical Industrial Organization

- importance of econometrics

Market Concentration

Real world markets fall between the polar extremes of our models of perfect competition and monopoly

Concentration measures allow us to gauge the proximity of a market to either extreme

- Easy to compare

- Assist in market regulation

Often ∈[0,1]

- 0 ⟹ perfect comepetition

- 1 ⟹ monopoly

Market Concentration Measures

- Good measure of market concentration meets:

Principle of Transfer of Sales: a transfer of sales from a small firm to a large firm should increase concentration

Entry condition: entry (exit) of a small firm (holding constant the relative shares of existing firms) should decrease (increase) concentration

Merger condition: merger of 2 or more firms should increase concentration

- Transfer of sales + exit of smallest firm (each raises concentration)

Measuring Market Concentration: Concentration Ratio

- An industry's concentration ratio (CR) adds the market share of the largest n firms, e.g.

CRn=n∑i=1si

- where si=qiQ, that firm's fraction of total industry sales

- Common concentration ratios:

- CR4

- CR8

Market Concentration: The Film Industry

| Rank | Studio | Releases | Tickets | Sales | Share |

|---|---|---|---|---|---|

| 1 | Walt Disney | 13 | 410,812,035 | $3,742,497,656 | 0.3315 |

| 2 | Warner Bros. | 43 | 172,395,261 | $1,570,520,862 | 0.1391 |

| 3 | Sony Pictures | 24 | 150,913,744 | $1,374,824,330 | 0.1218 |

| 4 | Universal | 26 | 143,128,035 | $1,303,896,396 | 0.1155 |

| 5 | Lionsgate | 21 | 87,579,701 | $797,851,162 | 0.0707 |

| 6 | Paramount | 11 | 61,899,898 | $563,908,126 | 0.0499 |

| 7 | 20thC. Fox | 13 | 54,024,024 | $492,158,921 | 0.0436 |

Measuring Market Concentration: Concentration Ratio

| Rank | Studio | Share |

|---|---|---|

| 1 | Walt Disney | 0.3315 |

| 2 | Warner Bros. | 0.1391 |

| 3 | Sony Pictures | 0.1218 |

| 4 | Universal | 0.1155 |

| 5 | Lionsgate | 0.0707 |

| 6 | Paramount | 0.0499 |

| 7 | 20thC. Fox | 0.0436 |

CR2=2∑i=1=0.4706

CR3=3∑i=1=0.5924

CR4=4∑i=1=0.7079

CR7=7∑i=1=0.8721

Measuring Market Concentration: Concentration Ratio

Problems with CR's:

n is arbitrarily chosen (2? 4? 8?)

Does not follow transfer of sales principle

- e.g. Firm 1 gaining 0.20 and Firm 3 and 4 each losing 0.10 doesn't change CR4!

No weighting by size

Measuring Market Concentration: Concentration Ratio

Example: Take industry A with

| Firm | Market Share |

|---|---|

| 1 | 0.60 |

| 2 | 0.10 |

| 3 | 0.05 |

| 4 | 0.05 |

| 5 | 0.05 |

CR4=0.80

Example: Take industry B with

| Firm | Market Share |

|---|---|

| 1 | 0.20 |

| 2 | 0.20 |

| 3 | 0.20 |

| 4 | 0.20 |

| 5 | 0.20 |

CR4=0.80

Measuring Market Concentration: HHI

- Herfindal-Hirschman Index (HHI): measures the sum of the squares of market share of all firms in an industry

HHI=n∑i=1s2i

- Where si=qiQ

- Why squared? Gives more weight to firms with more market share (unlike CR)

Measuring Market Concentration: HHI

HHI∈[0,1]

Monopoly HHI=1

Perfect competition: HHI=1n→0

- n firms of equal size

Measuring Market Concentration: HHI

Example: Take industry A with

| Firm | Market Share |

|---|---|

| 1 | 0.60 |

| 2 | 0.10 |

| 3 | 0.05 |

| 4 | 0.05 |

| 5 | 0.05 |

CR4=0.80

HHI=0.602+0.102+0.052+0.052+0.052=0.385

Example: Take industry B with

| Firm | Market Share |

|---|---|

| 1 | 0.20 |

| 2 | 0.20 |

| 3 | 0.20 |

| 4 | 0.20 |

| 5 | 0.20 |

CR4=0.80

HHI=0.202+0.202+0.202+0.202+0.202=0.20=1/5

Measuring Market Concentration: HHI

- Equivalent number n∗, number of equal-sized firms in a hypothetical market that would give rise to the same HHI as observed

n∗=1HHI

HHI=0.2⟹1HHI=5 equal sized firms

HHI=0.8⟹1HHI=1.25 equal sized firms

Measuring Market Concentration: HHI

HHI (in percentages)=10,000n∑i=1s2i

HHI is often measured in percentage form by U.S. antitrust authorities

- Market shares as percentages instead of decimals

Here, HHI∈[0,10,000]

- Monopoly: HHI = 10,000, 1 firm with 100% market share ⟹1002=10,000)

Measuring Market Concentration: HHI

Example: Take industry A with

| Firm | Market Share |

|---|---|

| 1 | 60% |

| 2 | 10% |

| 3 | 5% |

| 4 | 5% |

| 5 | 5% |

HHI=602+102+52+52+52=3,775

Example: Take industry B with

| Firm | Market Share |

|---|---|

| 1 | 20% |

| 2 | 20% |

| 3 | 20% |

| 4 | 20% |

| 5 | 20% |

HHI=202+202+202+202+202=2,000(=10,0005)

Measuring Market Concentration: HHI

- If two firms, with market share s1 and s2, merge, HHI increases by (s1+s2)2−s21−s22=2s1s2

Measuring Market Concentration: HHI

Before Firms 1 and 2 Merge

| Firm | Market Share |

|---|---|

| 1 | 60% |

| 2 | 10% |

| 3 | 5% |

| 4 | 5% |

| 5 | 5% |

HHIpre=3,775

After Firms 1 and 2 Merge

| Firm | Market Share |

|---|---|

| 1 | 70% |

| 2 | 5% |

| 3 | 5% |

| 4 | 5% |

HHIpost=4,975

ΔHHI=1,200=(2×60×10)

Measuring Markups

Recall: Lerner Index and Inverse Elasticity Rule

- Lerner Index measures market power as % of firm's price that is markup above MC(q)

L=p−MC(q)p=−1ϵD

- i.e. L×100% of firm's price is markup

- L=0⟹ perfect competition

- (since P=MC)

- As L→1⟹ more market power

Recall: Lerner Index and Inverse Elasticity Rule

L=p−MCp=−1ϵD

This simple formula only works for a monopoly (n=1)!

Lerner Index and Cournot Theorem

- Consider Cournot competition between n firms with identical costs MCi, the Lerner index actually becomes:

L=p−MCip=−siϵD

Where si=qiQ

- Note monopoly is special case where qiQ=1!

Lerner Index and Cournot Theorem

L=p−MCip=−siϵD

Alternatively, since si=1n:

L=p−MCip=−1nϵD

Lerner Index and Cournot Theorem

L=p−MCip=−siϵD=−1nϵD

Market power is inversely related to price elasticity of demand

- Larger (smaller) ϵ, smaller (larger) markup p−MC

Market power is inversely related to the number of competitors

- Greater number of competitors ↑n, smaller si, and hence less market power

Lerner Index and Cournot Theorem

n∑i=1sip−MCip=−∑ni=1s2iϵD=−HHIϵD

Can add up all of the market-share-weighted markups

Equivalent to HHI divided by price elasticity

Some Estimates

Some Estimates

DOJ on HHI

"The agencies generally consider markets in which the HHI is between 1,500 and 2,500 points to be moderately concentrated, and consider markets in which the HHI is in excess of 2,500 points to be highly concentrated.

"Transactions that increase the HHI by more than 200 points in highly concentrated markets are presumed likely to enhance market power under the Horizontal Merger Guidelines issued by the Department of Justice and the Federal Trade Commission."

Department of Justice, 2017, HHI

Market Definition

Shortcomings of Market Concentration Measures

Measures crucially rest on the definition of the industry or market

Product dimension: which products do consumers see as substitutes?

Geographic dimension: where are firms that produce similar products? (supply-side substitutes)

Differentiated products ⟹ imperfect substitutes

Often include all products that have significant cross-price elasticity of demand

Industry Classification

NAICS used by statistical agencies such as the U.S. Census to classify industries

Places production into one of 1,004 4-digit industries, defined nationally

Do not accurately correspond to economic markets

- May include some products clearly not substitutes, or leave out some products that clearly are substitutes

- Hence, should not be assumed to match properly with HHI measures

Market Definition

"The Agencies employ the hypothetical monopolist test to evaluate whether groups of products in candidate markets are sufficiently broad to constitute relevant antitrust markets. The Agencies use the hypothetical monopolist test to identify a set of products that are reasonably interchangeable with a product sold by one of the merging firms.

Department of Justice, 2010, Horizontal Merger Guidlines

Market Definition

"The hypothetical monopolist test requires that a product market contain enough substitute products so that it could be subject to post-merger exercise of market power significantly exceeding that existing absent the merger. Specifically, the test requires that a hypothetical profit-maximizing firm, not subject to price regulation, that was the only present and future seller of those products ('hypothetical monopolist') likely would impose at least a small but significant and non-transitory increase in price ('SSNIP') on at least one product in the market, including at least one product sold by one of the merging firms. For the purpose of analyzing this issue, the terms of sale of products outside the candidate market are held constant. The SSNIP is employed solely as a methodological tool for performing the hypothetical monopolist test; it is not a tolerance level for price increases resulting from a merger."

Department of Justice, 2010, Horizontal Merger Guidlines

Market Defintion

Starting in 1982, Department of Justice began defining an "antitrust market" to solve some of these problems

Determined by a "hypothetical monopolist test": a set of products and a geographic area where a single seller would be able to exert significant market power (raise price)

Specifically, a "small but significant and nontransitory increase in price" (SSNIP) of 5% for 1 year

Courts regularly talk about cross-price elasticities of demand in antitrust cases!

The Courts on Cross-Price Elasticity of Demand

For every product substitutes exist. But a relevant market cannot meaningfully encompass that infinite a range. The circle must be drawn narrowly to exclude any other product to which, within reasonable variations in price, only a limited number of buyers will turn; in technical terms, products whose 'cross-elasticities of demand' are small," Times-Picayune Publishing v. United States, 345 U.S. 594 at 621 n. 31 (1953)

"Every manufacturer is the sole producer of the particular commodity it makes but its control in the above sense of the relevant market depends on the availability of alternative commodities for buyers: i.e., whether there is a cross-elasticity of demand between cellophane and the other wrappings," U.S. v. E. I. du Pont de Nemours &. Co., 351 U.S. 377 (1956))

"Cross-price elasticity is a more useful tool than own-price elasticity in defining a relevant antitrust market. Cross-price elasticity estimates tell one where the lost sales will go when the price is raised, while own-price elasticity estimates simply tell one that a price increase would cause a decline in volume," New York v. Kraft General Foods, 926 F. Supp. 321 (1995)

Can We Measure Market Power from Prices?

Can We Measure Market Power from Prices?

- Can we tell a collusive market from a competitive one?

L=p−MCp=−1ϵD

We can only observe p's and q's

Could be Bertrand price competition, firms setting p=MC

- Or it could be a cartel splitting monopoly profits by fixing the price

Data problems: we never know MC!

Empirical Challenge: Identifying Market Power from Prices

L=p−MCp

Imagine we observe a market with n sellers all charging price p and selling quantity q

Two possible explanations:

- The market is competitive, and all firms are charging p=MC

- The market is a cartel, and all firms are marking up p>MC

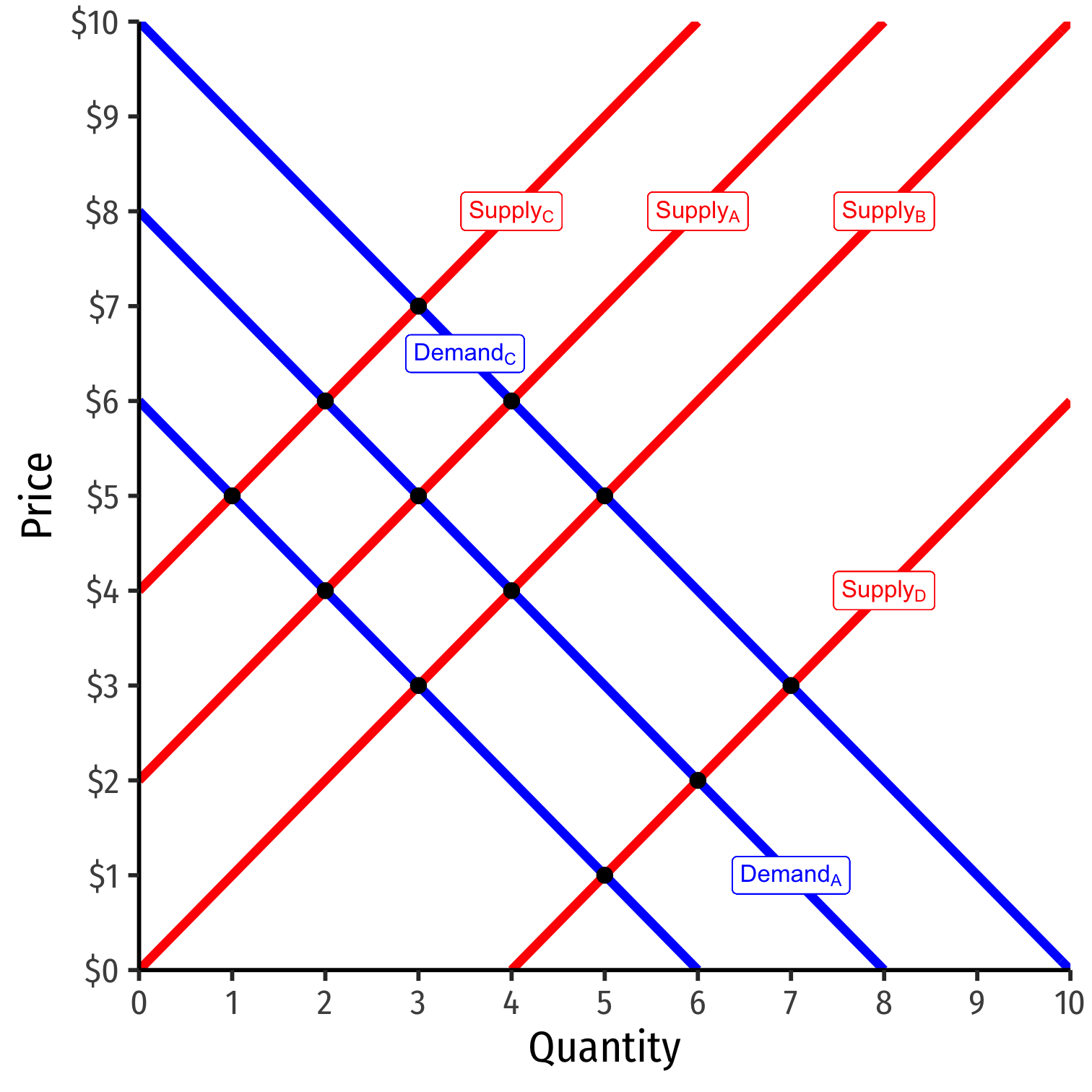

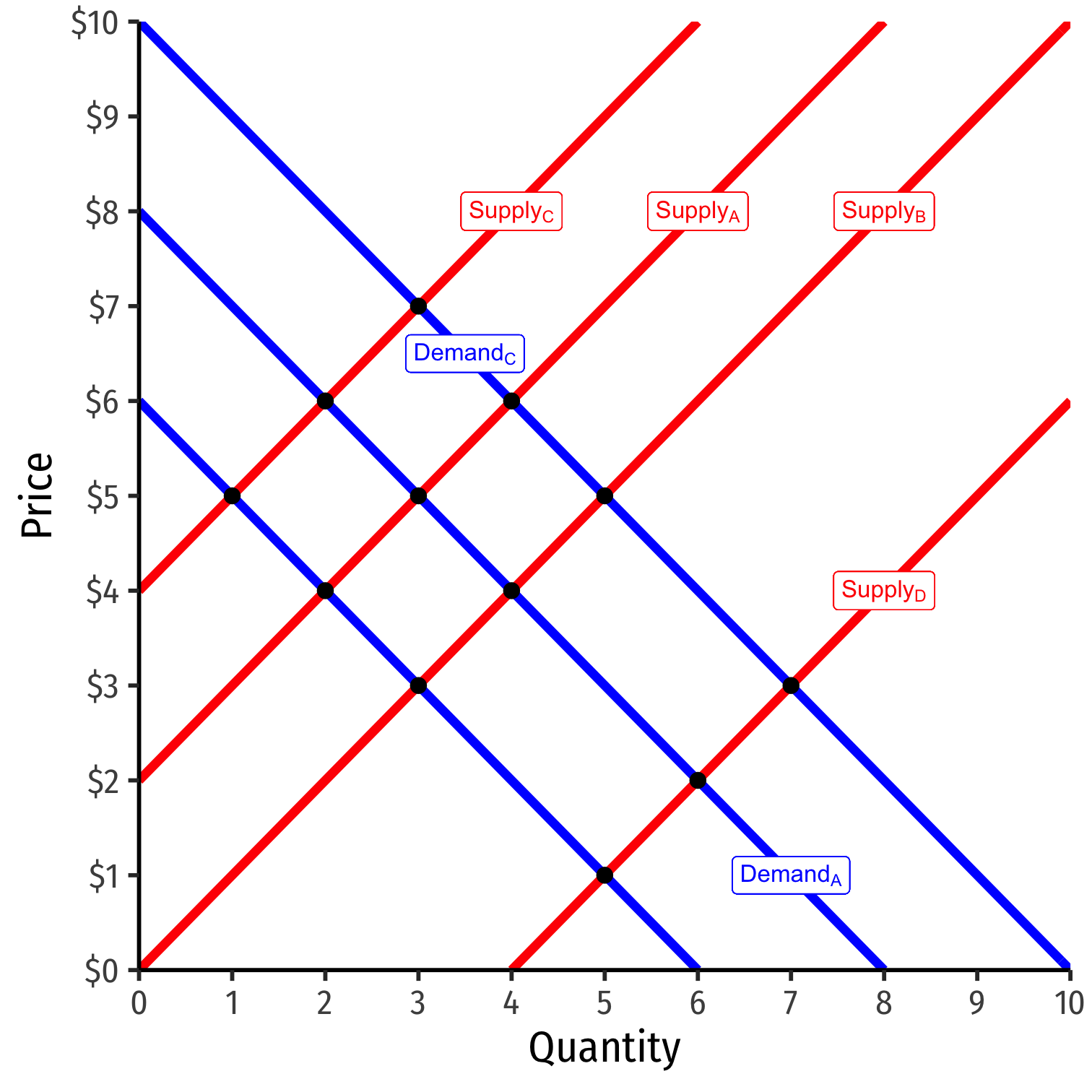

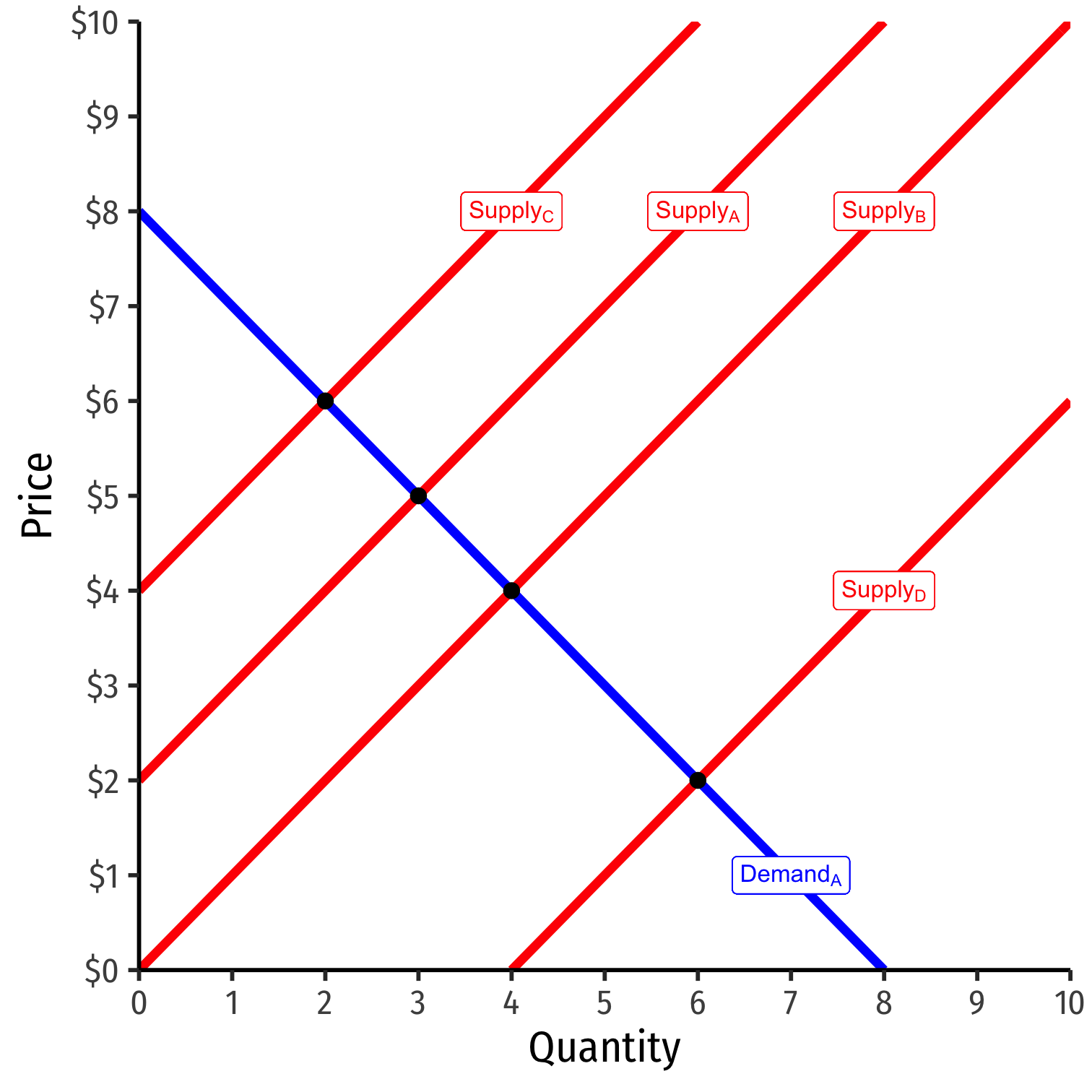

Empirical Challenge: Identifying Market Power from Prices

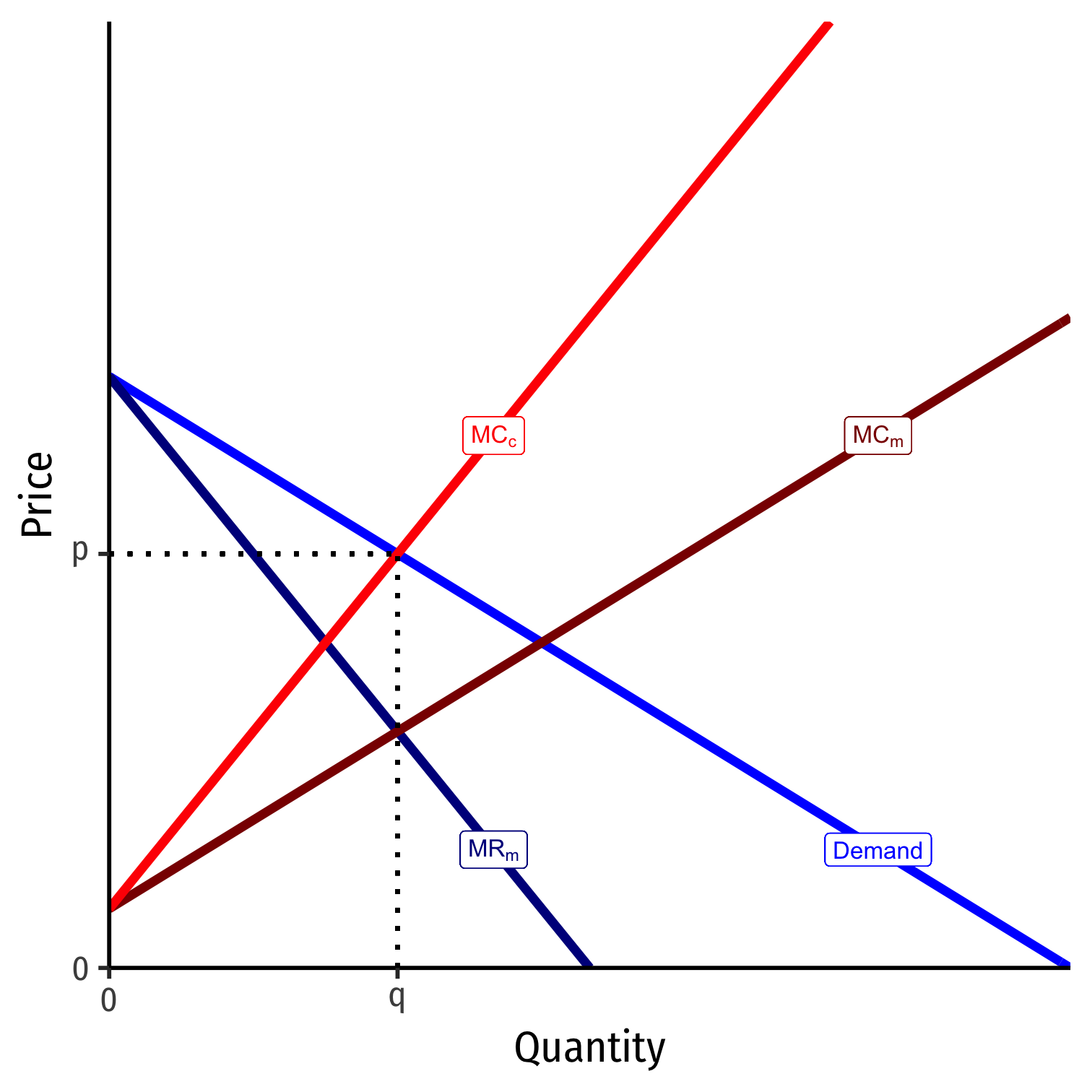

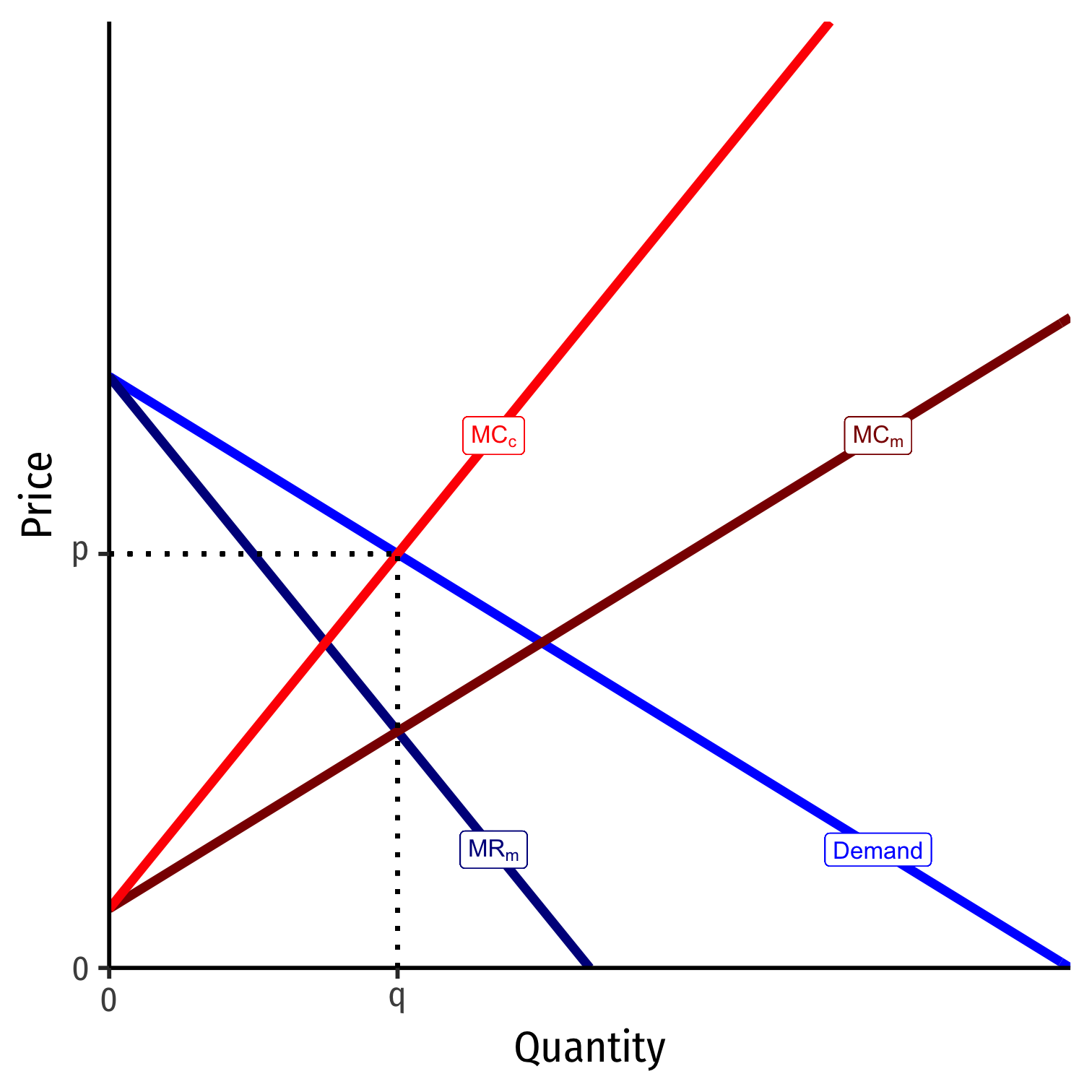

- We can rationalize each explanation as follows:

Competitive firms have (higher) MCc and are setting it equal to demand to get p at quantity q

Cartel has (lower) MCm at quantity q, sets it equal to MRM=m, marking price up to p

Empirical Challenge: Identifying Market Power from Prices

- What if Demand shifts to Demand 2? Same problem!

Competitive firms set MCc equal to new demand 2 to get p2 at q2

Cartel sets MCM equal to new MRM2 at q2, mark up to p2

- Changes in demand cannot identify market power

Empirical Challenge: Identifying Market Power from Prices

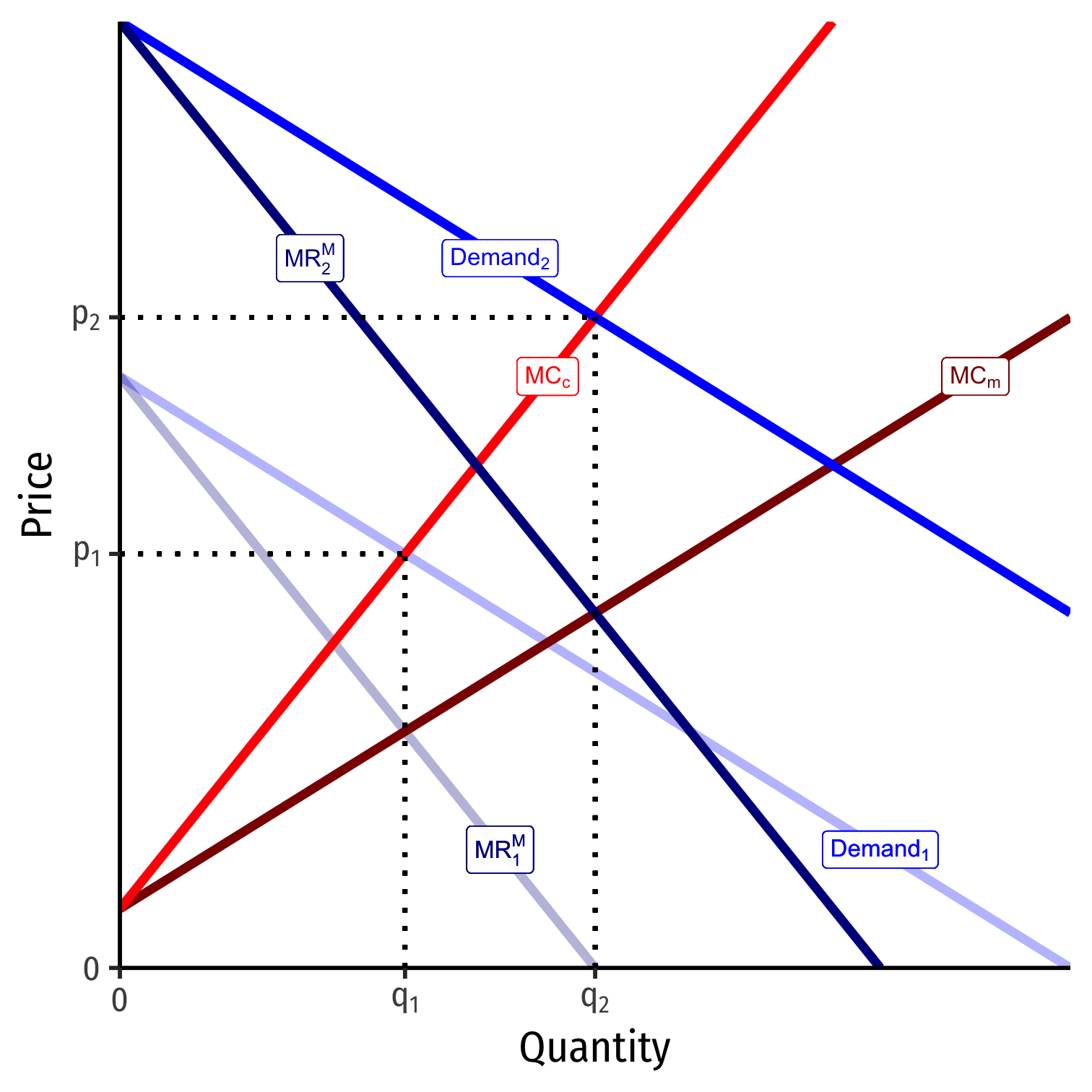

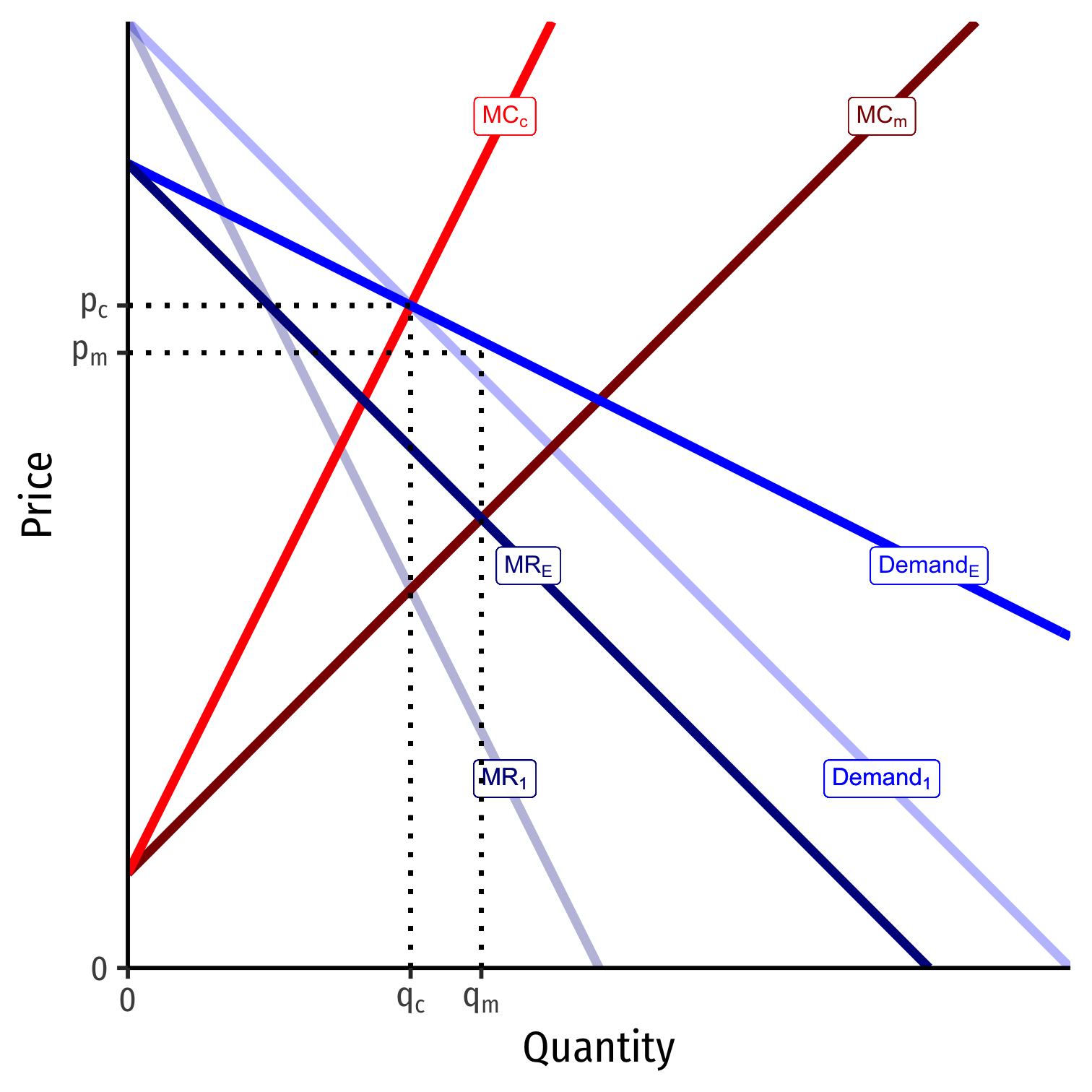

Potential solution famously identified by Bresnahan (1982):

If demand rotates around a price (i.e. becomes more elastic)

Competitive firms don't change p or q (MCc still intersects Demand at same point!)

Cartel changes to pm and qm since MR will change (and hence, intersection of MCm=MR)

"Translations [i.e. shifting] of the demand curve will always trace out a supply relation. Rotations of the demand curve around the equilibrium point will reveal the degree of market power," (Bresnahan 1982)

Empirical Challenges: Estimating Demand & Elasticity

Suppose we have price and consumption data for an industry

Fairly easy to acquire

Empirical Challenges: Estimating Demand & Elasticity

Suppose we have price and consumption data for an industry

Fairly easy to acquire

Why can't we estimate the demand curve with a simple regression here?

ln(Quantityit)=β0+β1ln(Priceit)+ϵit

- With natural logs, β1 is the price elasticity of Demand

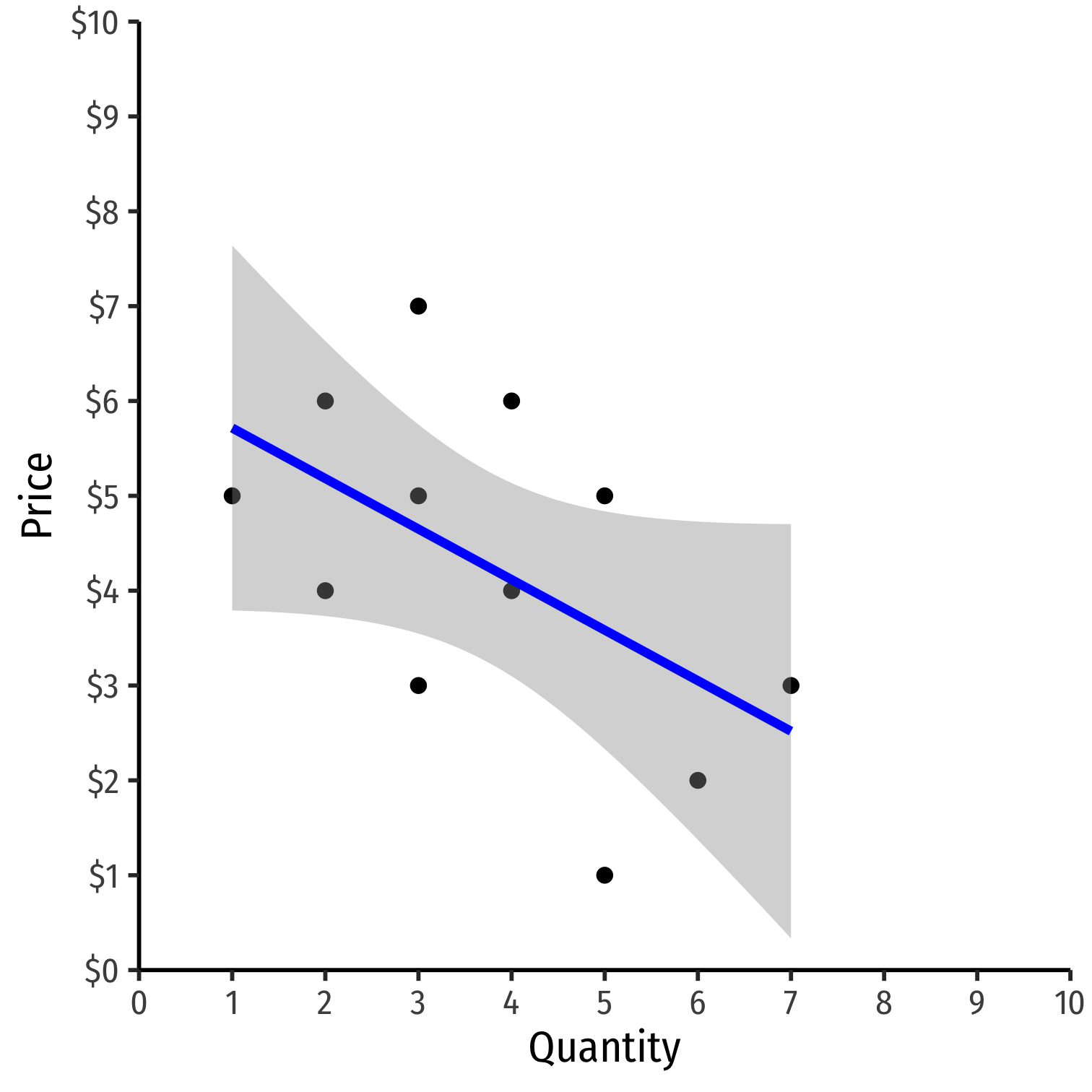

Empirical Challenges: Estimating Demand & Elasticity

What we are actually looking at are a series of equilibrium (Q∗,P∗) points!

Result of many demand and supply curve shifts & intersections!

Empirical Challenges: Estimating Demand & Elasticity

- Structural model of demand and of supply:

QD=α0+α1P+α2M+uDQS=β0+β1P+β2C+uS

Empirical Challenges: Estimating Demand & Elasticity

- Structural model of demand and of supply:

QD=α0+α1P+α2M+uDQS=β0+β1P+β2C+uS

- α's and β's are parameters (to be estimated), u's are unobserved error terms

Empirical Challenges: Estimating Demand & Elasticity

- Structural model of demand and of supply:

QD=α0+α1P+α2M+uDQS=β0+β1P+β2C+uS

α's and β's are parameters (to be estimated), u's are unobserved error terms

P is price

- Notice P simultaneously determines QD and QS!

Empirical Challenges: Estimating Demand & Elasticity

- Structural model of demand and of supply:

QD=α0+α1P+α2M+uDQS=β0+β1P+β2C+uS

α's and β's are parameters (to be estimated), u's are unobserved error terms

P is price

- Notice P simultaneously determines QD and QS!

M are variables that shift demand (i.e. income, prices of other goods, etc)

- C are variables that shift supply (i.e. costs, etc)

Empirical Challenges: Estimating Demand & Elasticity

QD=α0+α1P+α2M+uD

Why can't we just estimate price elasticity of demand (α1) with the demand equation?

P is partially a function of quantity supplied!

Empirical Challenges: Estimating Demand & Elasticity

Instrumental variables and 2-stage least squares techniques to identify demand relationship

Often use some supply shifter (like cost changes, C) correlated with price P, but not correlated with uD

Essentially: traces out unique demand relationship by allowing supply to vary & shift

Then, can estimate demand elasticity β1

The New Empirial Industrial Organization

"New Empirical Industrial Organization" (NEIO)

Focus on data, econometrics, machine learning, merger simulations

Private businesses, law firms, consulting firms, and government agencies (FTC, DOJ) hire economists trained in econometrics and IO for antitrust research, expert testimony