2.2: Cournot Competition

ECON 326 · Industrial Organization · Spring 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/IOs20

IOs20.classes.ryansafner.com

Models of Oligopoly

Three canonical models of Oligopoly

- Bertrand competition

- Firms simultaneously compete on price

- Cournot competition

- Firms simultaneously compete on quantity

- Stackelberg competition

- Firms sequentially compete on quantity

Cournot Competition

Antoine Augustin Cournot

1801-1877

"Cournot competition": two (or more) firms compete on quantity to sell the same good

Firms set their quantities simultaneously

Firms' joint output determines the market price faced by all firms

Cournot Competition: Mechanics

Suppose two firms (1 and 2), each have an identical constant cost MC(q)=AC(q)=c

Firm 1 and Firm 2 simultaneously set quantities, q1 and q2

Total market demand is given by

P=a−bQQ=q1+q2

Cournot Competition: Mechanics

- Firm 1's profit is given by:

π1=q1(P−c)π1=q1(a−b(q1+q2)−c)

And, symmetrically same for firm 2

Note each firm's profits depend (in part) on the outputs of the other firm!

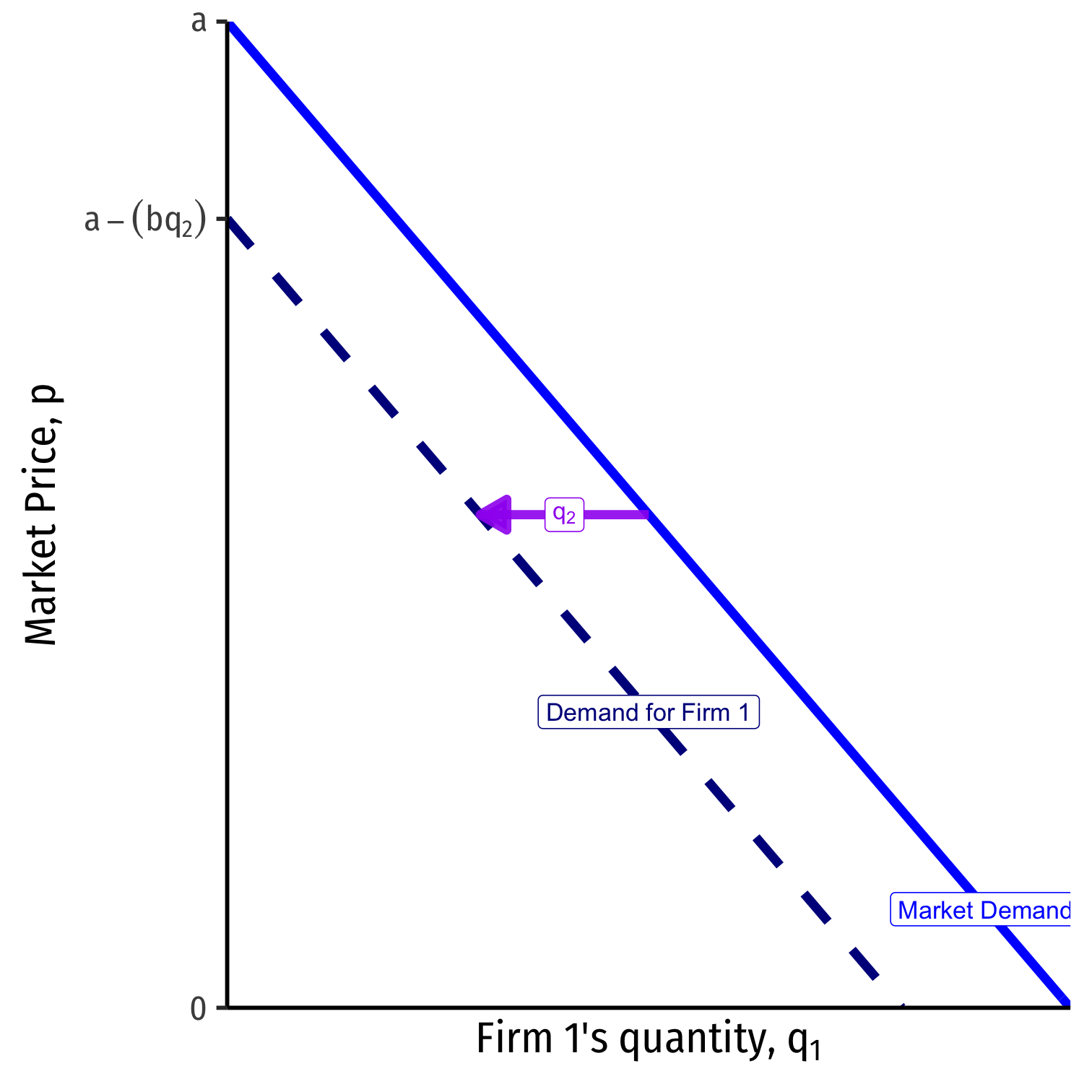

Residual Demand

Consider each the demand each firm faces to be a residual demand

e.g. for firm 1

p=a−b(q1+q2)p=(a−bq2)⏟intercept−b⏟slopeq1

Firm 2 will produce some amount, q2.

Firm 1 takes this as given, to find its own residual demand

- Intercept: a−bq2

- Slope: b (in front of q1)

Residual Demand

Firm 2 will produce some amount q2

Firm 1 will take this as a given, a constant

Firm 1's choice variable is q1, given q2

Cournot Competition: Example

Example: Assume Saudi Arabia (sa) and Iran (i) are the only two oil producers, each with a constant MC=AC=20. The market (inverse) demand curve is given by: P=200−3QQ=qsa+qi

Cournot Competition: Example

Example: Assume Saudi Arabia (sa) and Iran (i) are the only two oil producers, each with a constant MC=AC=20. The market (inverse) demand curve is given by: P=200−3QQ=qsa+qi

P=200−3qsa−3qi

Cournot Competition: Example

P=200−3qi⏟intercept−3qsa

- Firms maximize profit (as always), by setting q∗:MR(q)=MC(q)

Cournot Competition: Example

P=200−3qi⏟intercept−3qsa

Firms maximize profit (as always), by setting q∗:MR(q)=MC(q)

Solve for Saudi Arabia

- Take qi as given, a constant

- Recall MR is twice the slope of demand

Cournot Competition: Example

P=200−3qi⏟intercept−3qsa

Firms maximize profit (as always), by setting q∗:MR(q)=MC(q)

Solve for Saudi Arabia

- Take qi as given, a constant

- Recall MR is twice the slope of demand

MRsa=200−3qi−6qsa

Cournot Competition: Example

Solve for q∗ for each firm (where MR(q)=MC(q)), we derive each firm's reaction function or best response function to the other firm's output

Symmetric marginal costs and marginal revenues

Cournot Competition: Example

Solve for q∗ for each firm (where MR(q)=MC(q)), we derive each firm's reaction function or best response function to the other firm's output

Symmetric marginal costs and marginal revenues

q∗sa=30−0.5qiq∗i=30−0.5qsa

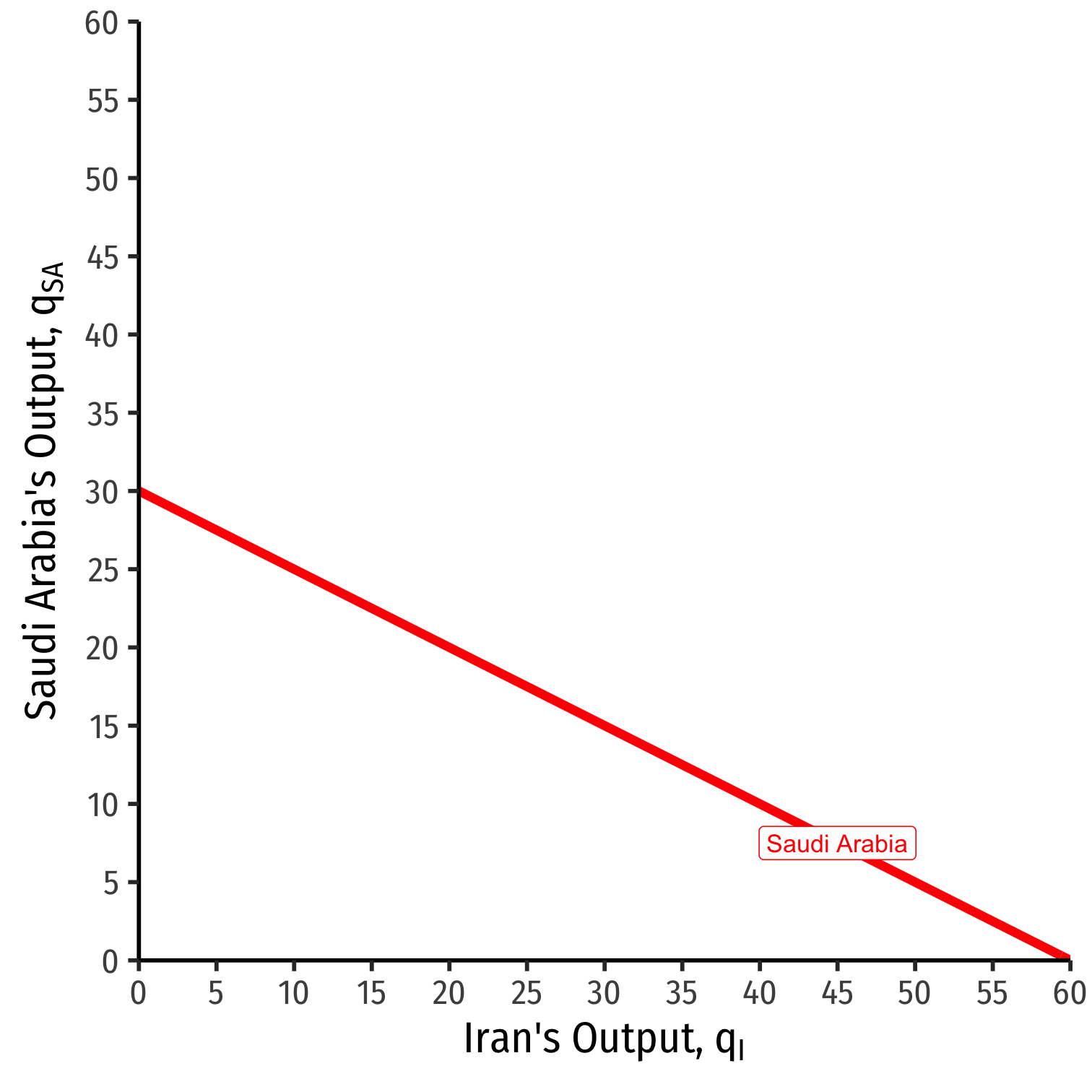

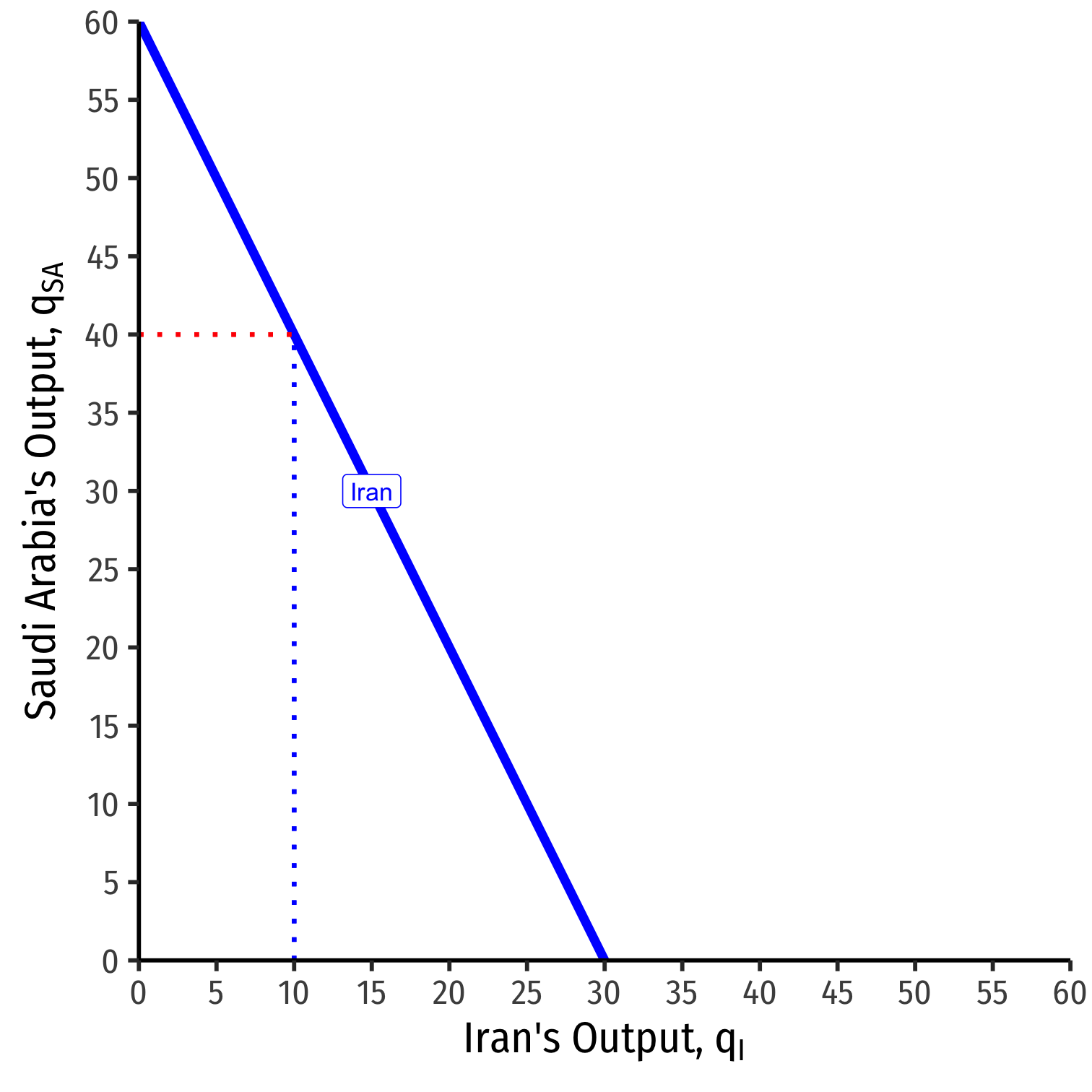

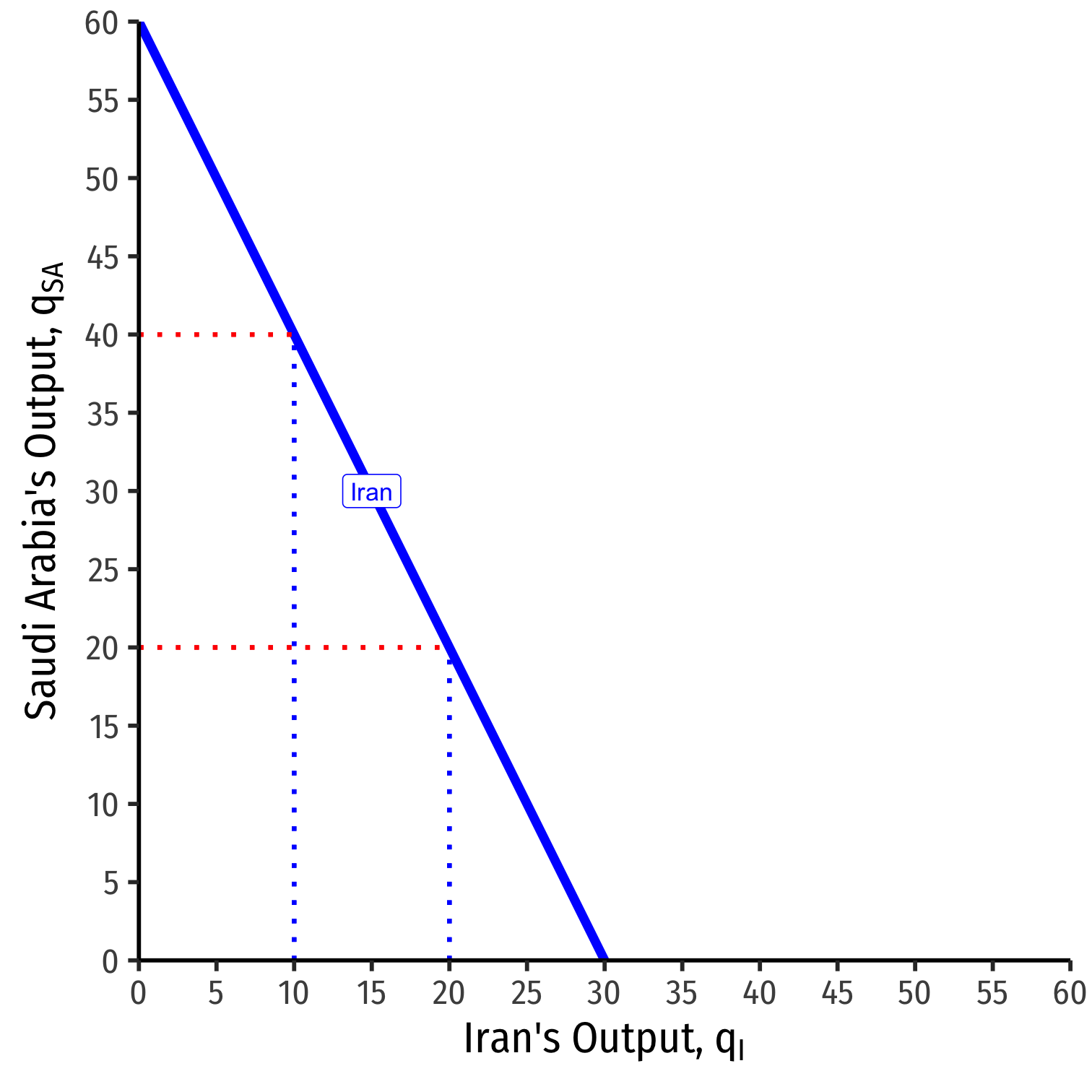

Saudi Arabia's Reaction Curve

We can graph Saudi Arabias's reaction curve to Irans's output

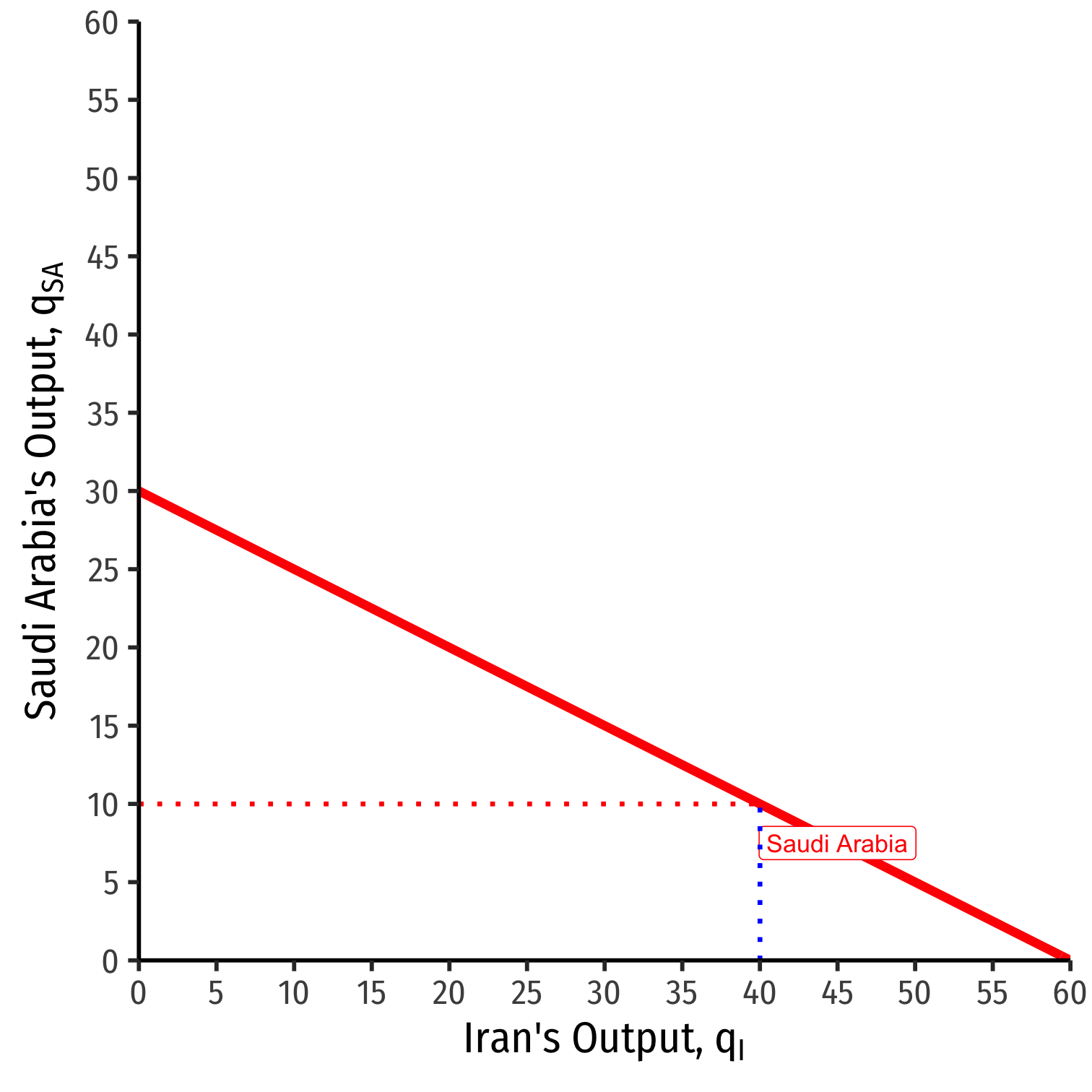

Saudi Arabia's Reaction Curve

We can graph Saudi Arabias's reaction curve to Irans's output

- e.g. if Iran produces 40, Saudi Arabia's best response is 10

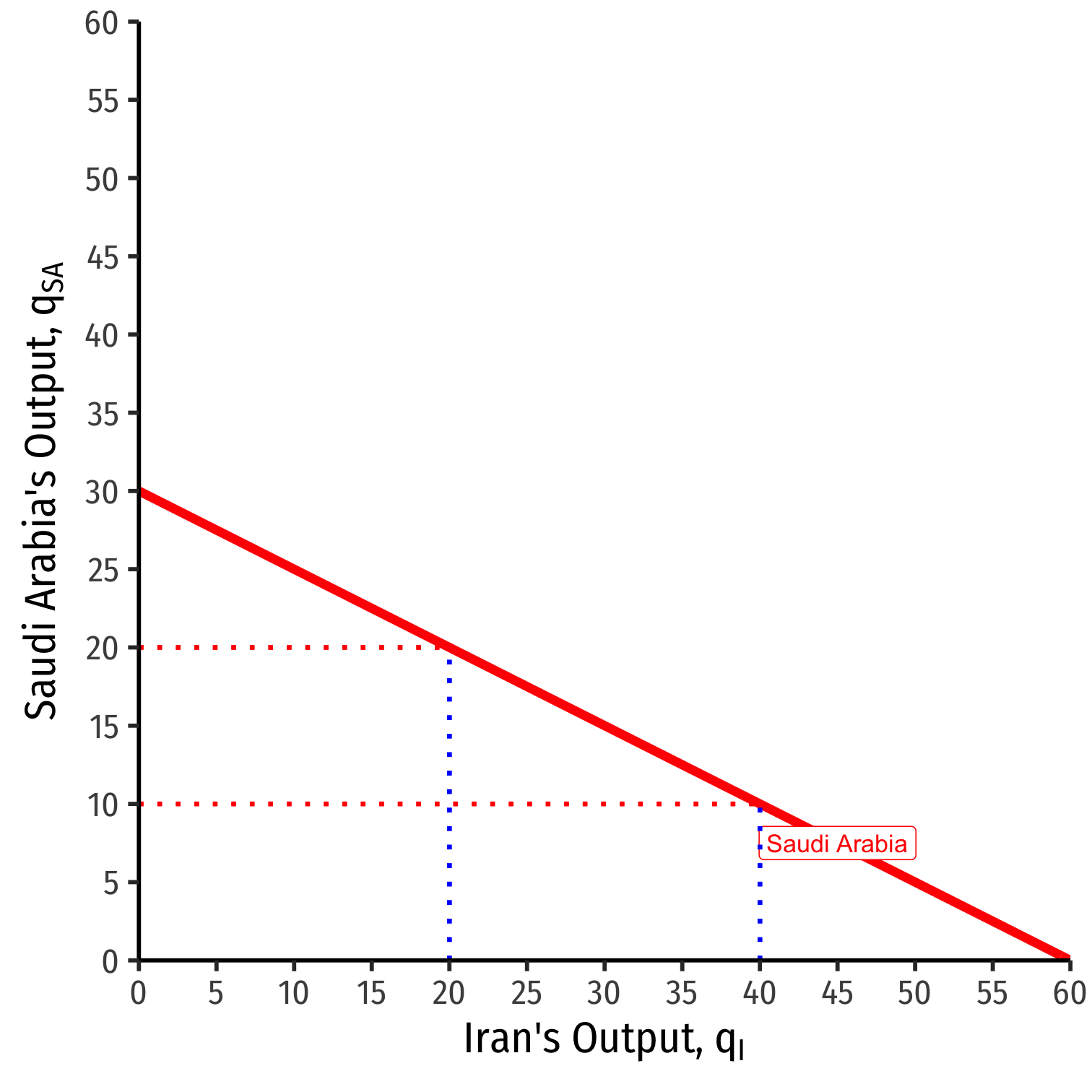

Saudi Arabia's Reaction Curve

We can graph Saudi Arabias's reaction curve to Irans's output

- e.g. if Iran produces 40, Saudi Arabia's best response is 10

- e.g. if Iran produces 20, Saudi Arabia's best response is 20

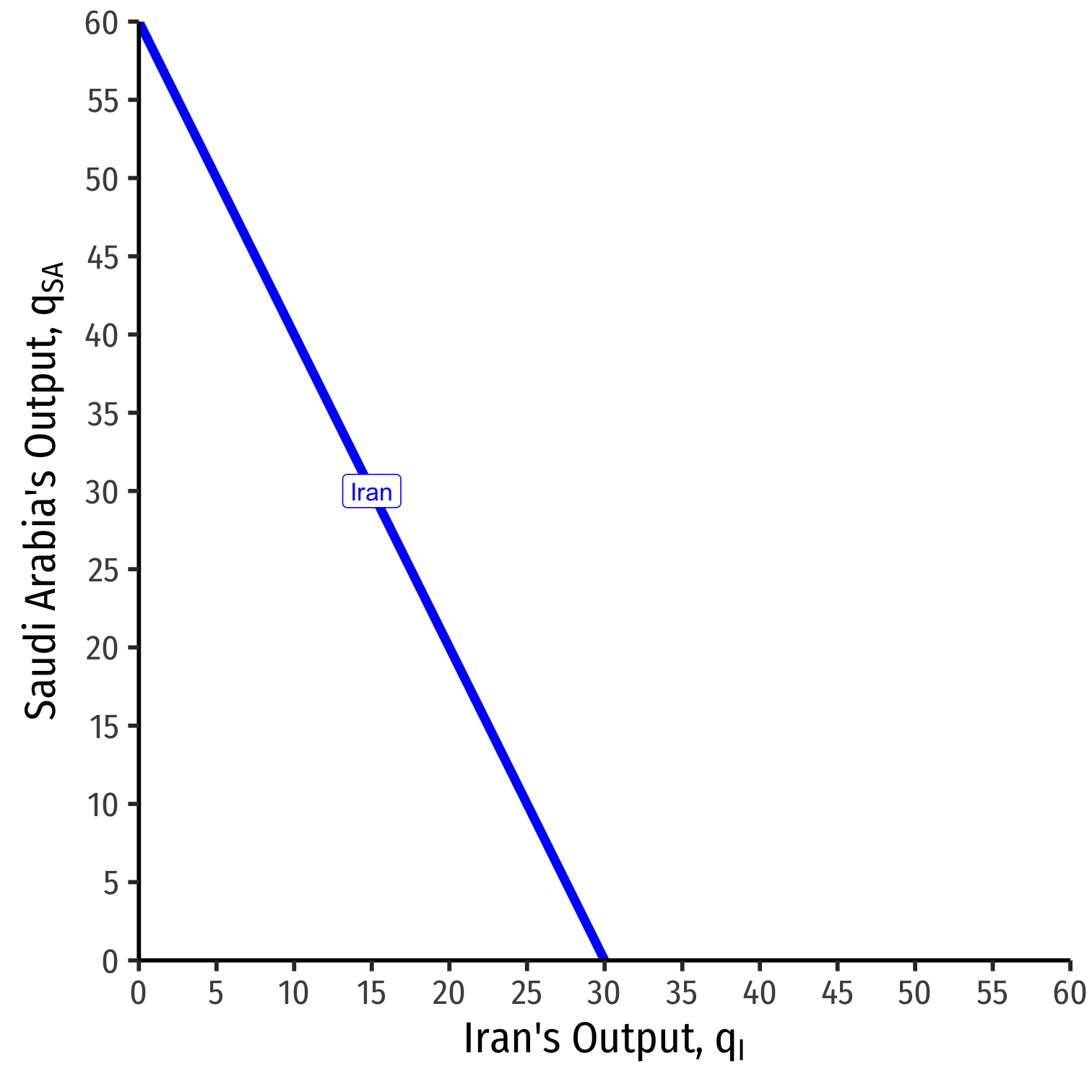

Iran's Reaction Curve

We can graph Iran's reaction curve to Saudi Arabia's output

Iran's Reaction Curve

We can graph Iran's reaction curve to Saudi Arabia's output

- e.g. if Saudi Arabia produces 40, Iran's best response is 10

Iran's Reaction Curve

We can graph Iran's reaction curve to Saudi Arabia's output

- e.g. if Saudi Arabia produces 40, Iran's best response is 10

- e.g. if Saudi Arabia produces 20, Iran's best response is 20

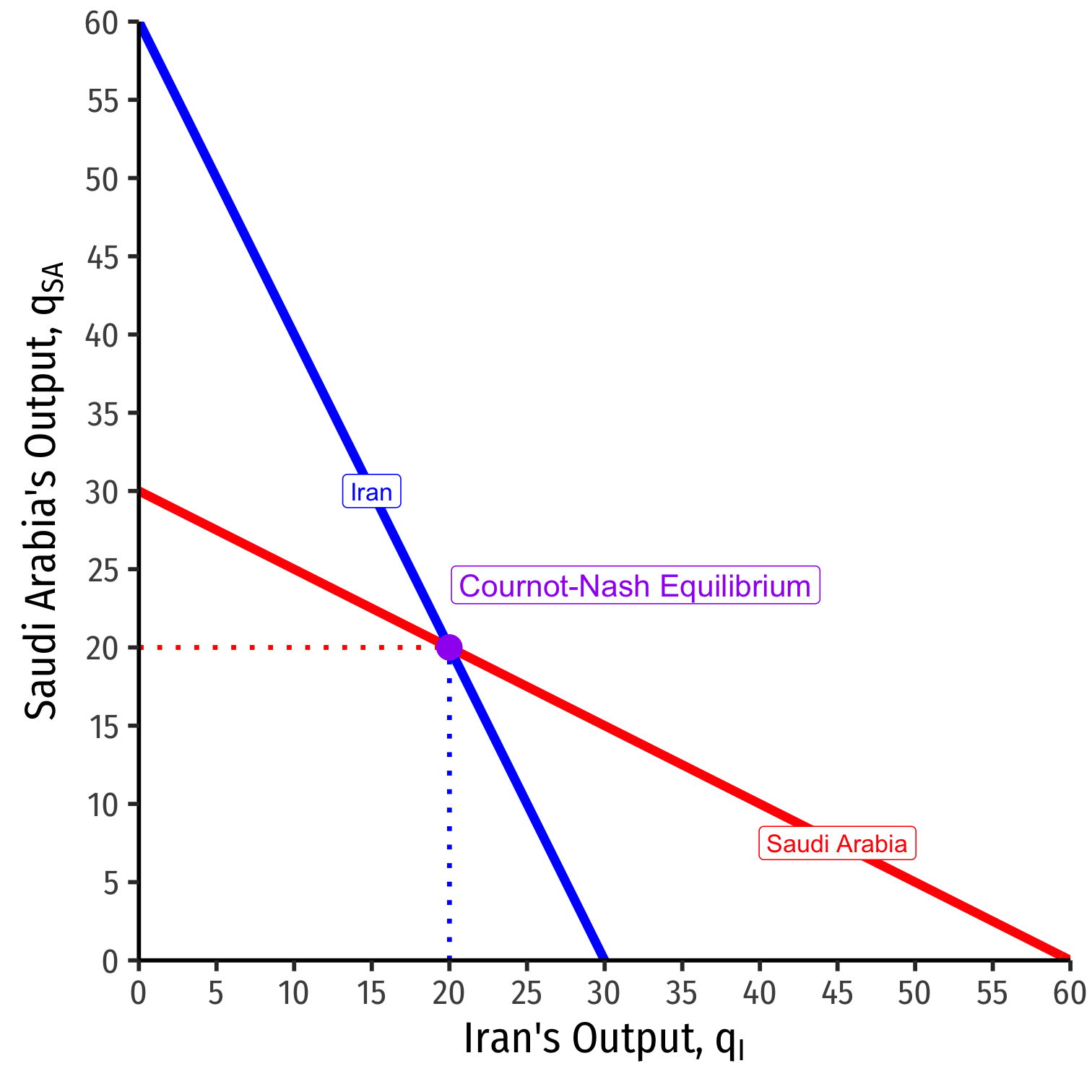

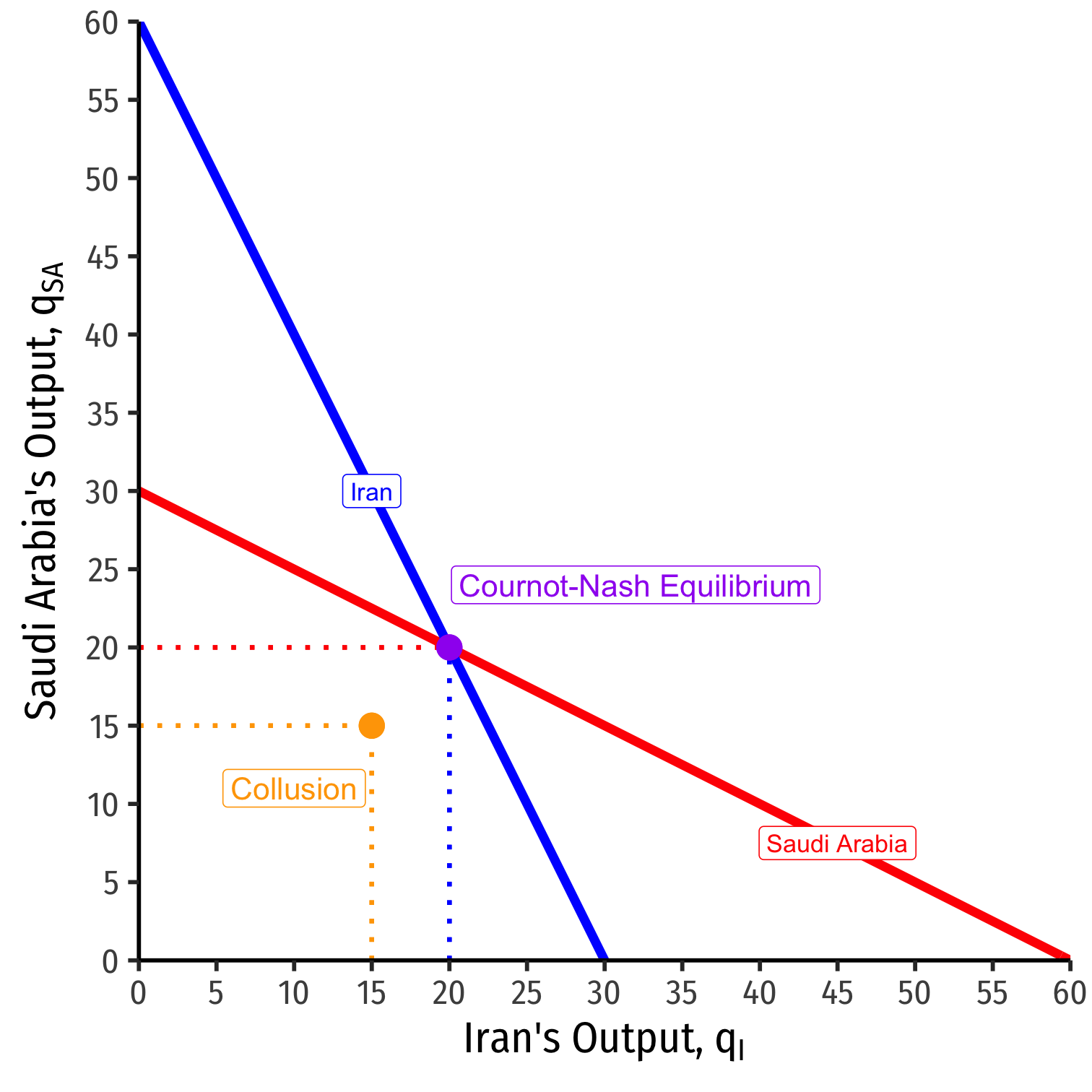

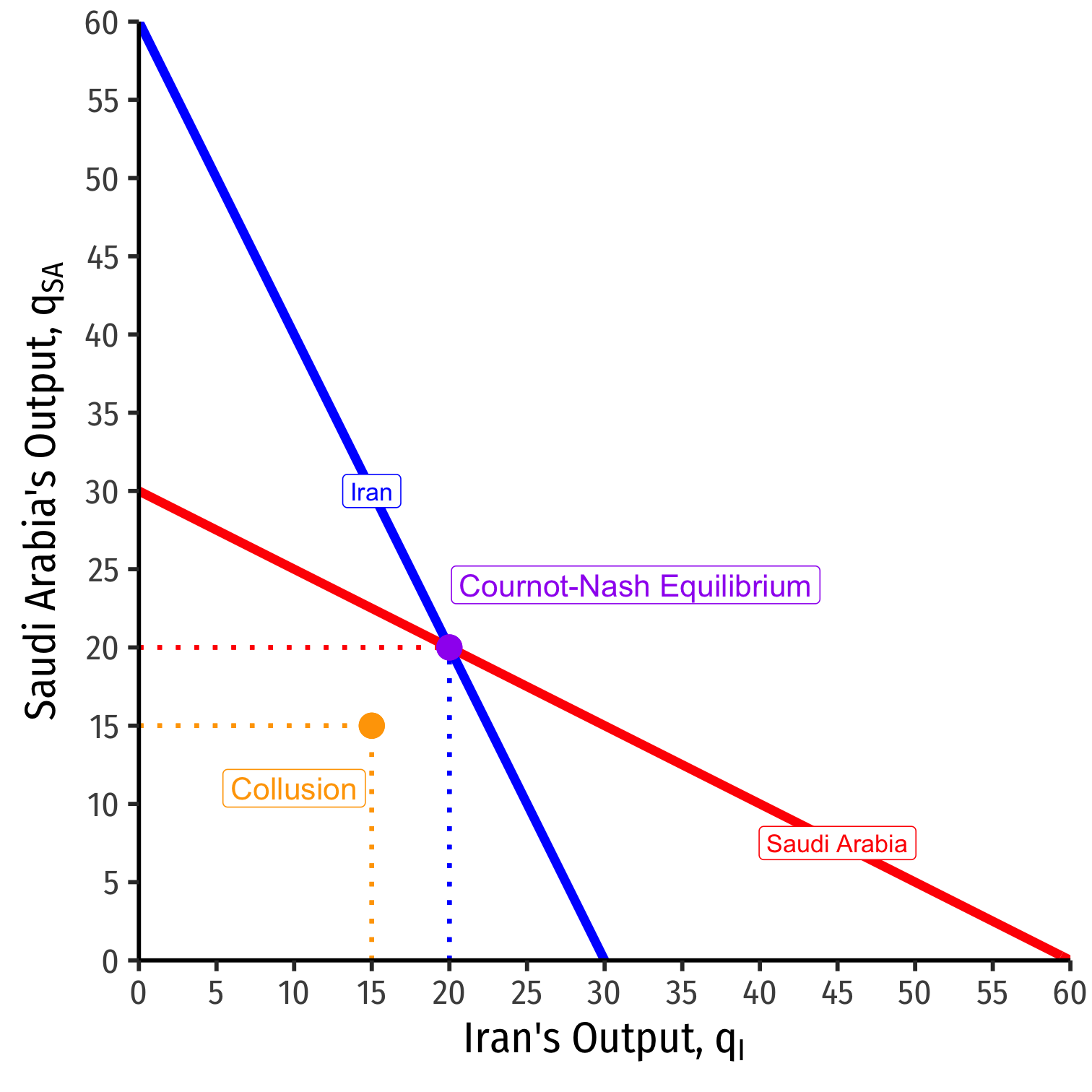

Cournot-Nash Equilibrium, Graphically

Combine both curves on the same graph

Cournot-Nash Equilibrium: (20,20)

- Where both reaction curves intersect

Both are playing mutual best response to one another

Cournot-Nash Equilibrium, Algebraically

- Cournot-Nash Equilibrium algebraically: plug one firm's reaction function into the other's

Cournot-Nash Equilibrium, Algebraically

- Cournot-Nash Equilibrium algebraically: plug one firm's reaction function into the other's

q∗sa=30−0.5qiq∗i=30−0.5qsa

Cournot-Nash Equilibrium, Algebraically

- Cournot-Nash Equilibrium algebraically: plug one firm's reaction function into the other's

q∗sa=30−0.5qiq∗i=30−0.5qsa

- The market demand again was

P=200−3qsa−3qi

Cournot-Nash Equilibrium, Algebraically

- Both countries produce 20

Cournot-Nash Equilibrium, Algebraically

- Both countries produce 20

P=200−3(20)−3(20)P=$80

Cournot-Nash Equilibrium, Algebraically

- Both countries produce 20

P=200−3(20)−3(20)P=$80

- Find profit for each country:

Cournot-Nash Equilibrium, Algebraically

- Both countries produce 20

P=200−3(20)−3(20)P=$80

- Find profit for each country:

πsa=qsa(P−c)πsa=20(80−20)πsa=1,200

- Symmetrically for Iran, πi=1,200

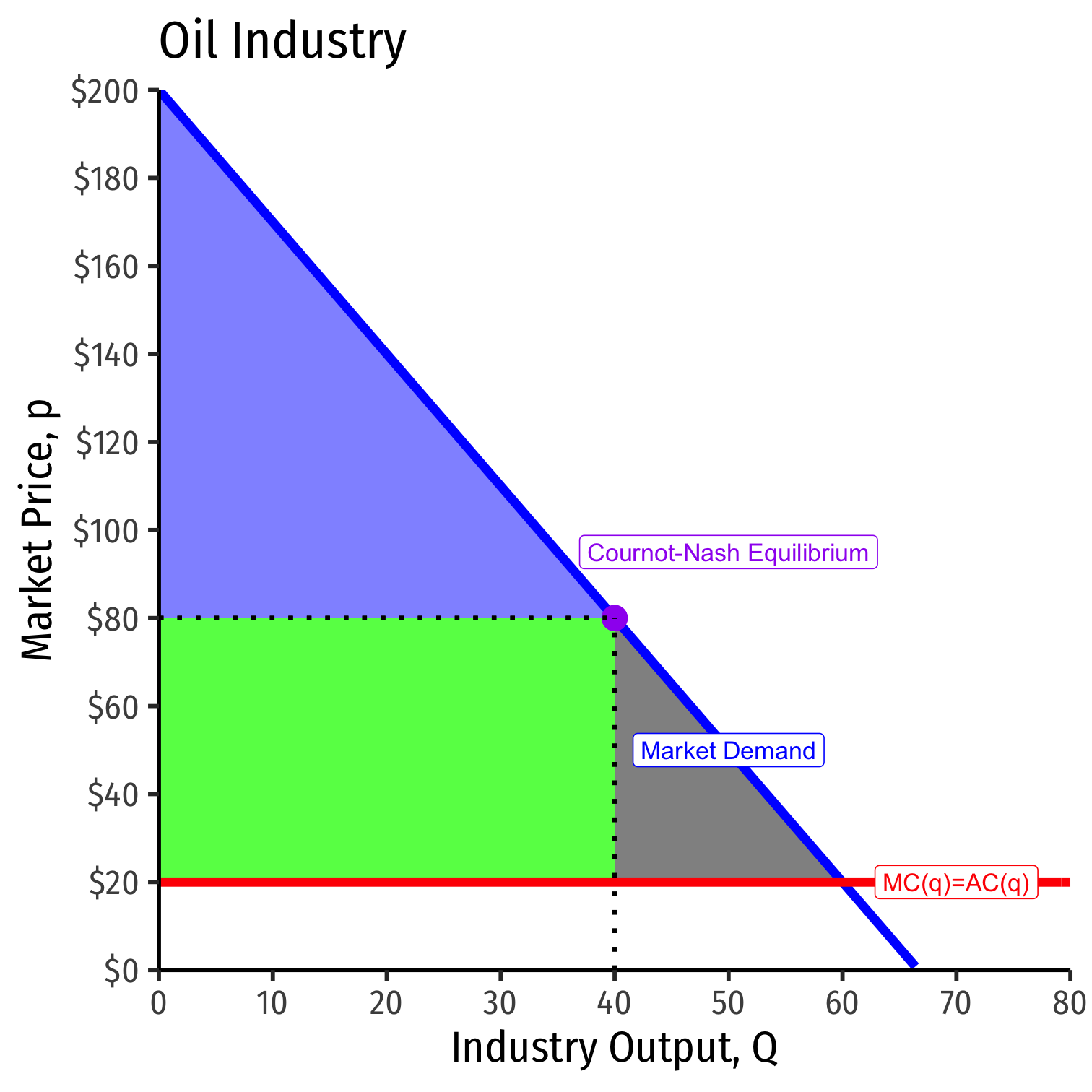

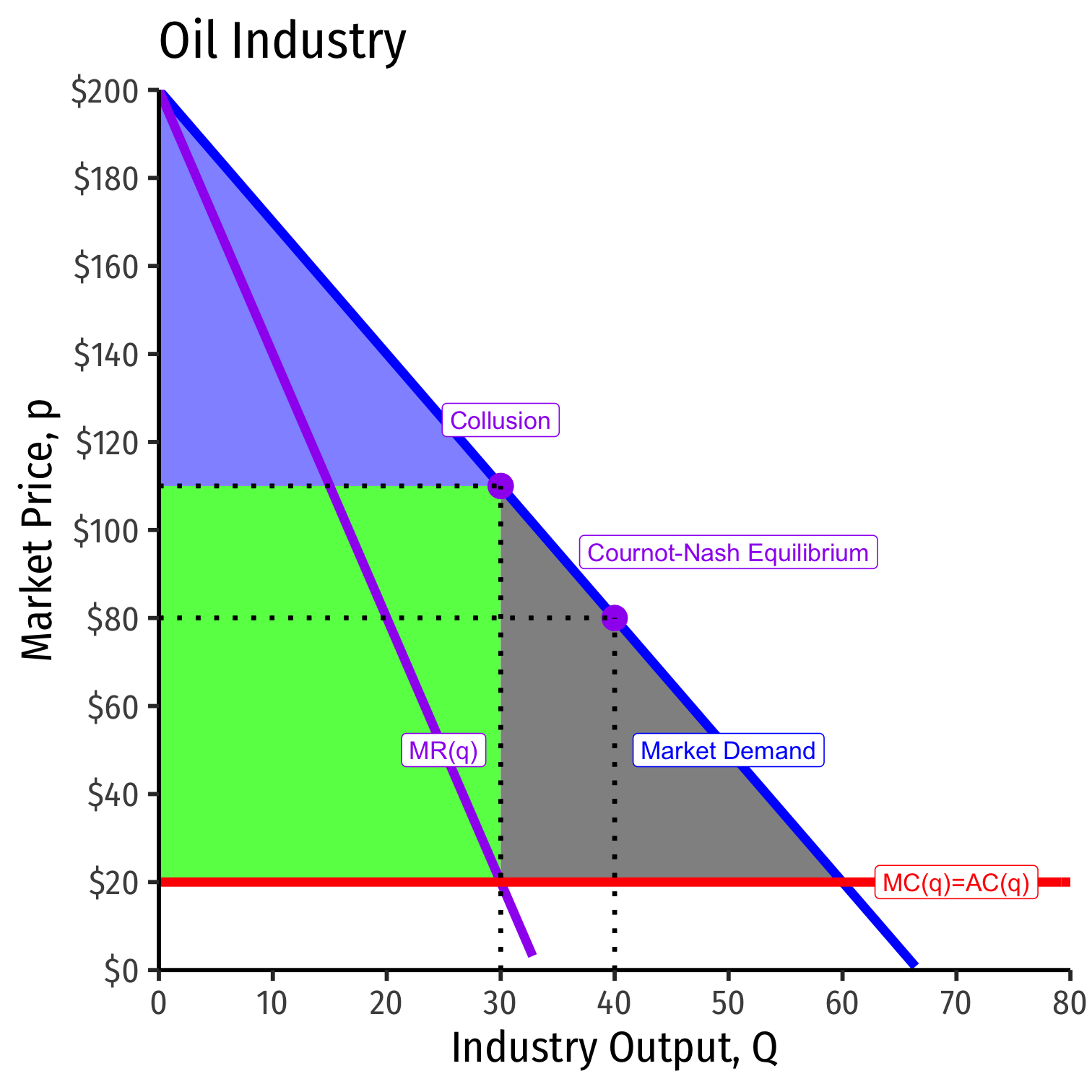

Cournot-Nash Equilibrium, The Market

Cournot Collusion

- Suppose now both firms collude to act like a monopolist, who sets the entire market:

MR=MC200−6Q=2030=Q∗

Cournot Collusion

- Suppose now both firms collude to act like a monopolist, who sets the entire market:

MR=MC200−6Q=2030=Q∗

- The monopoly price will then be:

P=200−3(30)P=$110

Cournot Collusion

- Suppose now both firms collude to act like a monopolist, who sets the entire market:

MR=MC200−6Q=2030=Q∗

- The monopoly price will then be:

P=200−3(30)P=$110

- Total profit will then be:

Π=30(110−20)=$2,700

with $1,400 going to each firm

Cournot Collusion

Cournot Competition: each firm produces 20 and earns $1,200

Cournot Collusion: each firm produces 15 and earns $1,400

Cournot Collusion

Cournot Competition: each firm produces 20 and earns $1,200

Cournot Collusion: each firm produces 15 and earns $1,400

But is collusion a Nash equilibrium?

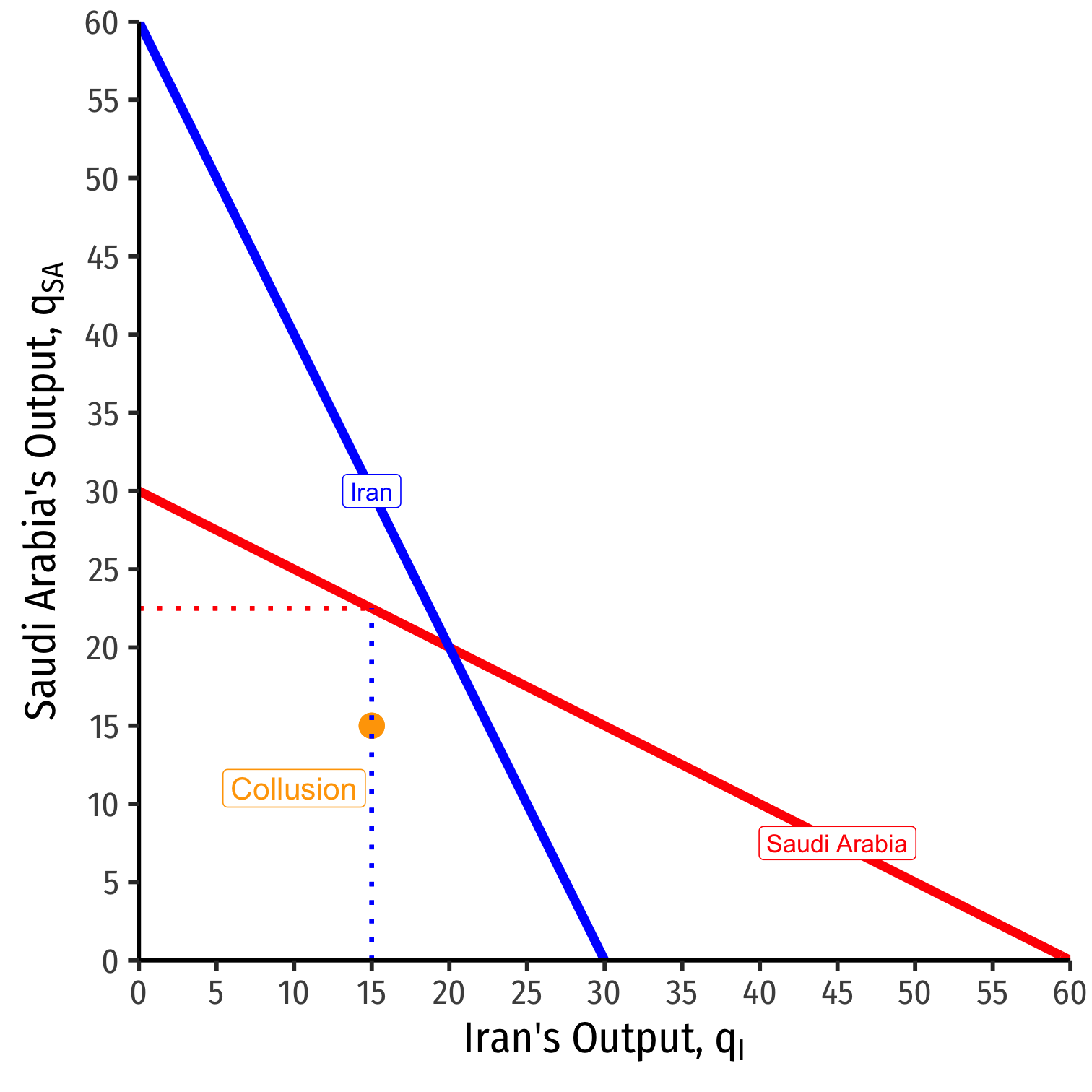

Cournot Collusion

Read either firm's reaction curve at the collusive outcome

Suppose Saudi Arabia knows Iran is producing 15 (as per the cartel agreement)

Saudi Arabia's best response to Iran's 15 is to produce 22.5

Cournot Collusion

- This would bring market price to

P=200−3qsa−3qiP=200−3(22.5)−3(15)P=$87.50

Cournot Collusion

- This would bring market price to

P=200−3qsa−3qiP=200−3(22.5)−3(15)P=$87.50

- Saudi Arabia's profit would be:

πsa=qsa(P−c)πsa=22.5(87.50−20)πsa=$1,518.75

Cournot Collusion

- This would bring market price to

P=200−3qsa−3qiP=200−3(22.5)−3(15)P=$87.50

- Saudi Arabia's profit would be:

πsa=qsa(P−c)πsa=22.5(87.50−20)πsa=$1,518.75

- Iran's profit would be:

πi=qi(P−c)πi=15(87.50−20)πi=$712.50

Cournot Collusion, The Market

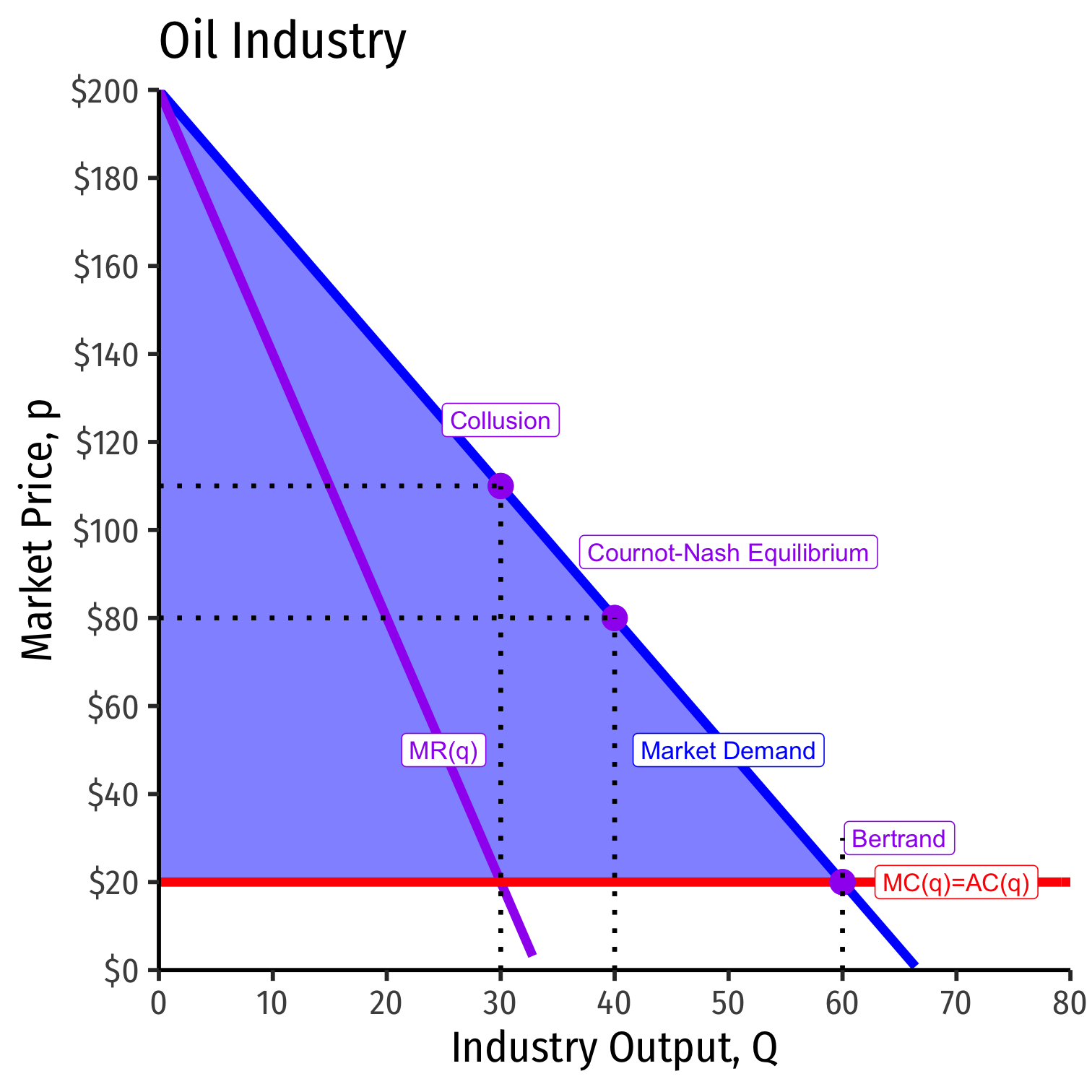

Bertrand Competition for our Example

Imagine Bertrand competition between Saudi Arabia and Iran instead (price competition)

Nash equilibrium: Firms will set P=MC, so:

P=MC200−3Q=20Q=60

Both countries split demand equally, each selling 30 units

Profit for both countries would be 0, since P=MC

Bertrand Competition, The Market

Cournot vs. Bertrand Competition

| Type | Output | Price | Profits |

|---|---|---|---|

| Collusion | 30 | $110 | $2,700 |

| Cournot | 40 | $80 | $2,400 |

| Bertrand | 60 | $20 | $0 |

Cournot vs. Bertrand Competition

| Type | Output | Price | Profits |

|---|---|---|---|

| Collusion | 30 | $110 | $2,700 |

| Cournot | 40 | $80 | $2,400 |

| Bertrand | 60 | $20 | $0 |

- Output: Qm<Qc<Qb

- Market price: Pb<Pc<Pm

- Profit: πb=0<πc<πm

Where subscript m is monopoly (collusion), c is Cournot, b is Bertrand

Cournot Competition, You Try

Example: Suppose Firm 1 and Firm 2 have a constant MC=AC=8. The market (inverse) demand curve is given by:

P=200−2QQ=q1+q2

Find the Cournot-Nash equilibrium output and profit for each firm.

Find the output and profit for each firm if the two were to collude.

Find the price and output if the two were to compete on price instead of quantity.

Cournot Competition

Antoine Augustin Cournot

1801-1877

Cournot Theorem: as the number of firms (N) in the market increases, market output Nq goes to the competitive level, and price converges to c.

- Assuming no fixed costs, and an identical constant marginal cost for firms

More (fewer) firms reduce (increase) market distortions from market power

Cournot Competition on Moblab

Cournot Competition on Moblab

- Each of you is a firm selling identical scooters

- Each season, each firm chooses its quantity to produce

- You pay a cost for each you produce (identical across all firms)

- Market price depends on total industry output

- More total output ⟹ lower market price

- Market price is revealed after all firms have chosen their output

Cournot Competition on Moblab

- We will play 4 times:

- You are the only firm (monopoly)

- You will be matched with another firm (duopoly)

- You will be matched with 2 other firms (triopoly)

- The entire class is competing in the same market (N=10)

- Each instance will have 3 rounds