2.1: Bertrand Competition

ECON 326 · Industrial Organization · Spring 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/IOs20

IOs20.classes.ryansafner.com

A More Rigorous Oligopoly/Cartel Problem

Example: Suppose Squeaky Clean (Firm 1) and Biobase (Firm 2) are the only two producers of chlorine for swimming pools. The inverse market demand for chlorine is P=32−2Q

If the two firms collude and agree to act as a monopolist and evenly split the market, how much will each firm produce, what will be the market price, and how much profit will each firm earn?

Under this agreement, does either firm have an incentive to cheat (i.e. by producing an additional ton of chlorine)?

Models of Oligopoly

Three canonical models of Oligopoly

- Bertrand competition

- Firms simultaneously compete on price

- Cournot competition

- Firms simultaneously compete on quantity

- Stackelberg competition

- Firms sequentially compete on quantity

Bertrand Competition

Joseph Bertrand

1822-1890

"Bertrand competition": two (or more) firms compete on price to sell the same good

Firms set their prices simultaneously

Consumers are indifferent between the brands and always buy from the seller with the lowest price

Bertrand Competition: Example

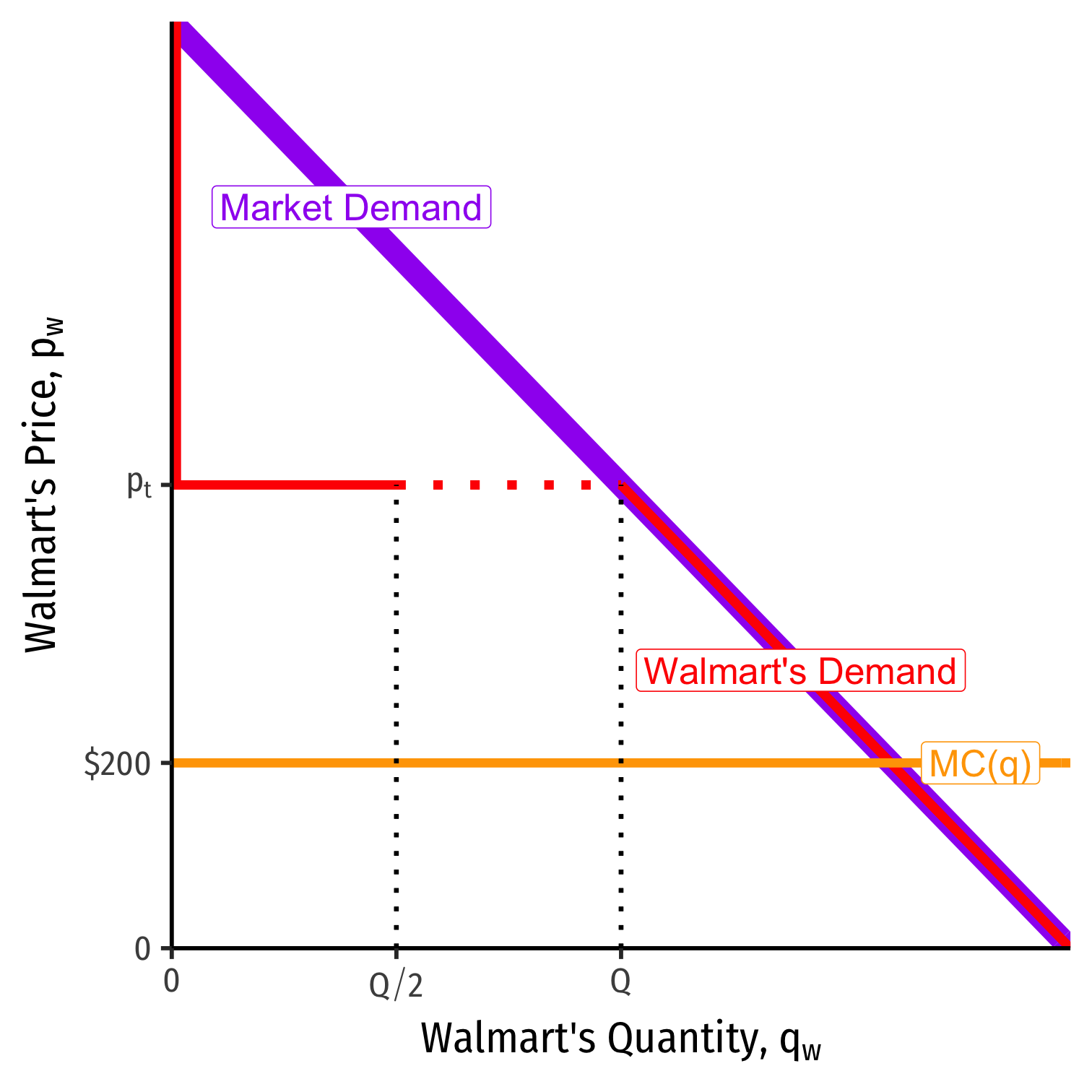

Suppose two firms, Walmart and Target stock and sell identical HDTVs

Costs each firm $200 to stock an HDTV

Let Q be the total quantity purchased by consumers from the entire market (i.e. both firms)

- Q=qw+qt

Denote Walmart's price as pw and Target's price as pt

Bertrand Competition: Example

- Demand for HDTV's at Walmart:

Bertrand Competition: Example

- Demand for HDTV's at Walmart:

- Q if pw < pt

Bertrand Competition: Example

- Demand for HDTV's at Walmart:

- Q if pw < pt

- Q2 if pw = pt

Bertrand Competition: Example

- Demand for HDTV's at Walmart:

- Q if pw < pt

- Q2 if pw = pt

- 0 if pw > pt

Bertrand Competition: Example

- Demand for HDTV's at Walmart:

- Q if pw < pt

- Q2 if pw = pt

- 0 if pw > pt

Bertrand Competition: Example

- Demand for HDTV's at Walmart:

- Q if pw < pt

- Q2 if pw = pt

- 0 if pw > pt

- Demand for HDTV's at Target:

- 0 if pw < pt

- Q2 if pw = pt

- Q if pw > pt

Bertrand Competition: Example

- The only way to sell TVs is to match or beat your competitor's price

Bertrand Competition: Example

The only way to sell TVs is to match or beat your competitor's price

Suppose you are Walmart

For a known pt, setting your price

pw=pt−ϵ

for any arbitrary ϵ>0 captures you the entire market Q

- Same for Target for pw

Bertrand Competition: Example

Won't charge p<MC, earn losses

Firms continue undercutting one another until pw = pt =MC

Nash Equilibrium: (pw=MC,pt=MC)

- Firms earn no profits!

Bertrand Paradox

- Bertrand Paradox: competitive outcome can be acheived with just 2 firms!

- p=MC, π=0

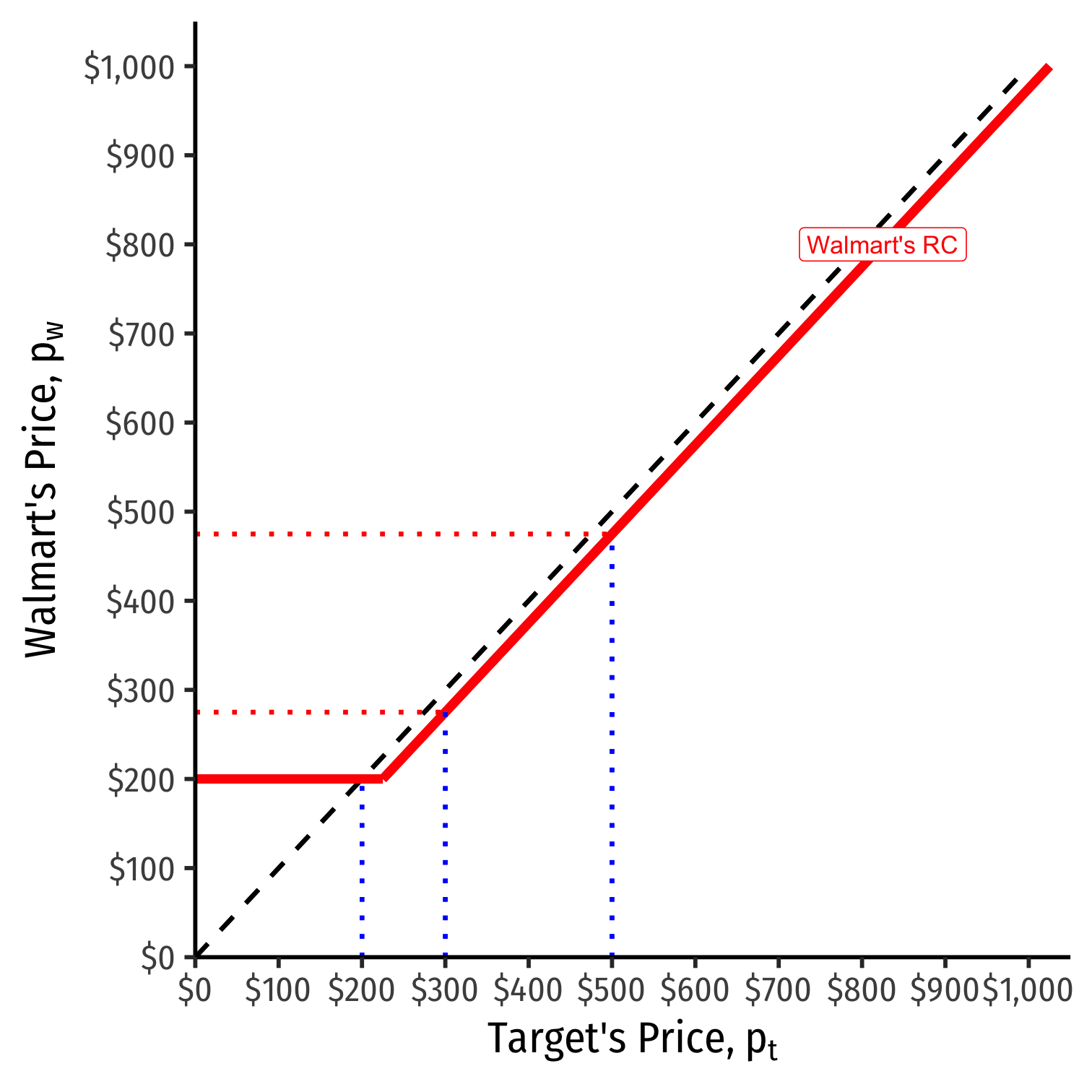

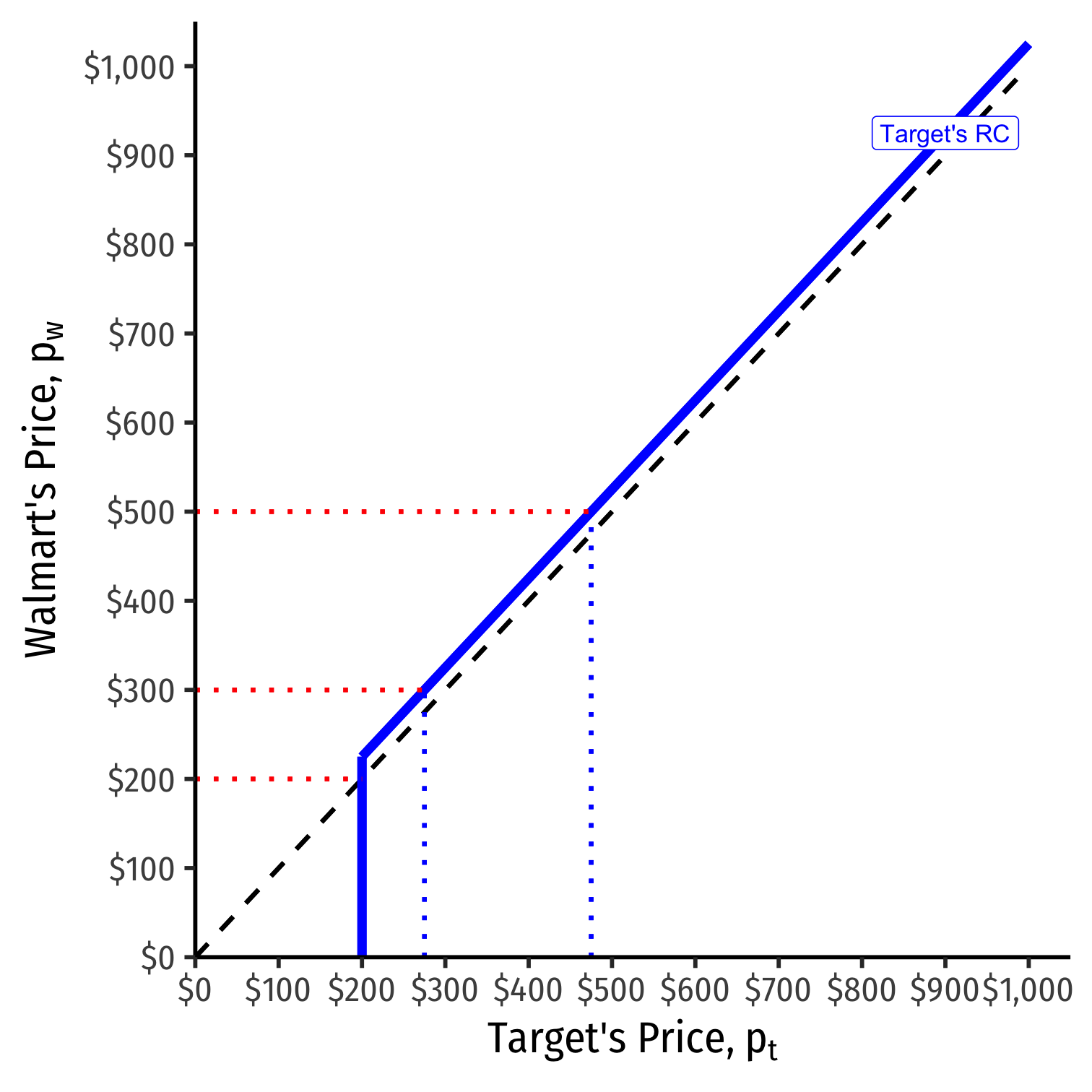

Walmart's Reaction Curve

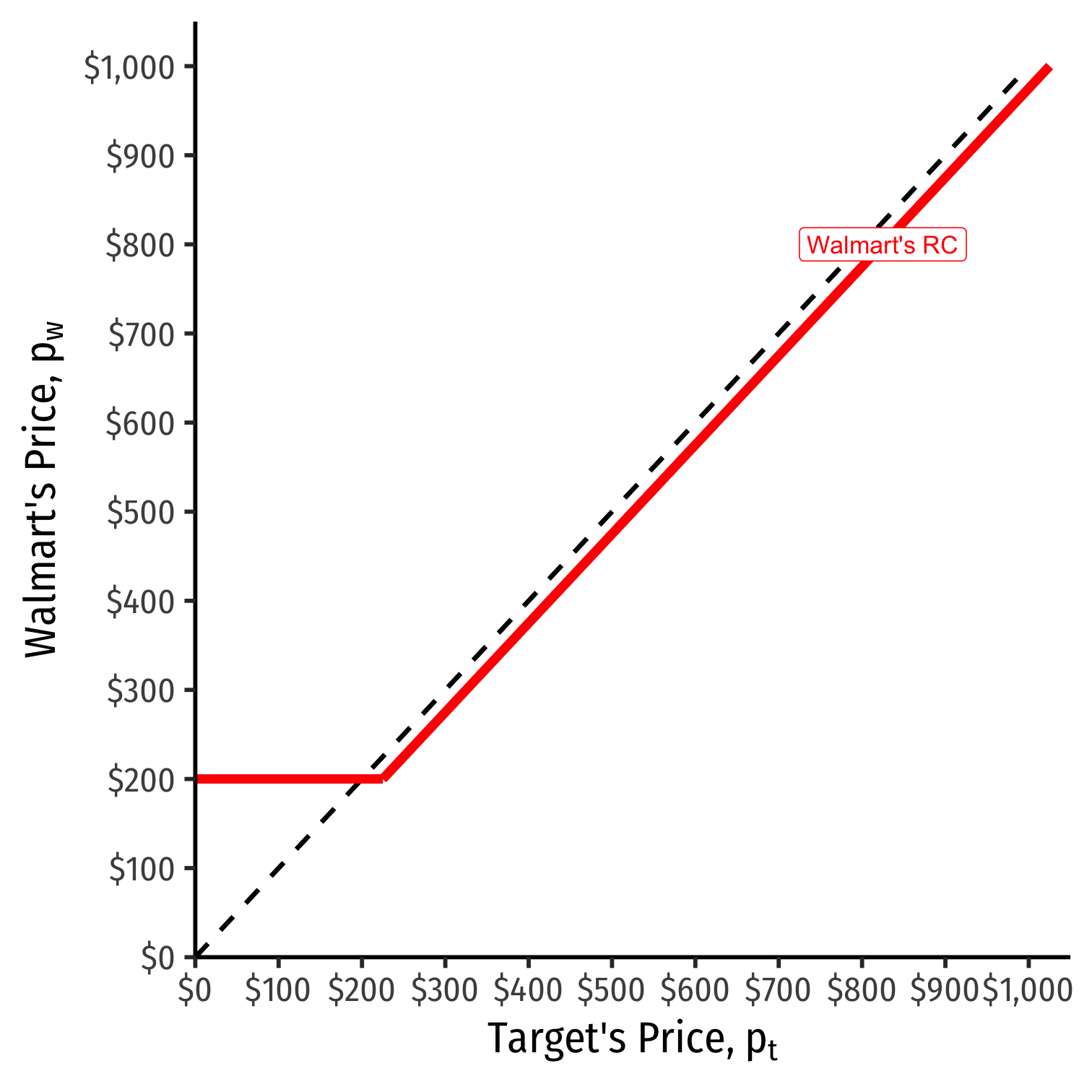

We can graph Walmart's reaction curve to Target's price

Walmart's Reaction Curve

We can graph Walmart's reaction curve to Target's price

- e.g. if Target sets a price of $500, Walmart's best response is $500−ϵ

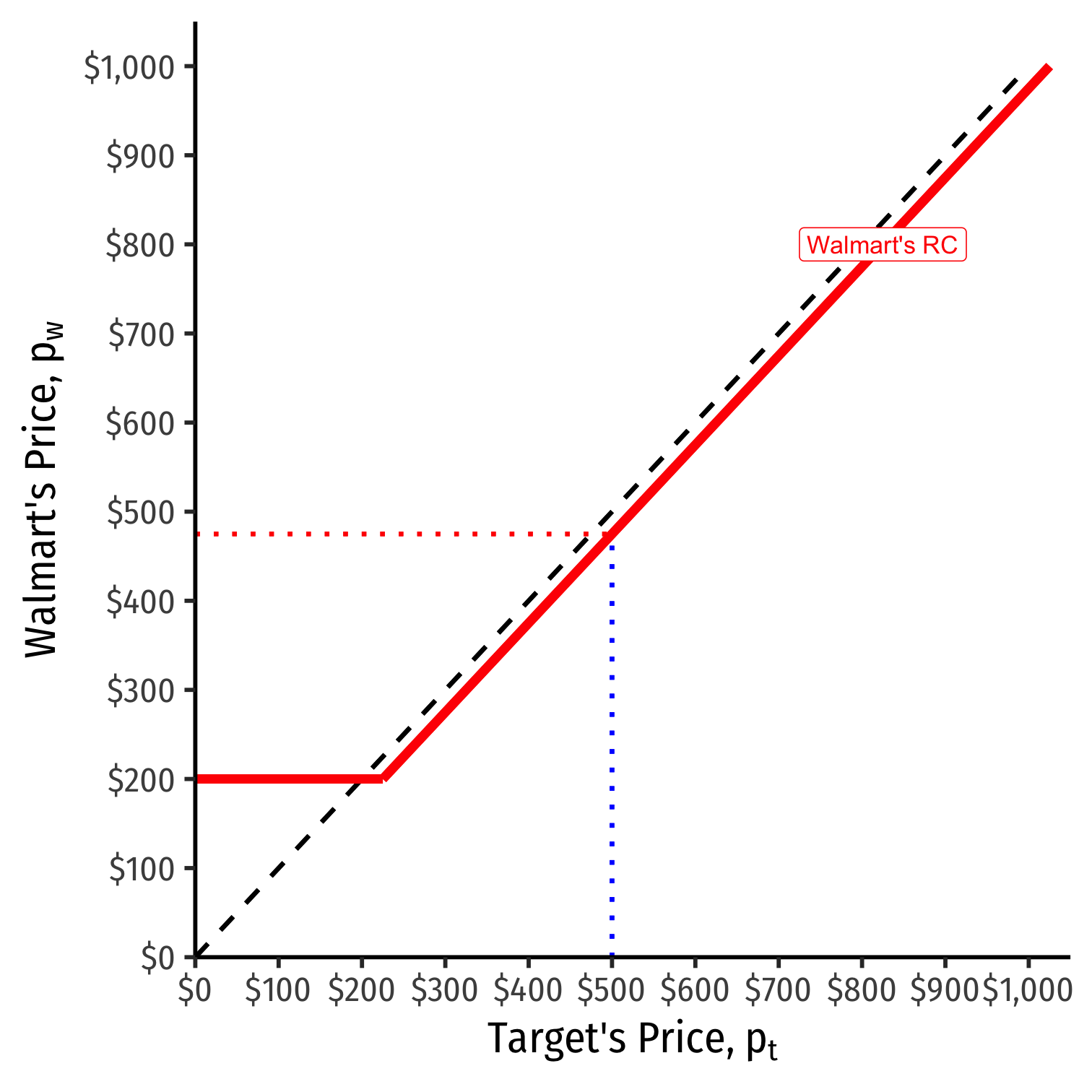

Walmart's Reaction Curve

We can graph Walmart's reaction curve to Target's price

- e.g. if Target sets a price of $500, Walmart's best response is $500−ϵ

- e.g. if Target sets a price of $300, Walmart's best response is $300−ϵ

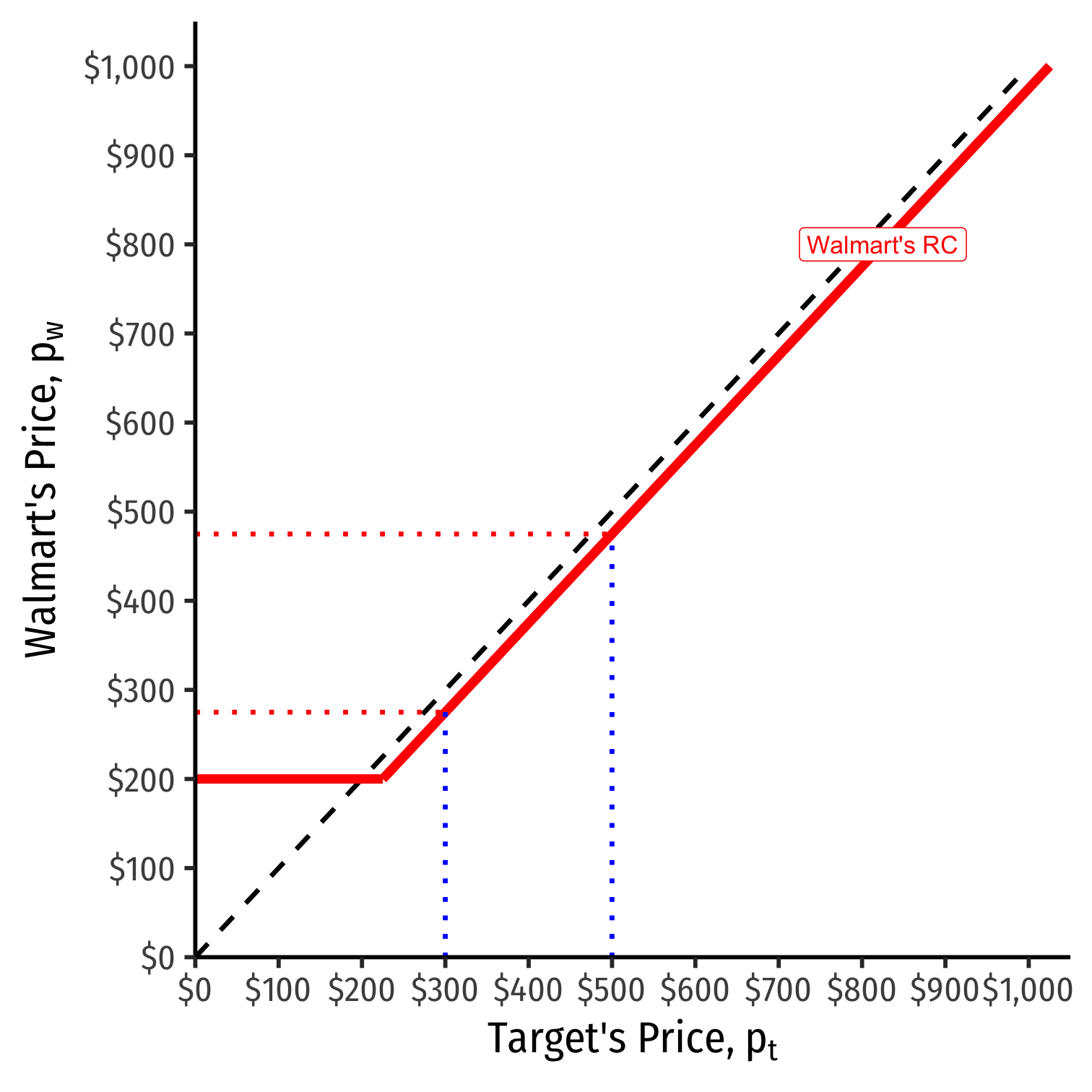

Walmart's Reaction Curve

We can graph Walmart's reaction curve to Target's price

- e.g. if Target sets a price of $500, Walmart's best response is $500−ϵ

- e.g. if Target sets a price of $300, Walmart's best response is $300−ϵ

- e.g. if Target sets a price of $200, (MC) Walmart's best response is $200 (MC)

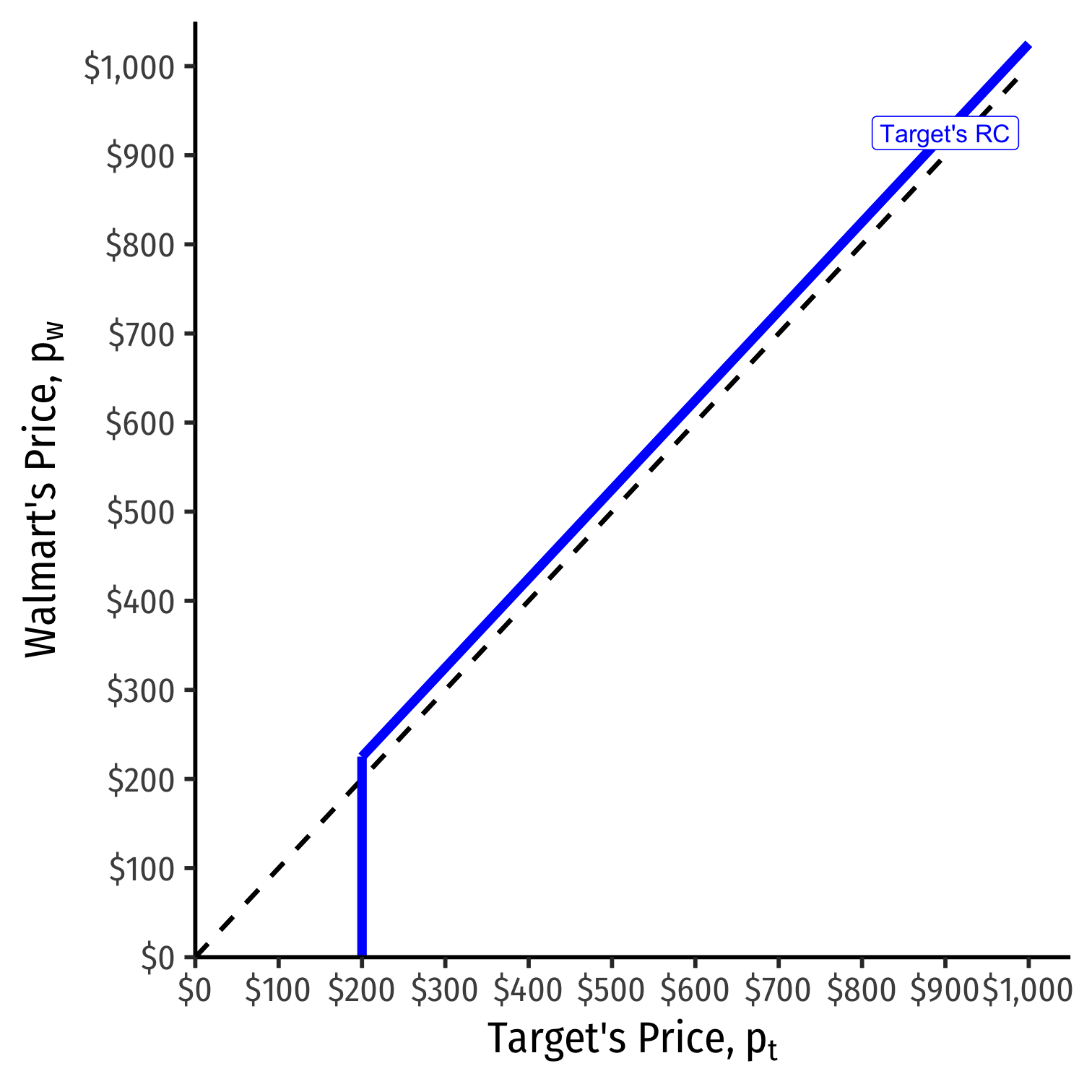

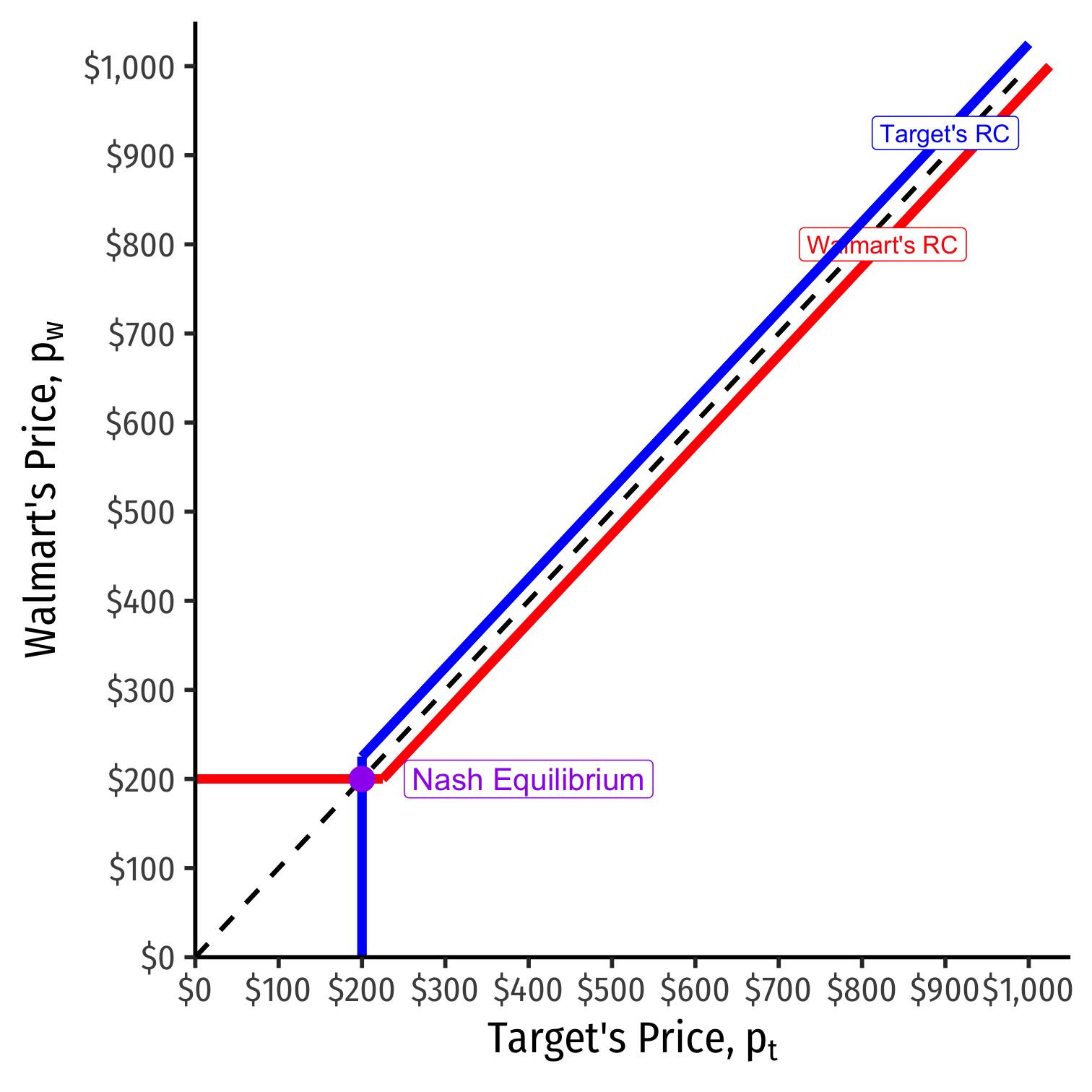

Target's Reaction Curve

We can graph Target's reaction curve to Walmart's price

Target's Reaction Curve

We can graph Target's reaction curve to Walmart's price

- e.g. if Walmart sets a price of $500, Target's best response is $500−ϵ

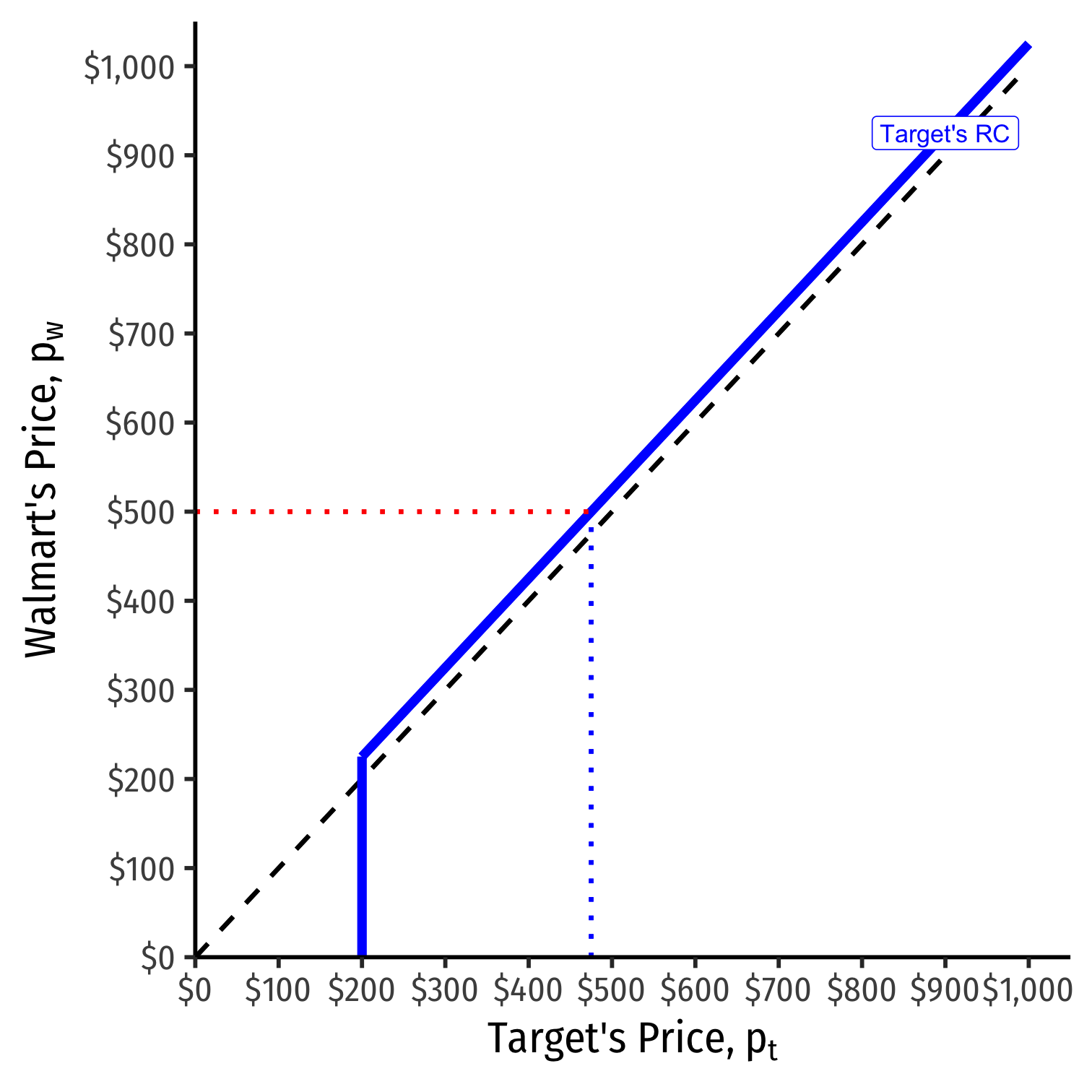

Target's Reaction Curve

We can graph Target's reaction curve to Walmart's price

- e.g. if Walmart sets a price of $500, Target's best response is $500−ϵ

- e.g. if Walmart sets a price of $300, Target's best response is $300−ϵ

Target's Reaction Curve

We can graph Target's reaction curve to Walmart's price

- e.g. if Walmart sets a price of $500, Target's best response is $500−ϵ

- e.g. if Walmart sets a price of $300, Target's best response is $300−ϵ

- e.g. if Walmart sets a price of $200 (MC), Target's best response is $200 (MC)

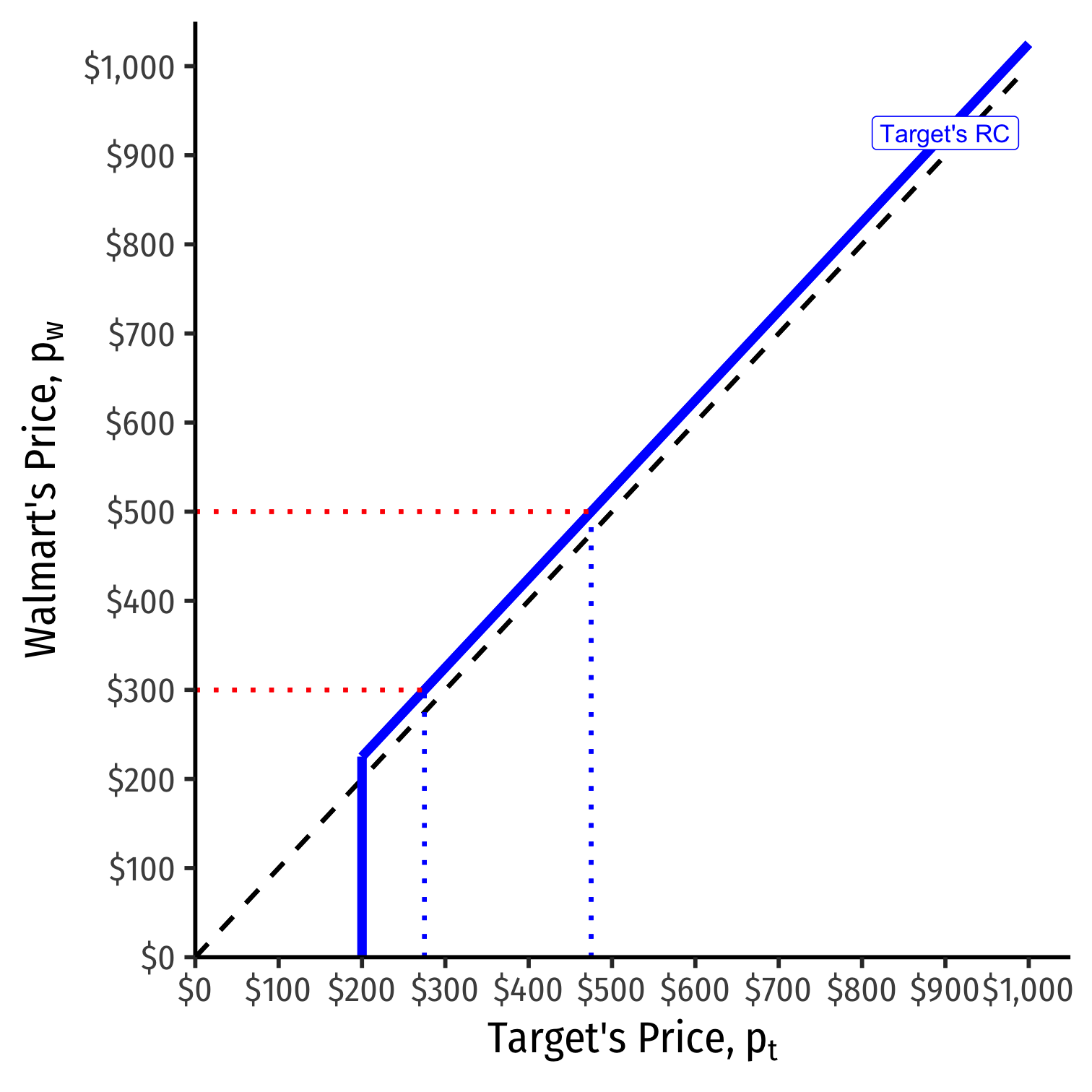

Nash Equilibrium with Reaction Curves

Combine both curves on the same graph

Nash Equilibrium: (pw=MC,pt=MC)

- Where both reaction curves intersect

No longer an incentive to undercut or change price

Bertrand Competition: Moblab

Bertrand Competition: Moblab

Each of you selling identical Economics course notes

You will be put into a market with one other player

Each term, both of you simultaneously choose your price

Firm(s) choosing the lowest price get all the customers

Bertrand Competition: Moblab

- The lowest price pL determines the market demand

q=3600−200pL

Both firms have $2 cost per unit sold

p=10 maximizes total market profits

Bertrand Competition: Moblab

q=3600−200pL

Example:

Suppose Firm 1 sets p=9 and Firm 2 sets p=10

Firm 2 sells 0, makes $0

Firm 1 sells q=3,600−200(9)=1,800 and earns 1,800(9−2)=12,600 profit