1.3: Perfect Competition I: Short Run

ECON 326 · Industrial Organization · Spring 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/IOs20

IOs20.classes.ryansafner.com

Profit Maximization in the Short Run

A Competitive Market

- We assume (for now) the firm is in a competitive industry:

Firms' products are perfect substitutes

Firms are "price-takers", no one firm can affect the market price

Market entry and exit are free†

† Remember this feature. It turns out to be the most important!

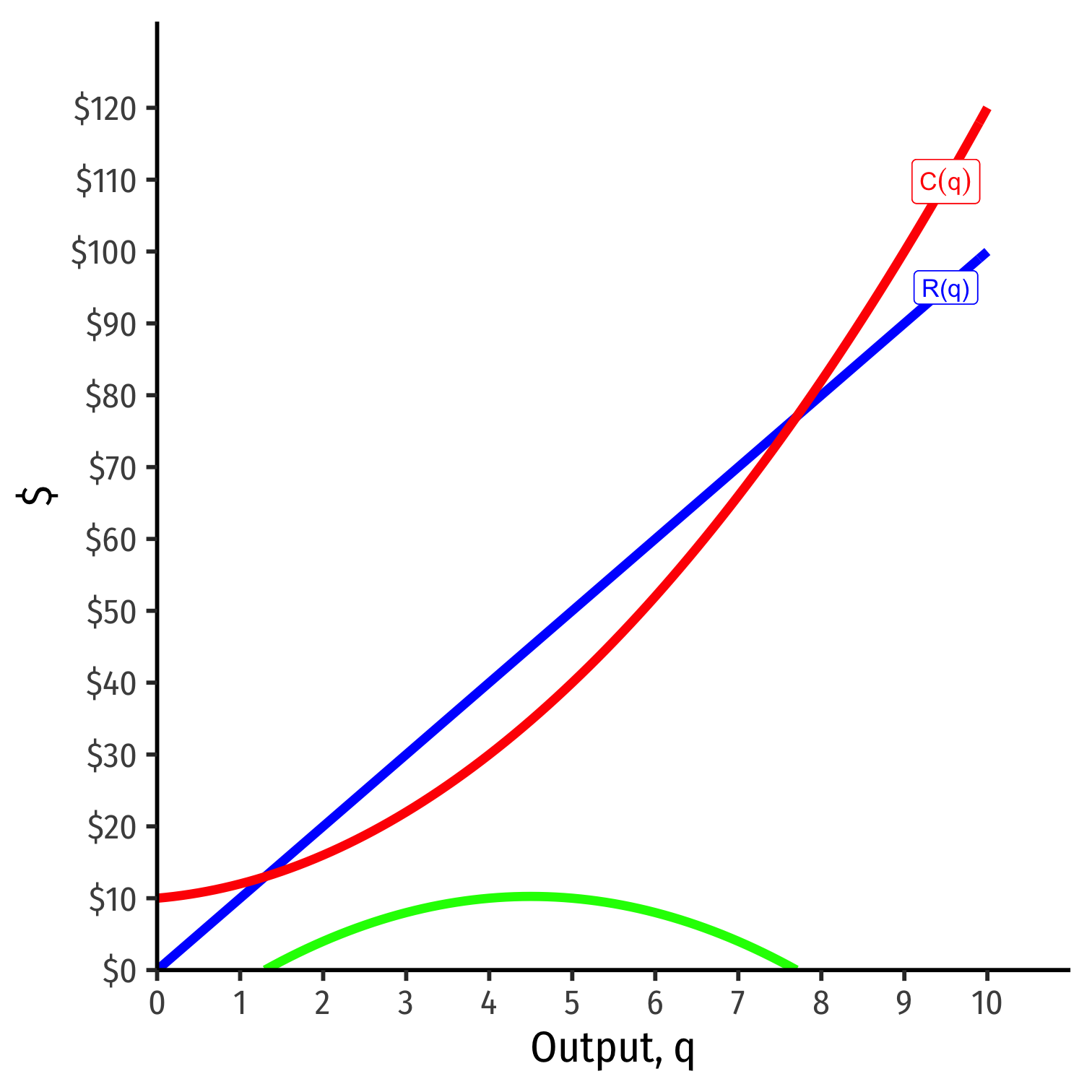

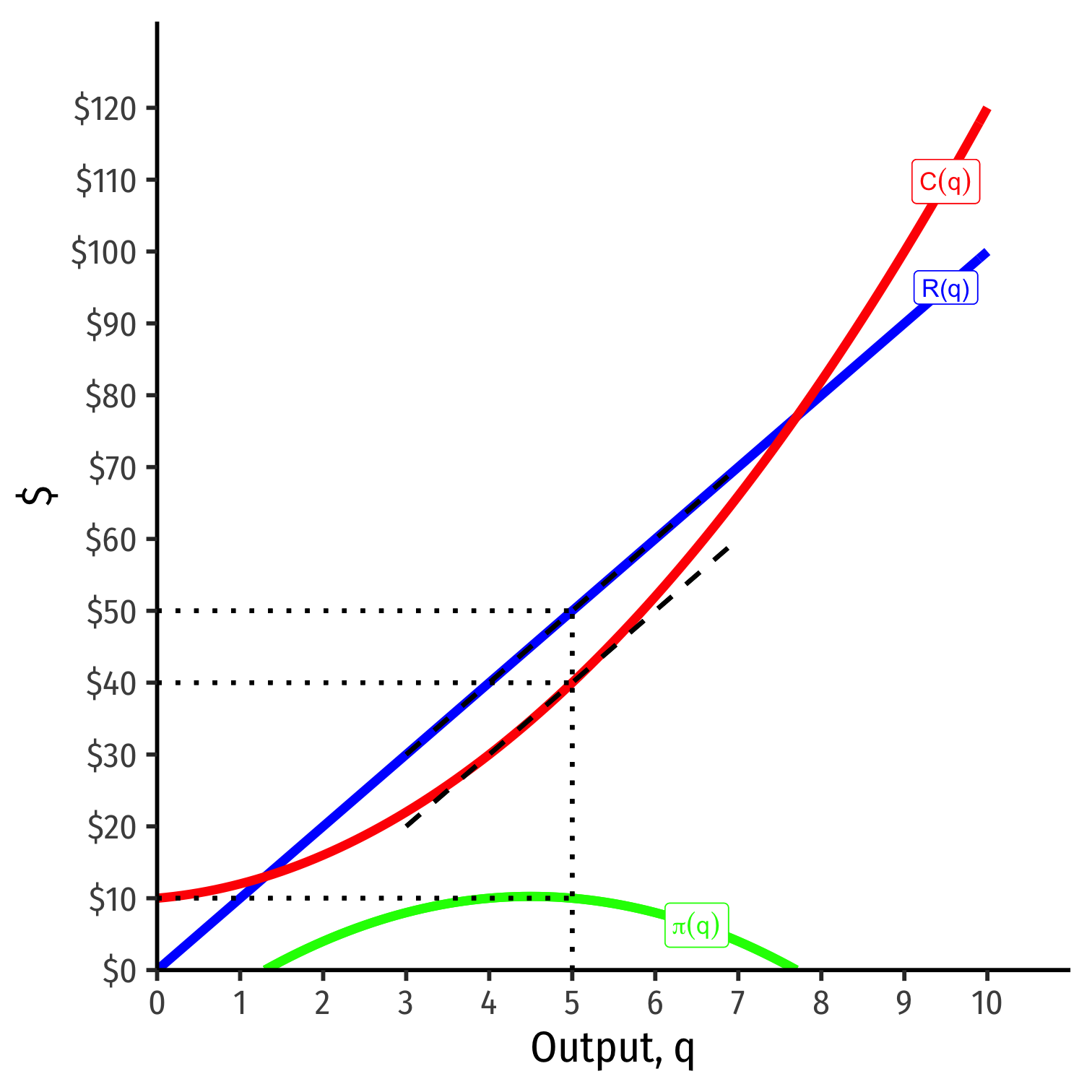

Visualizing Total Profit As R(q)−C(q)

- π(q)=R(q)−C(q)

Visualizing Total Profit As R(q)−C(q)

- π(q)=R(q)−C(q)

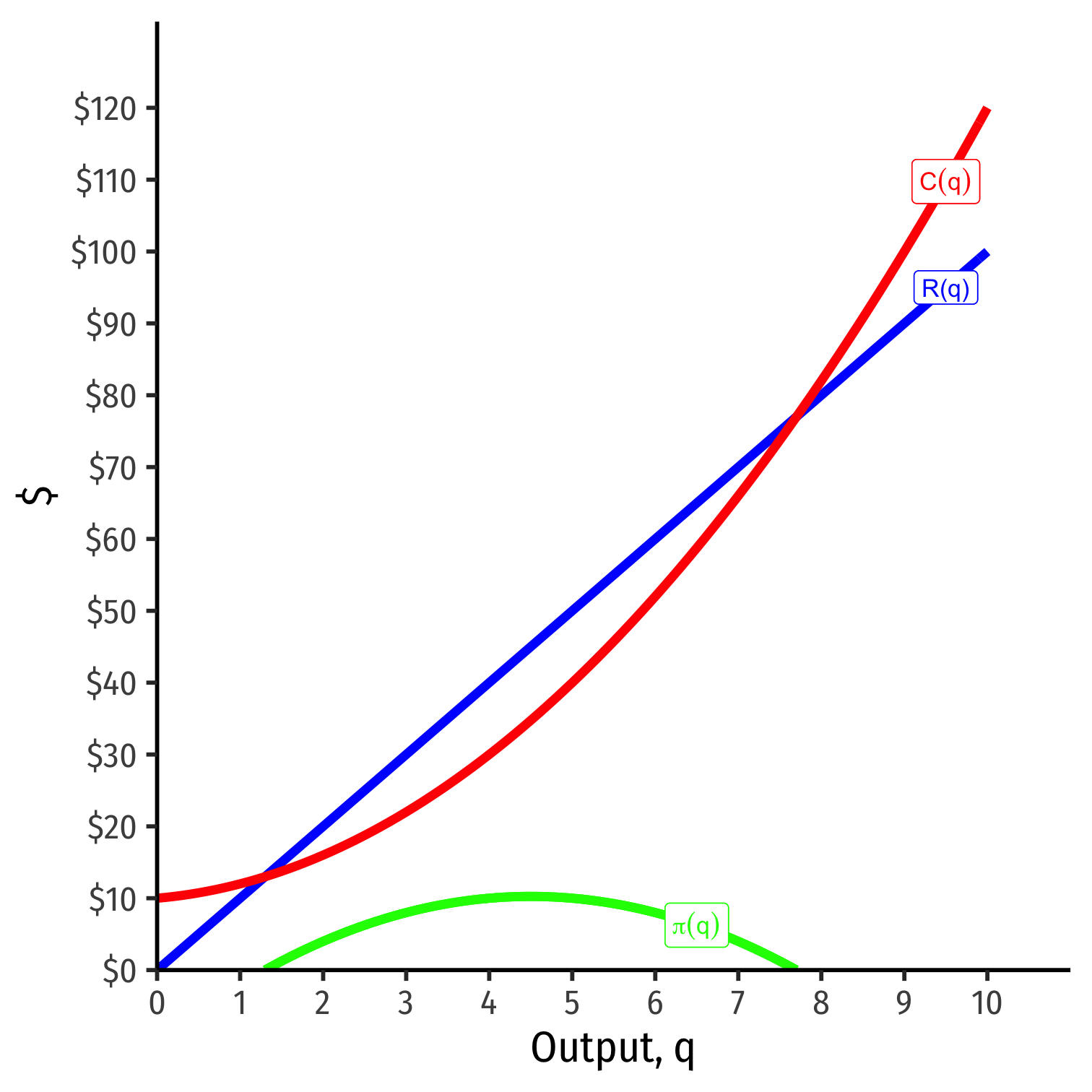

Visualizing Total Profit As R(q)−C(q)

π(q)=R(q)−C(q)

Graph: find q∗ to max π⟹q∗, max distance between R(q) and C(q)

Visualizing Total Profit As R(q)−C(q)

π(q)=R(q)−C(q)

Graph: find q∗ to max π⟹q∗, max distance between R(q) and C(q)

Slopes must be equal: MR(q)=MC(q)

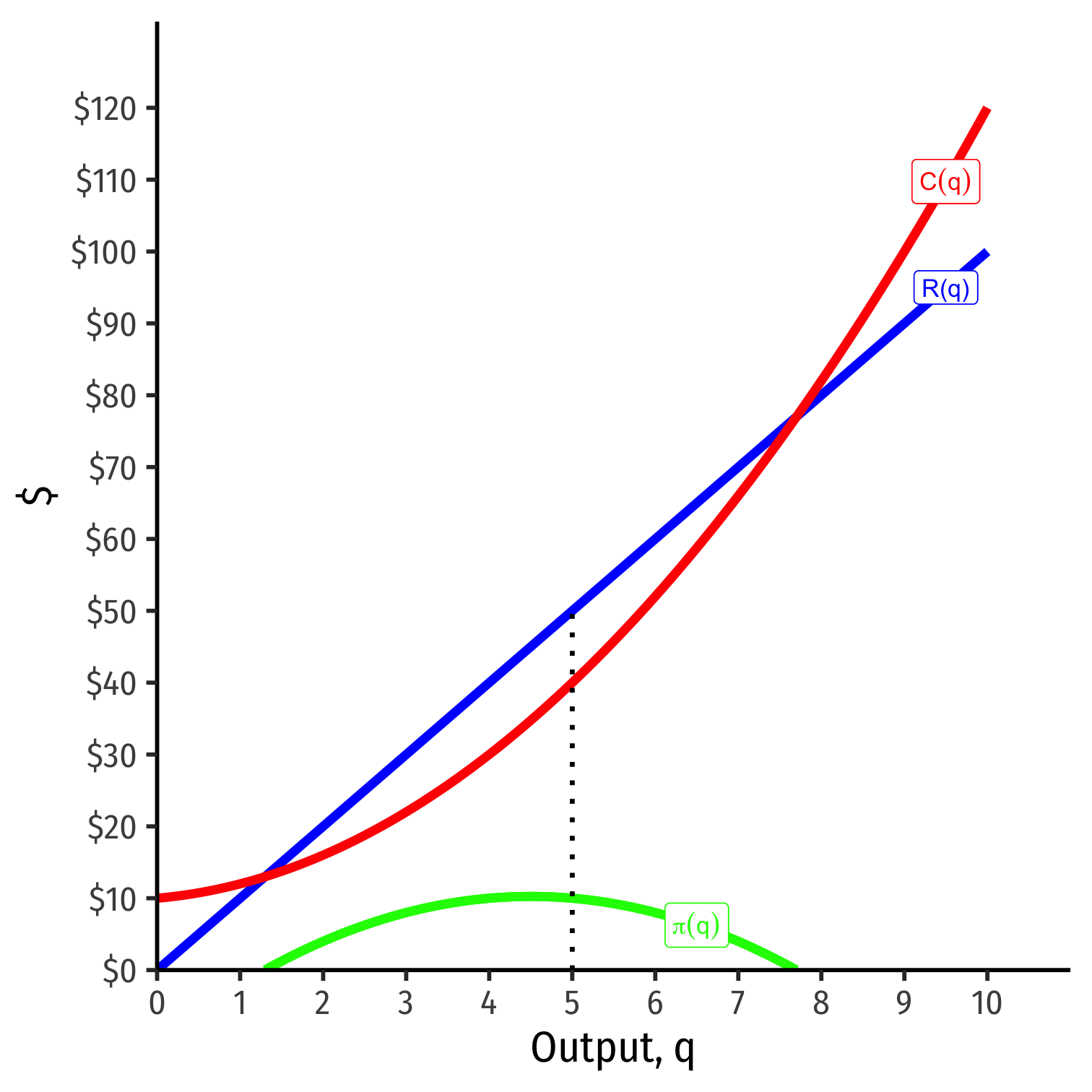

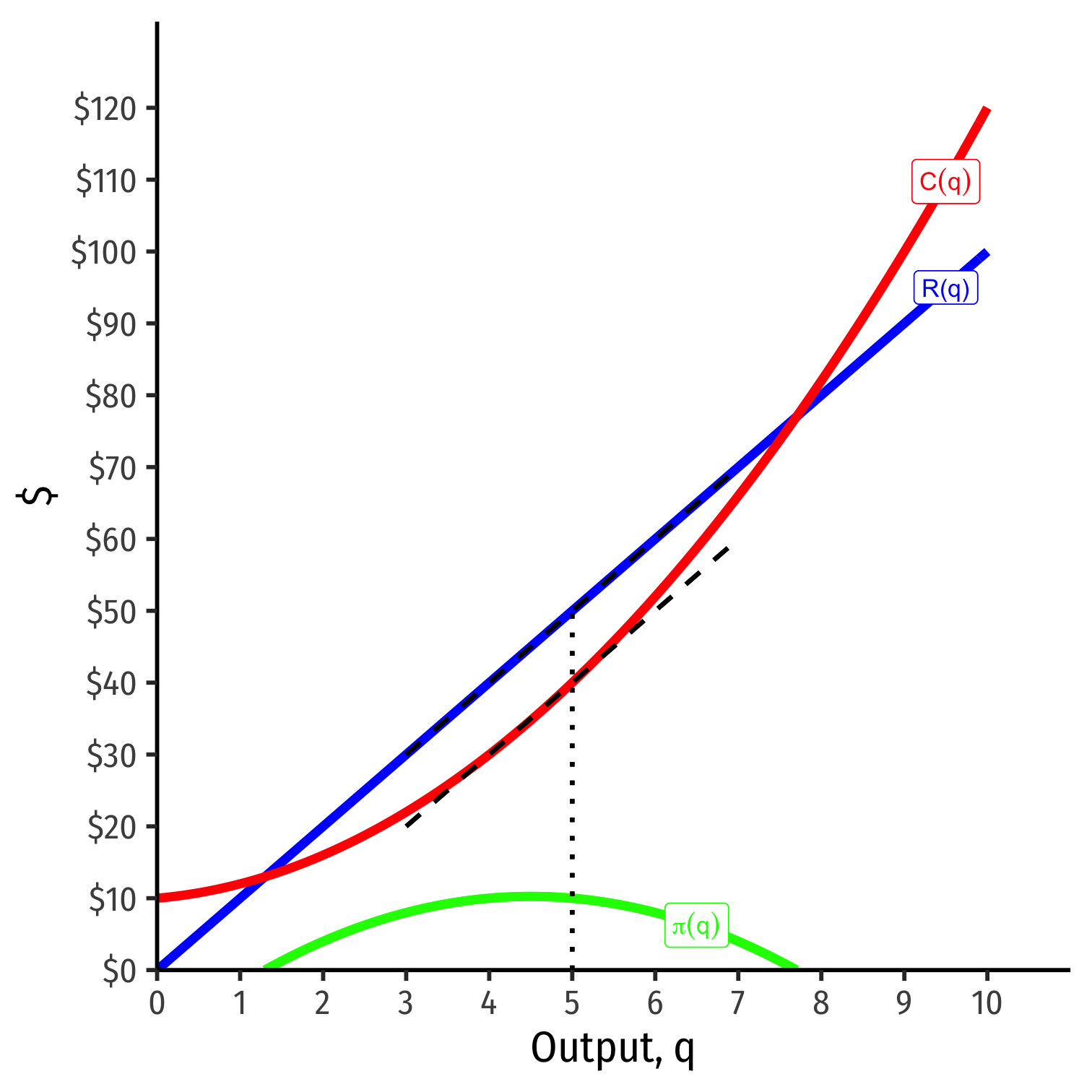

Visualizing Total Profit As R(q)−C(q)

π(q)=R(q)−C(q)

Graph: find q∗ to max π⟹q∗, max distance between R(q) and C(q)

Slopes must be equal: MR(q)=MC(q)

At q∗=5:

- R(q)=50

- C(q)=40

- π(q)=10

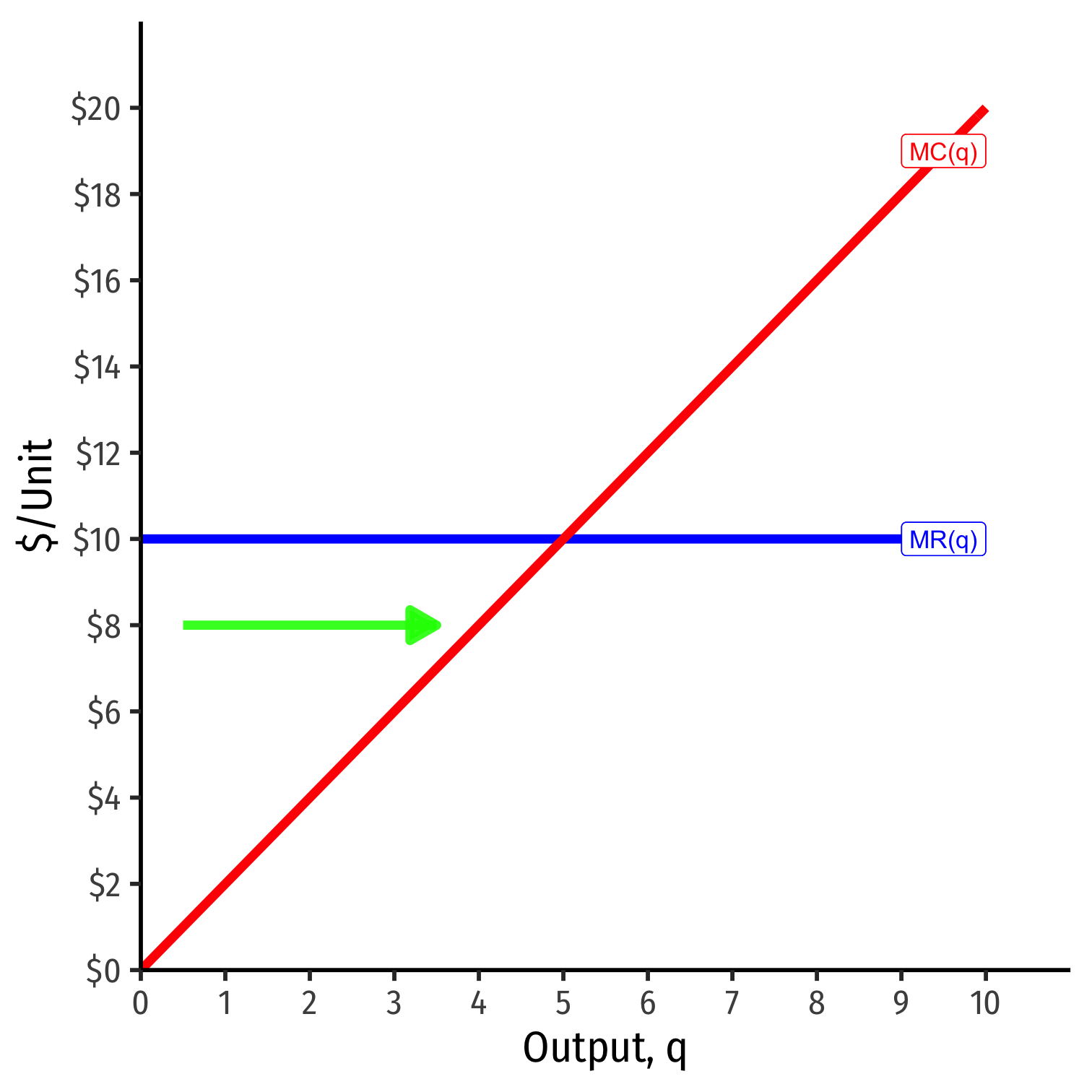

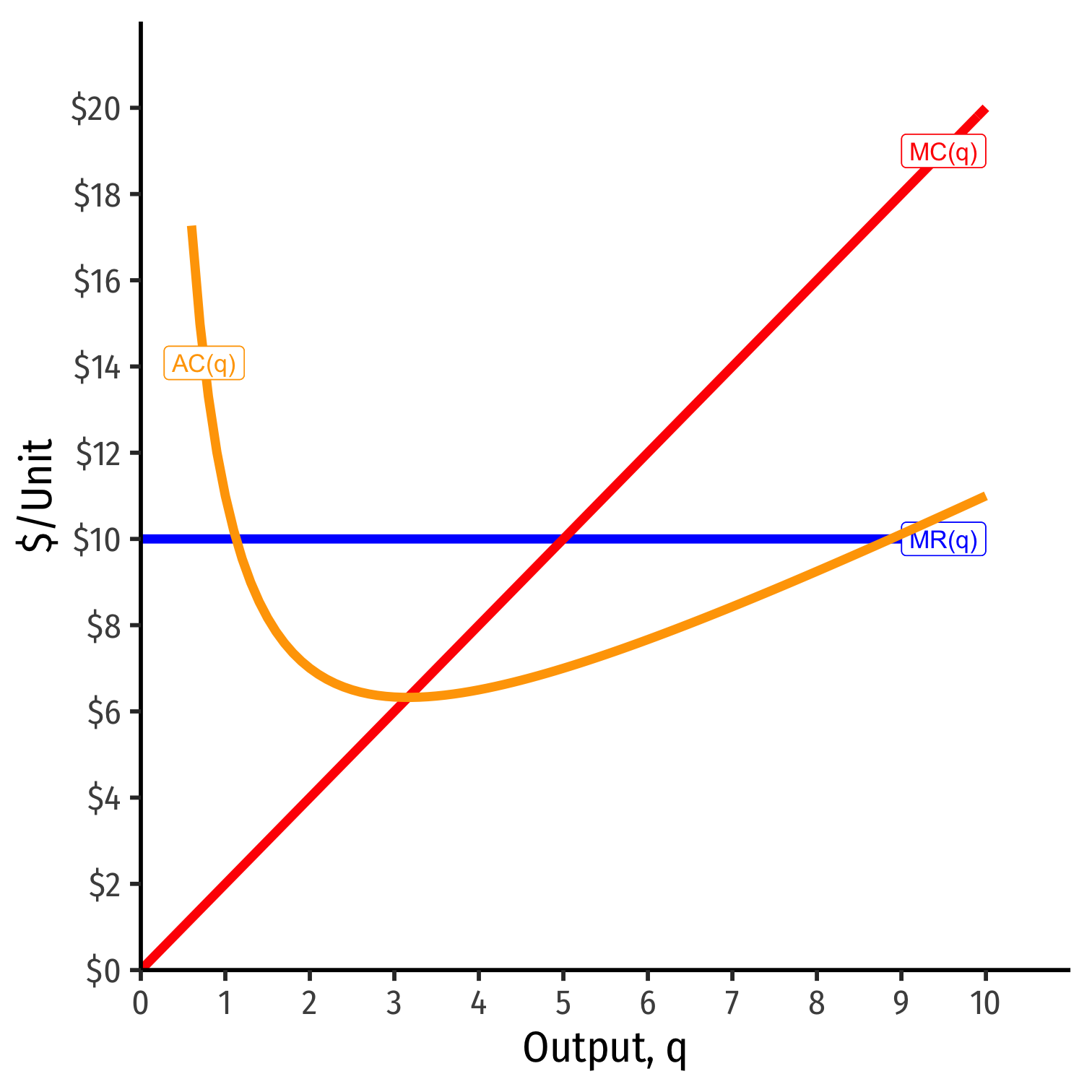

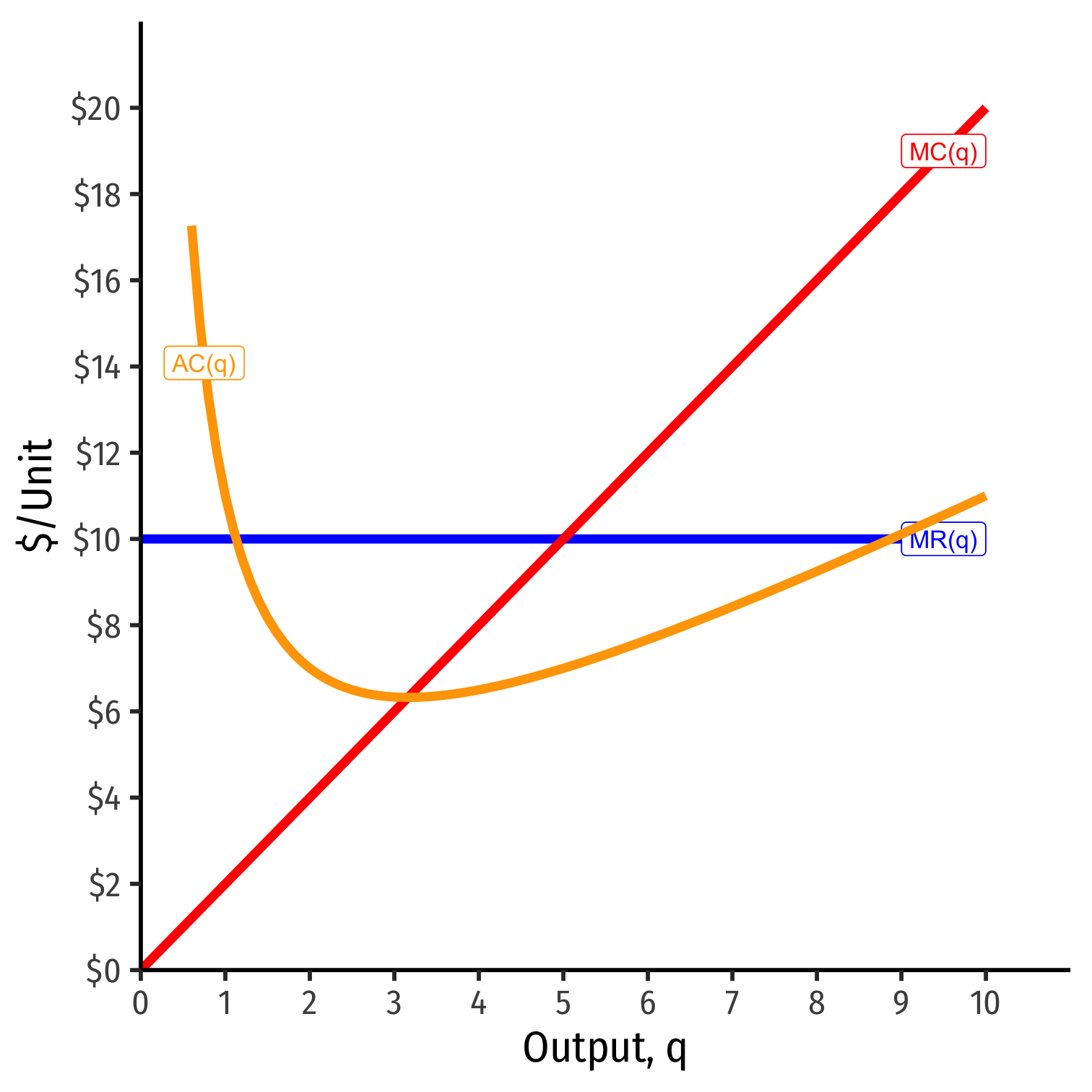

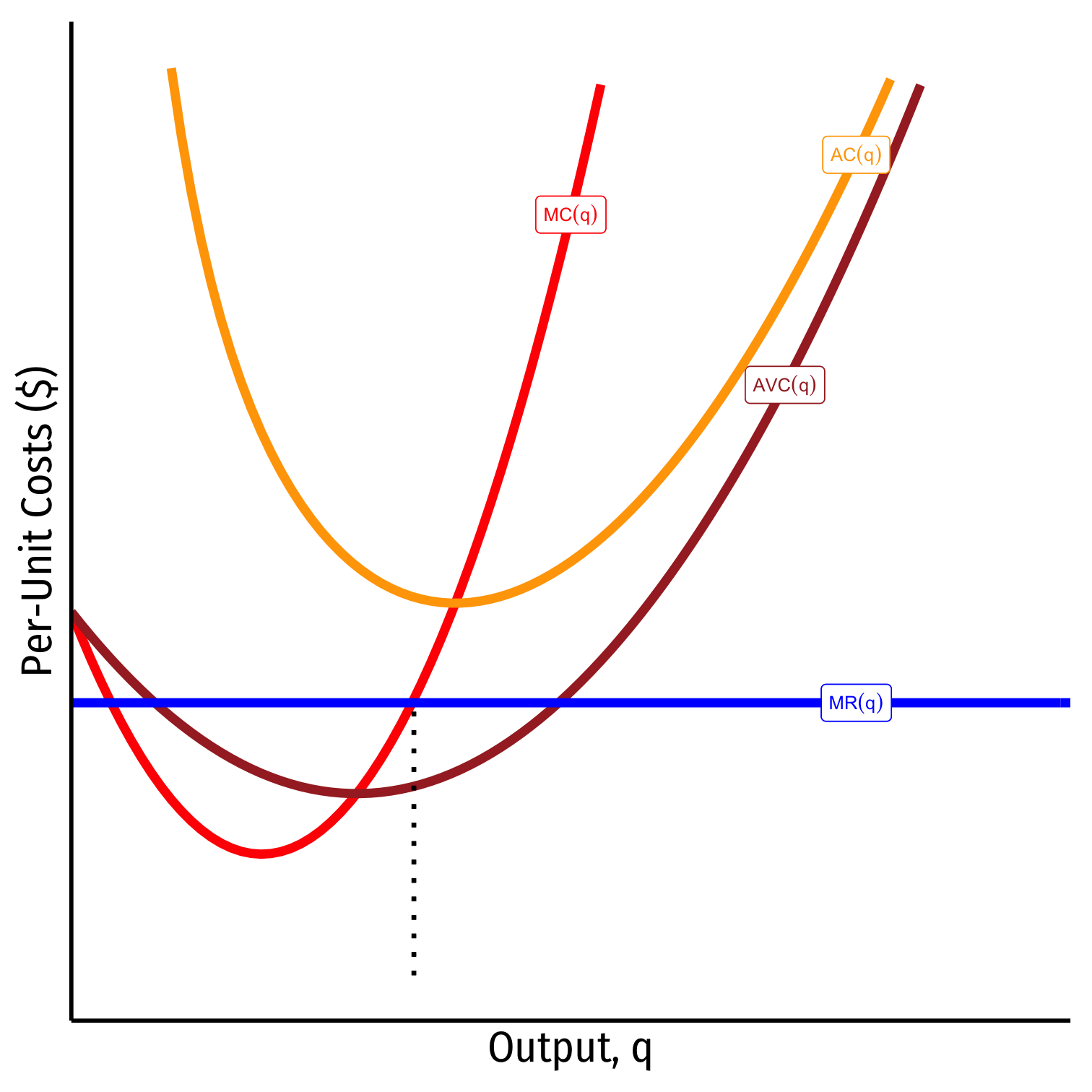

Visualizing Profit Per Unit As MR(q) and MC(q)

- At low output q<q∗, can increase π by producing more: MR(q)>MC(q)

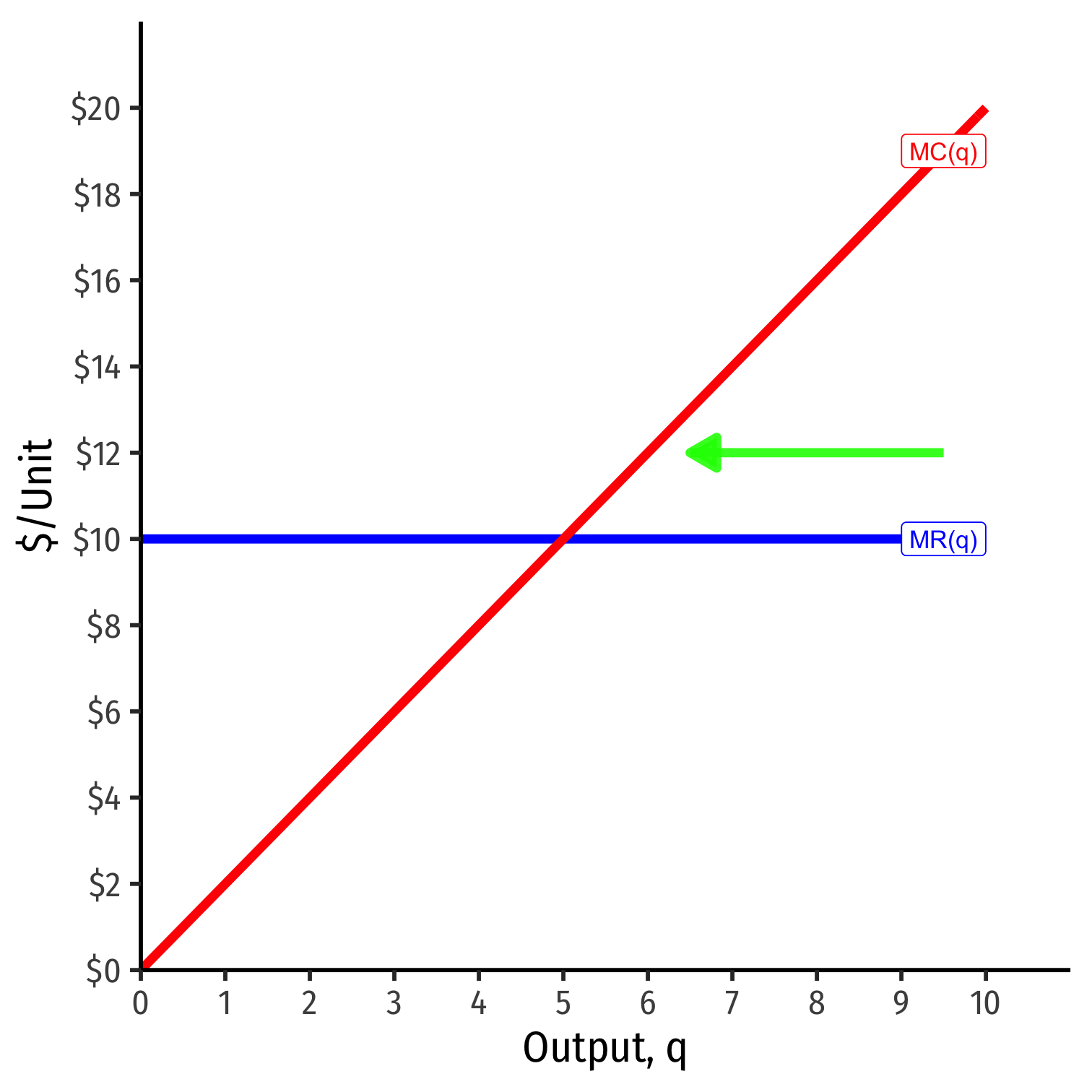

Visualizing Profit Per Unit As MR(q) and MC(q)

- At high output q>q∗, can increase π by producing less: MR(q)<MC(q)

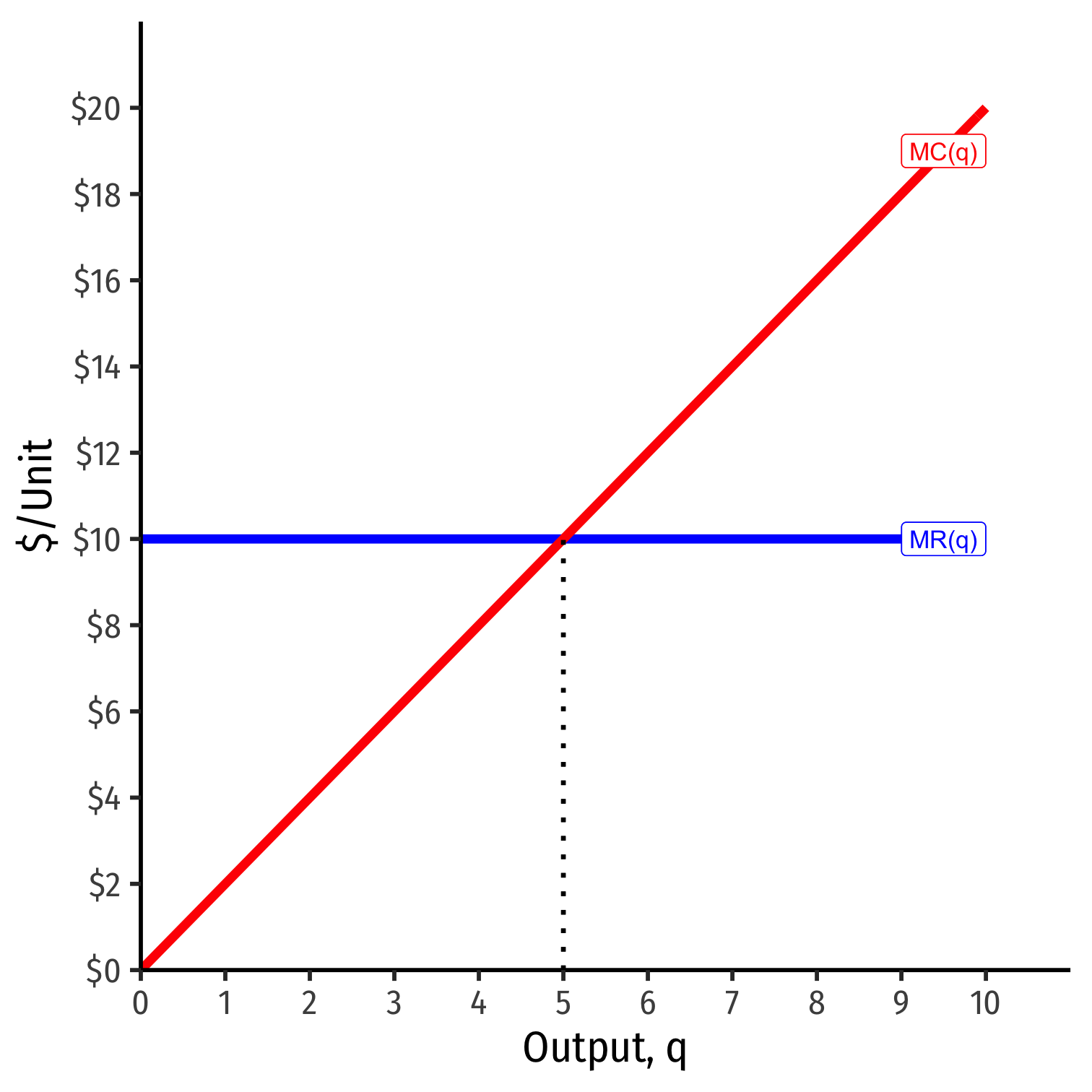

Visualizing Profit Per Unit As MR(q) and MC(q)

- π is maximized where MR(q)=MC(q)

Comparative Statics

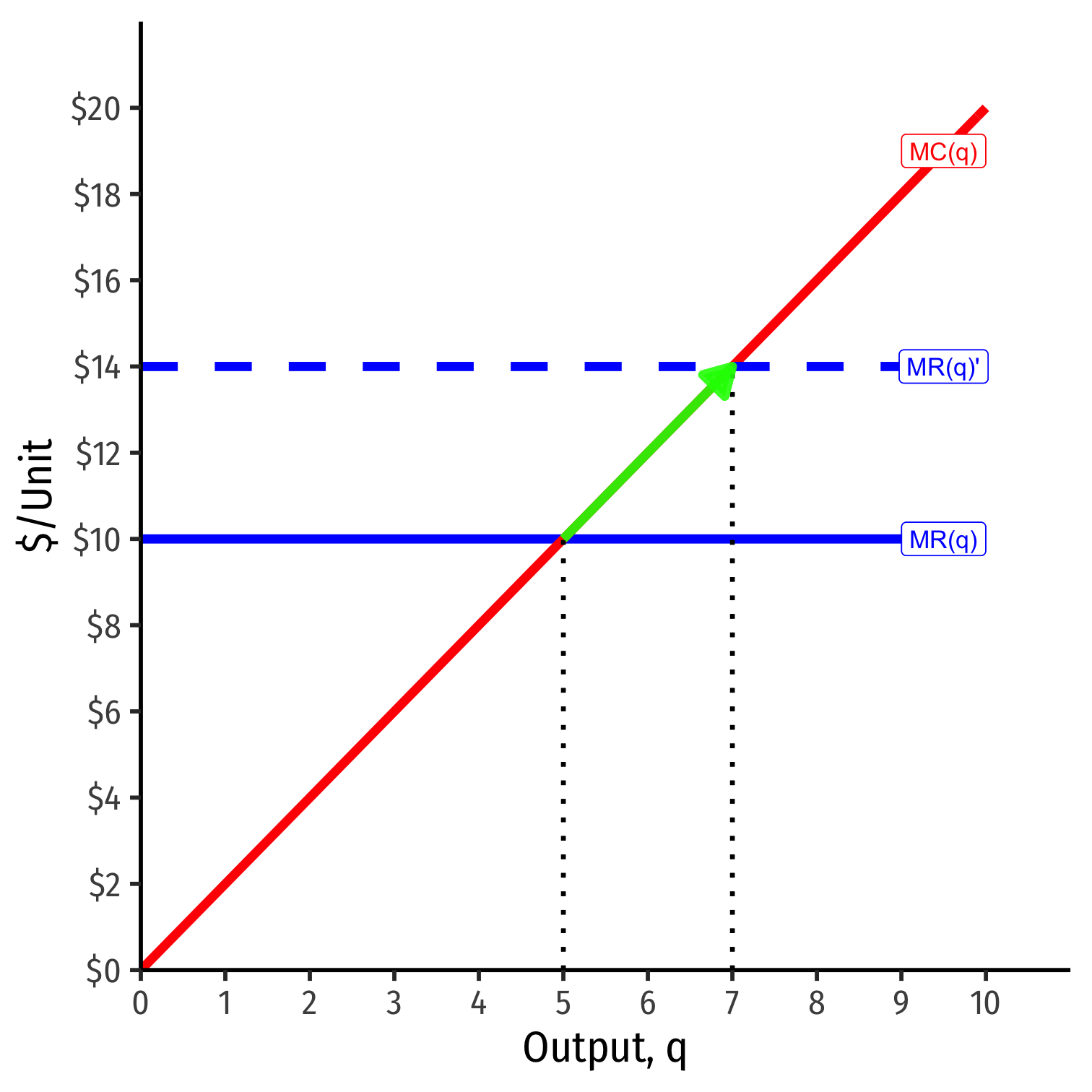

If Market Price Changes I

Suppose the market price increases

Firm--always setting MR=MC--will respond by producing more

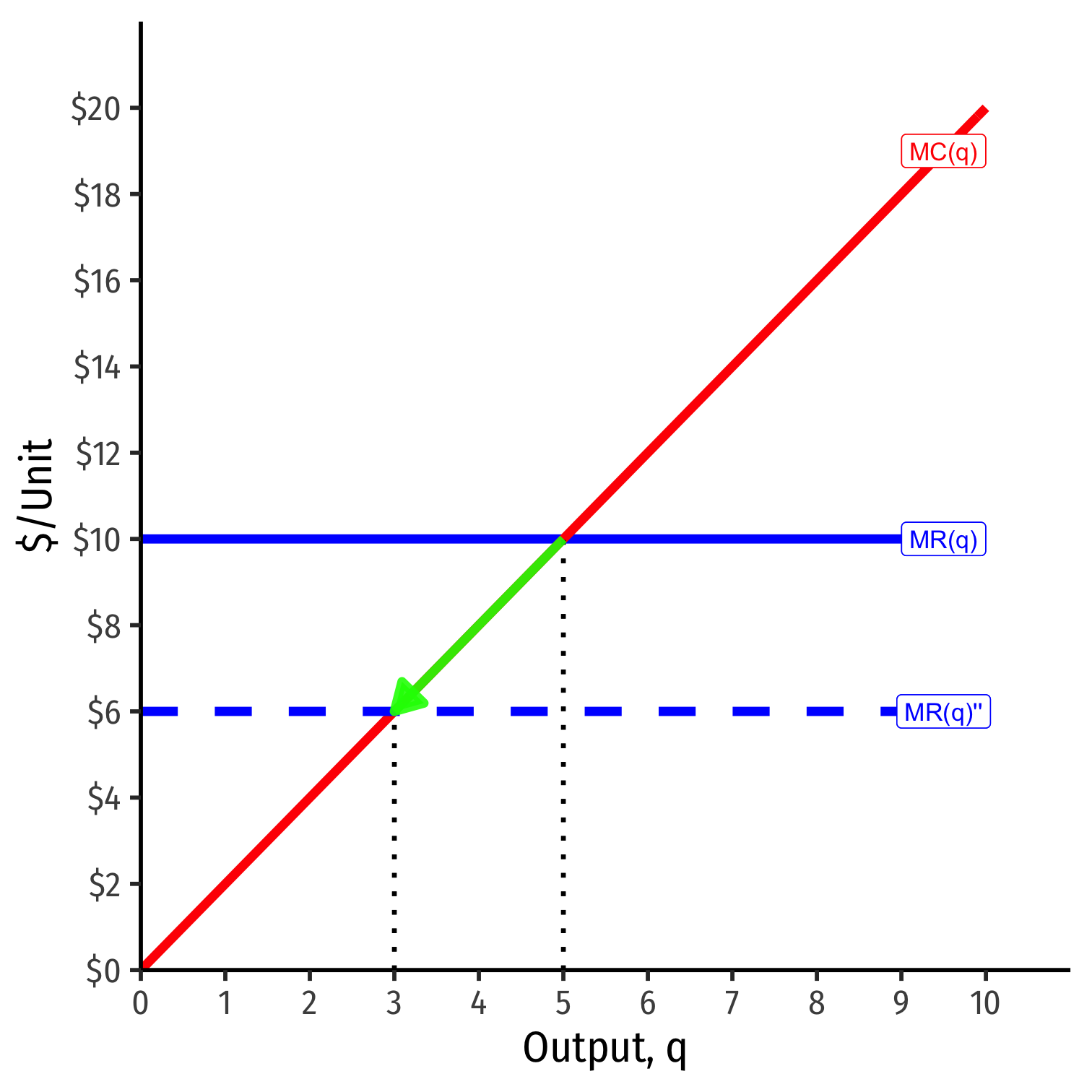

If Market Price Changes II

Suppose the market price decreases

Firm--always setting MR=MC--will respond by producing less

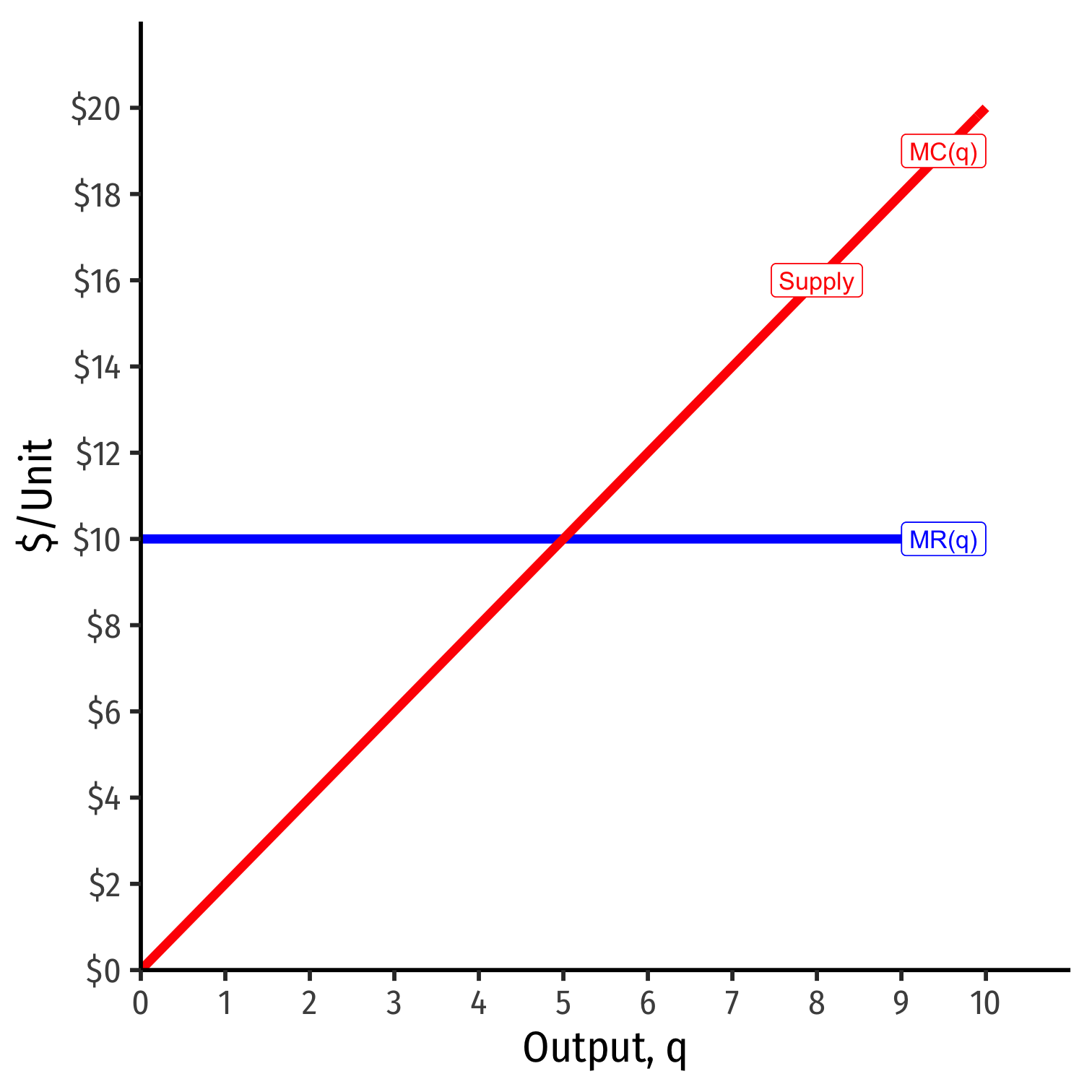

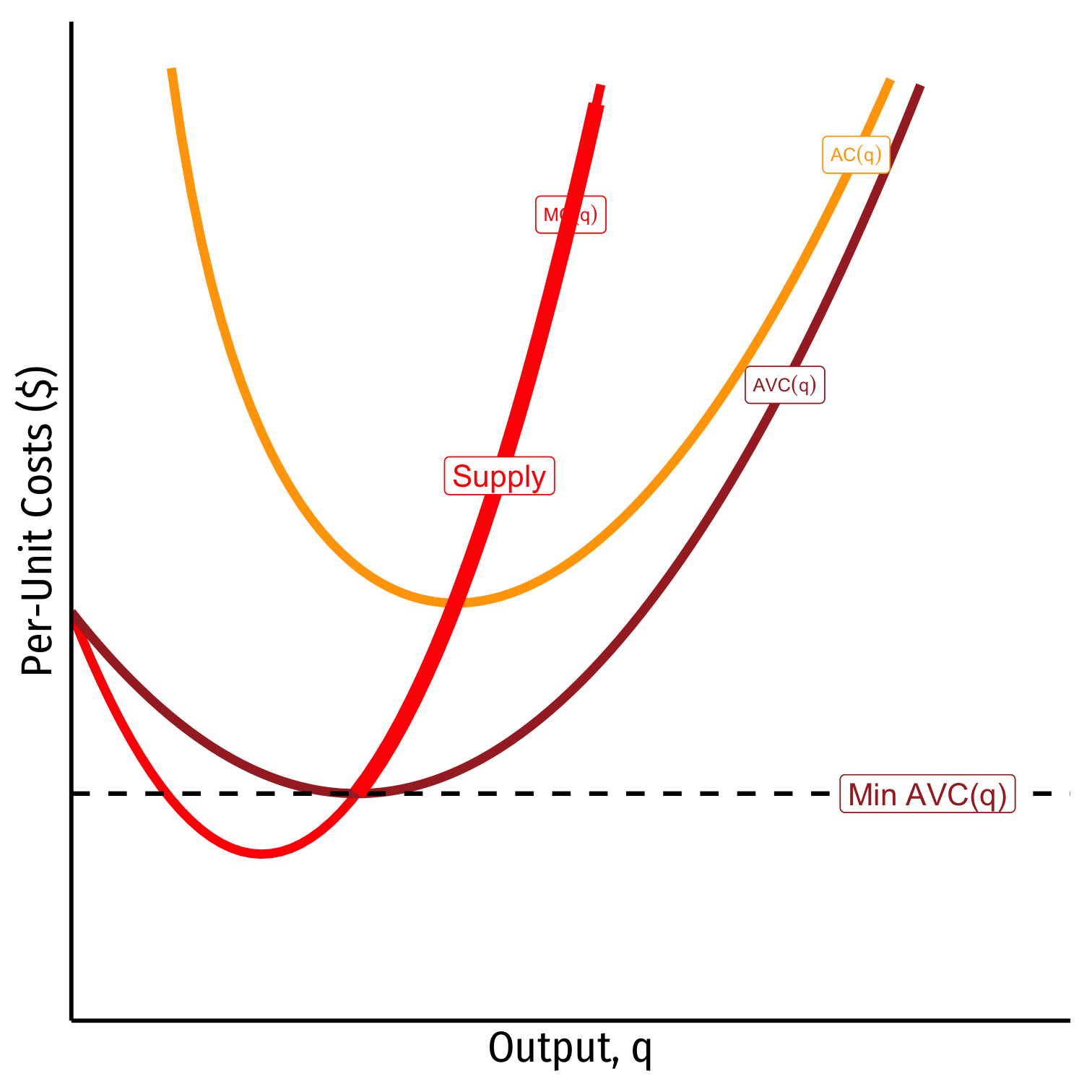

If Market Price Changes III

- The firm's marginal cost curve is its (inverse) supply curve†

Supply=MC(q)

- How it will supply the optimal amount of output in response to the market price

† Mostly...there is an exception we'll see shortly!

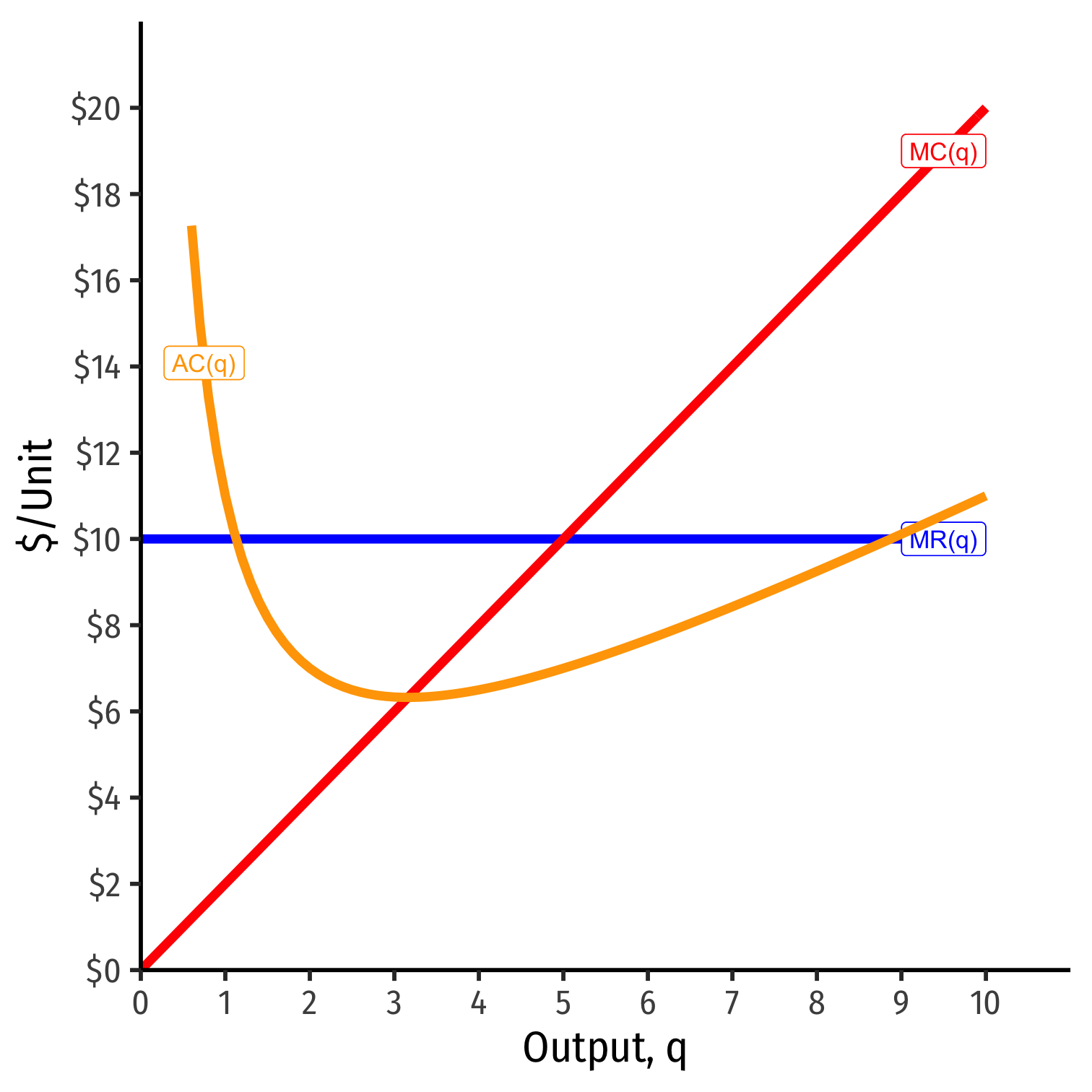

Calculating Profit

Calculating Average Profit as AR(q)−AC(q)

- Profit is

π(q)=R(q)−C(q)

Calculating Average Profit as AR(q)−AC(q)

Profit is π(q)=R(q)−C(q)

Profit per unit can be calculated as: π(q)q=AR(q)−AC(q)=p−AC(q)

Calculating Average Profit as AR(q)−AC(q)

Profit is π(q)=R(q)−C(q)

Profit per unit can be calculated as: π(q)q=AR(q)−AC(q)=p−AC(q)

Multiply by q to get total profit: π(q)=q[p−AC(q)]

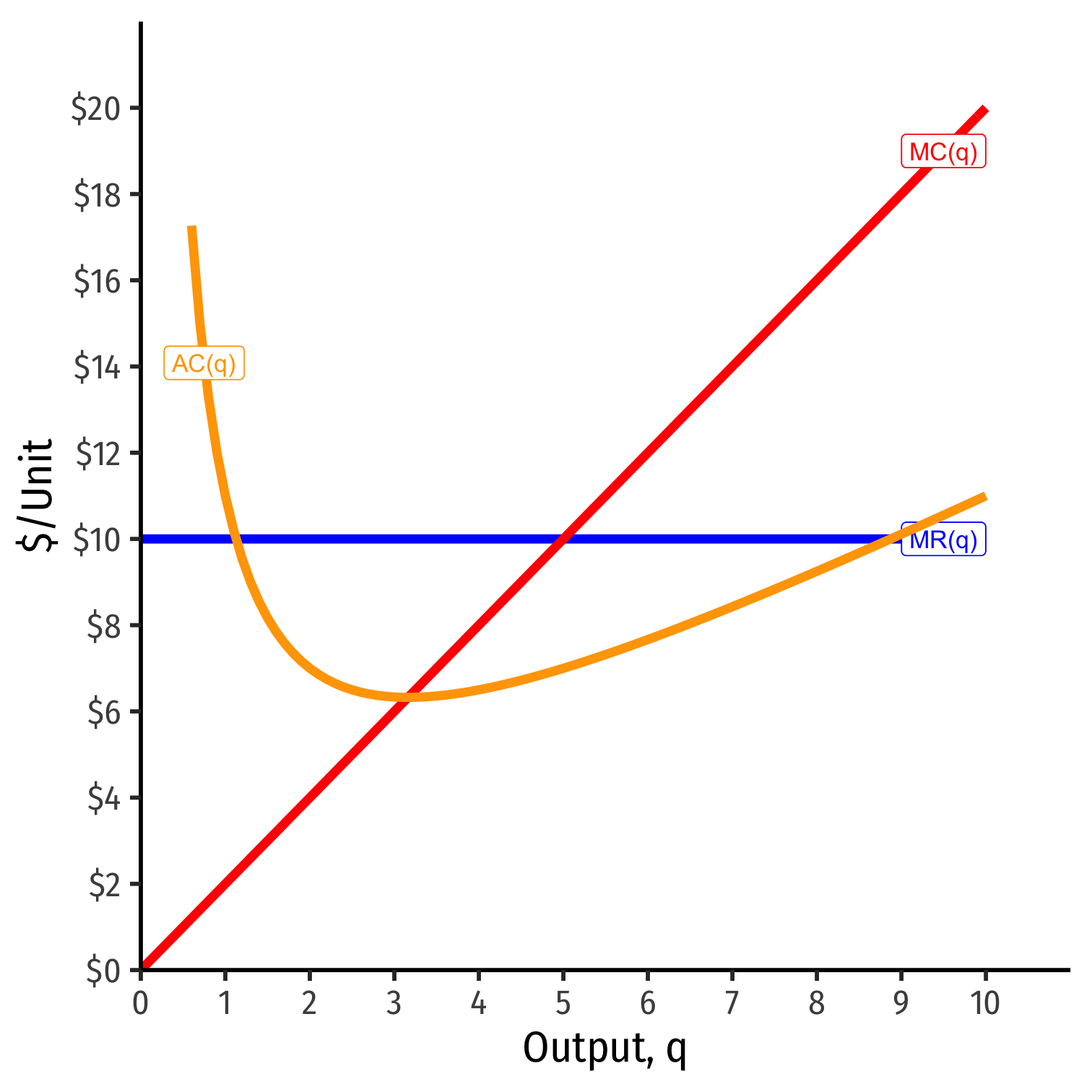

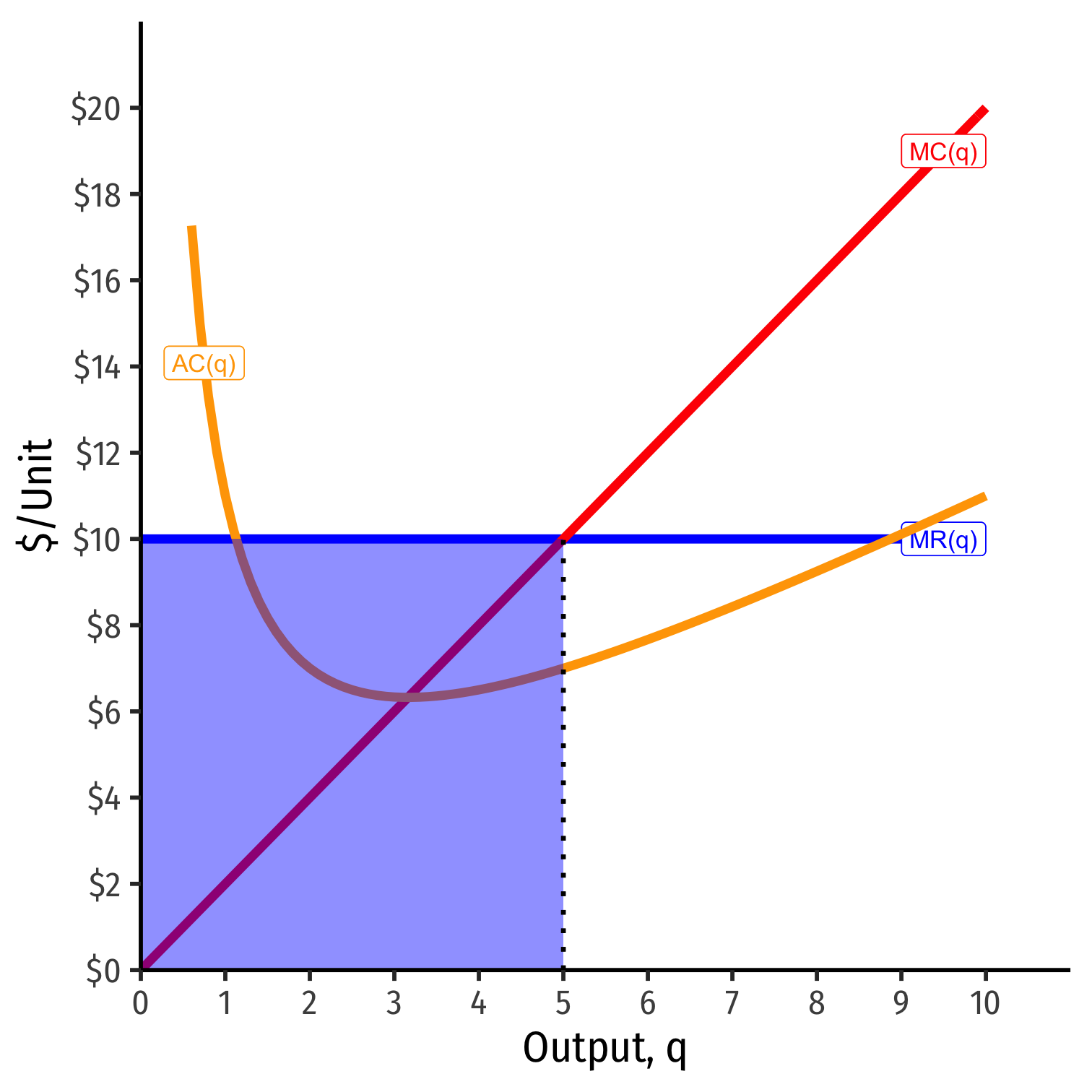

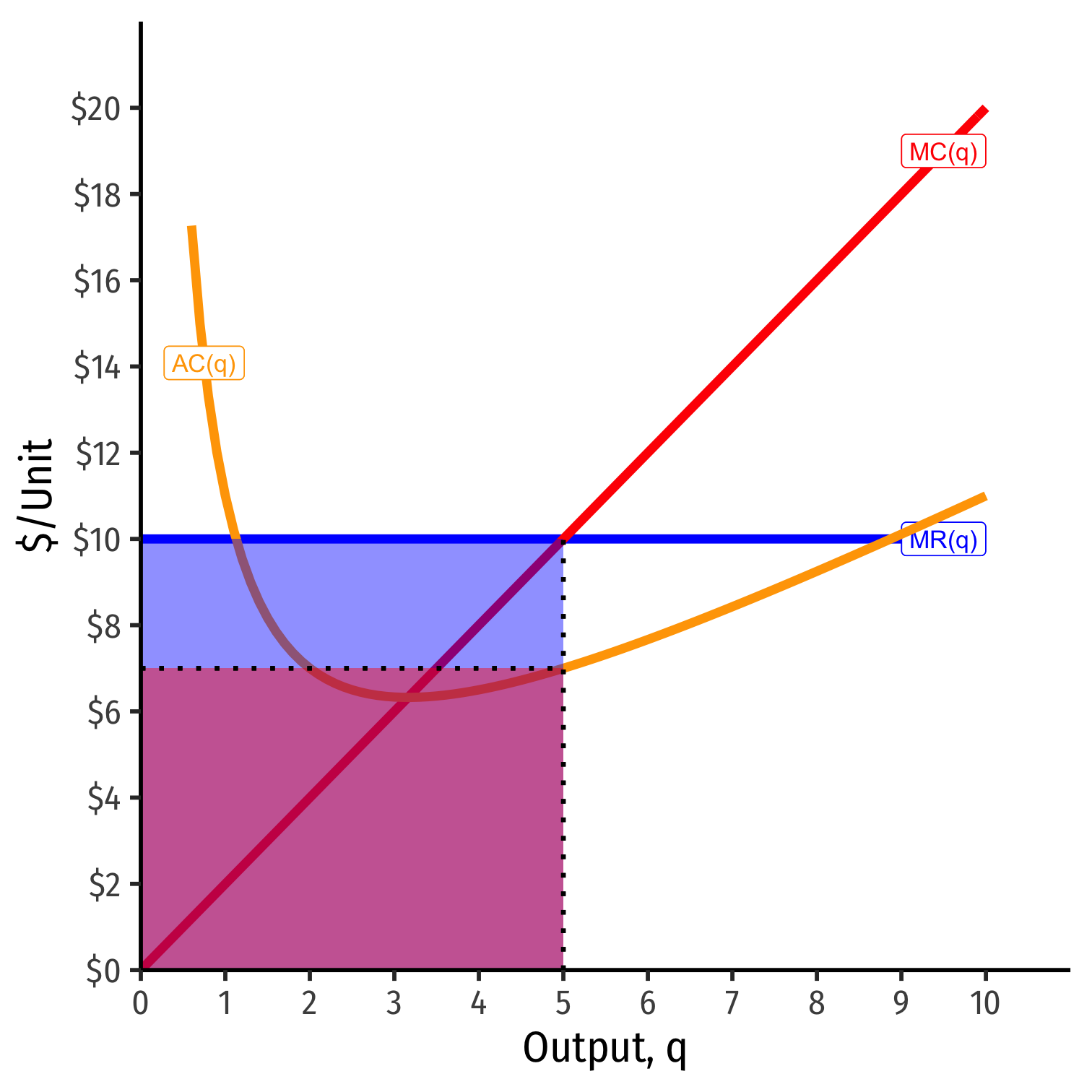

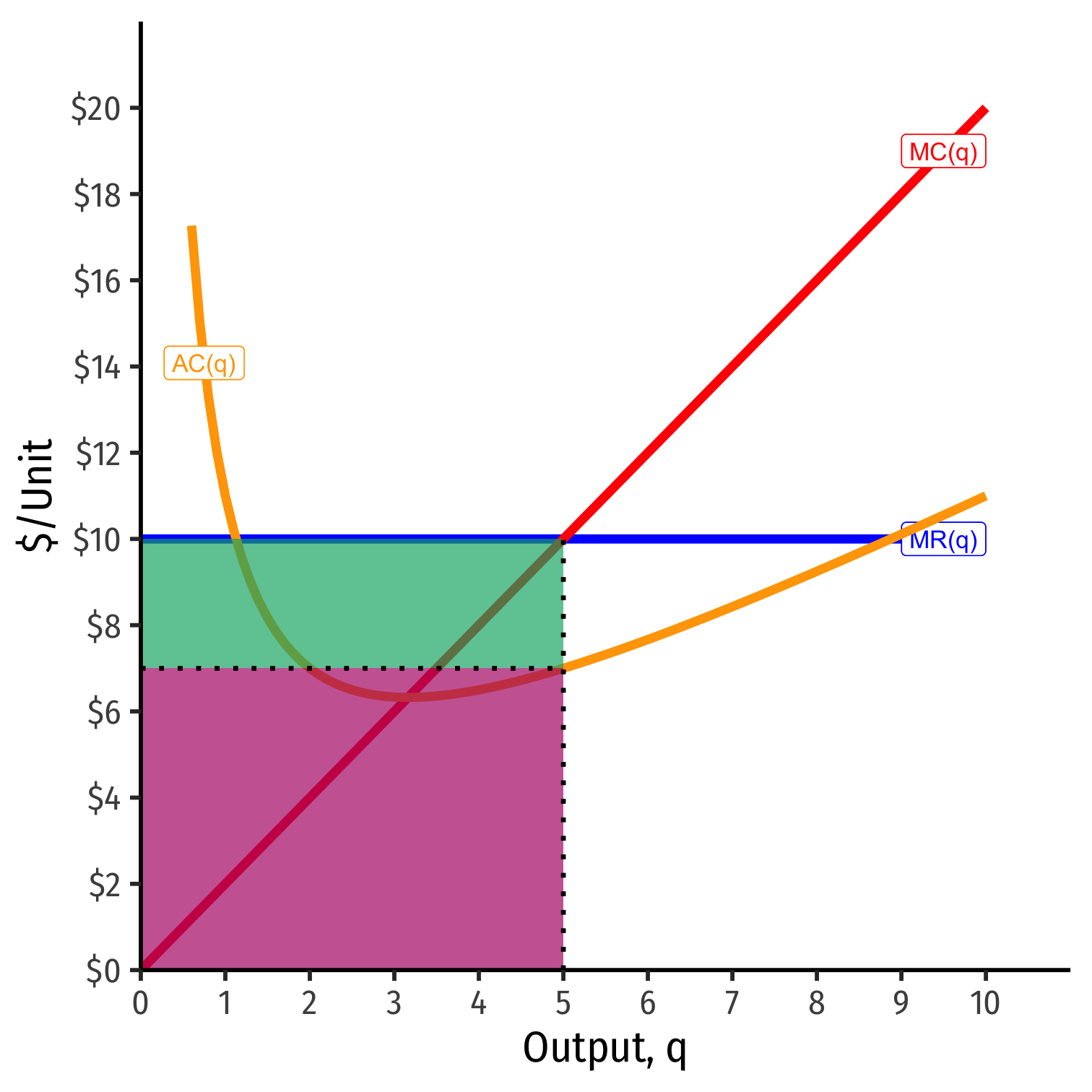

Calculating Average Profit as AR(q)−AC(q)

At market price of p∗= $10

At q∗=5 (per unit):

At q∗=5 (totals):

## geom_segment: arrow = NULL, arrow.fill = NULL, lineend = butt, linejoin = round, na.rm = FALSE## stat_identity: na.rm = FALSE## position_identityCalculating Average Profit as AR(q)−AC(q)

At market price of p∗= $10

At q∗=5 (per unit):

- AR(5)= $10/unit

At q∗=5 (totals):

- R(5)= $50

Calculating Average Profit as AR(q)−AC(q)

At market price of p∗= $10

At q∗=5 (per unit):

- AR(5)= $10/unit

- AC(5)= $7/unit

At q∗=5 (totals):

- R(5)= $50

- C(5)= $35

Calculating Average Profit as AR(q)−AC(q)

At market price of p∗= $10

At q∗=5 (per unit):

- AR(5)= $10/unit

- AC(5)= $7/unit

- Aπ(5)= $3/unit

At q∗=5 (totals):

- R(5)= $50

- C(5)= $35

- π(5)= $15

Calculating Average Profit as AR(q)−AC(q)

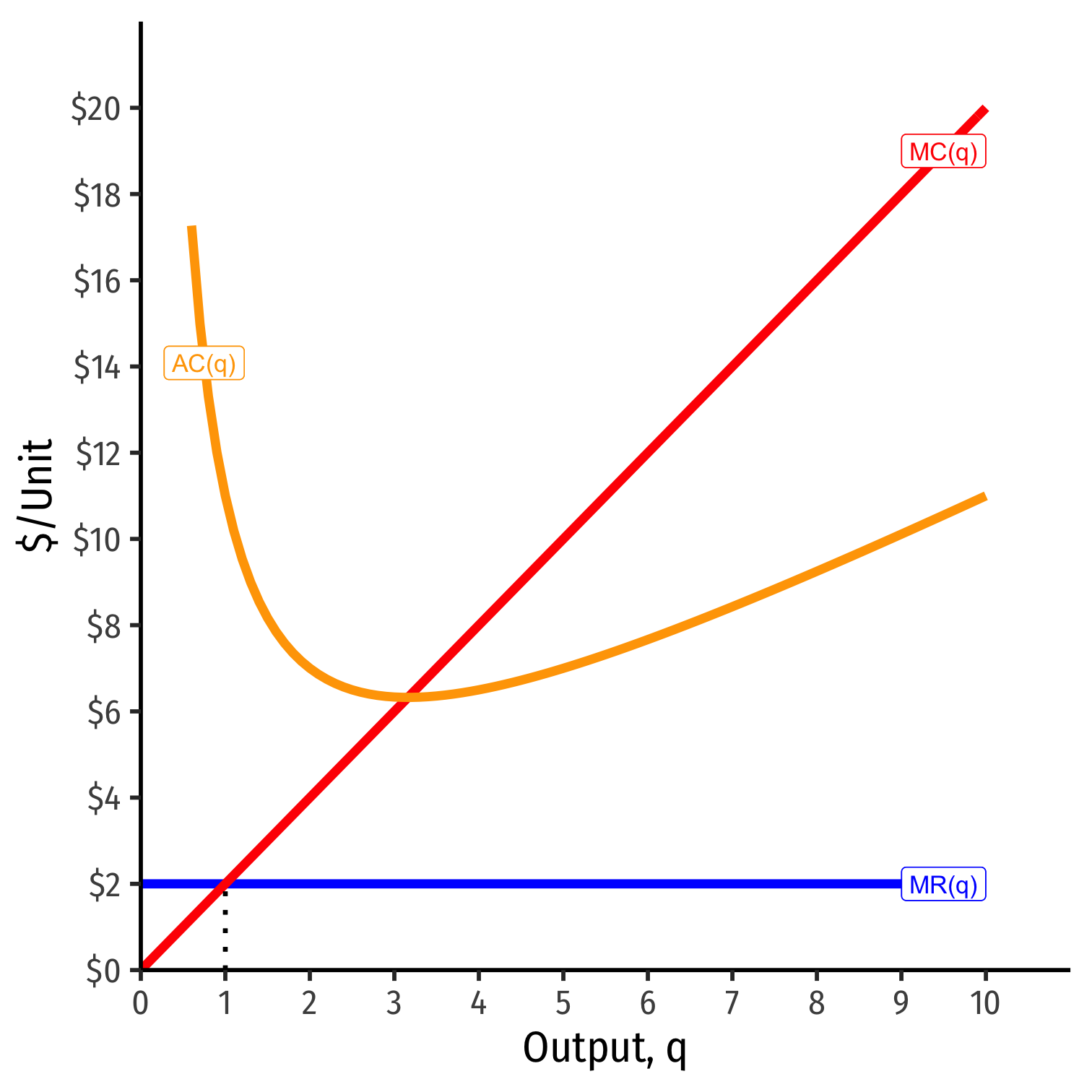

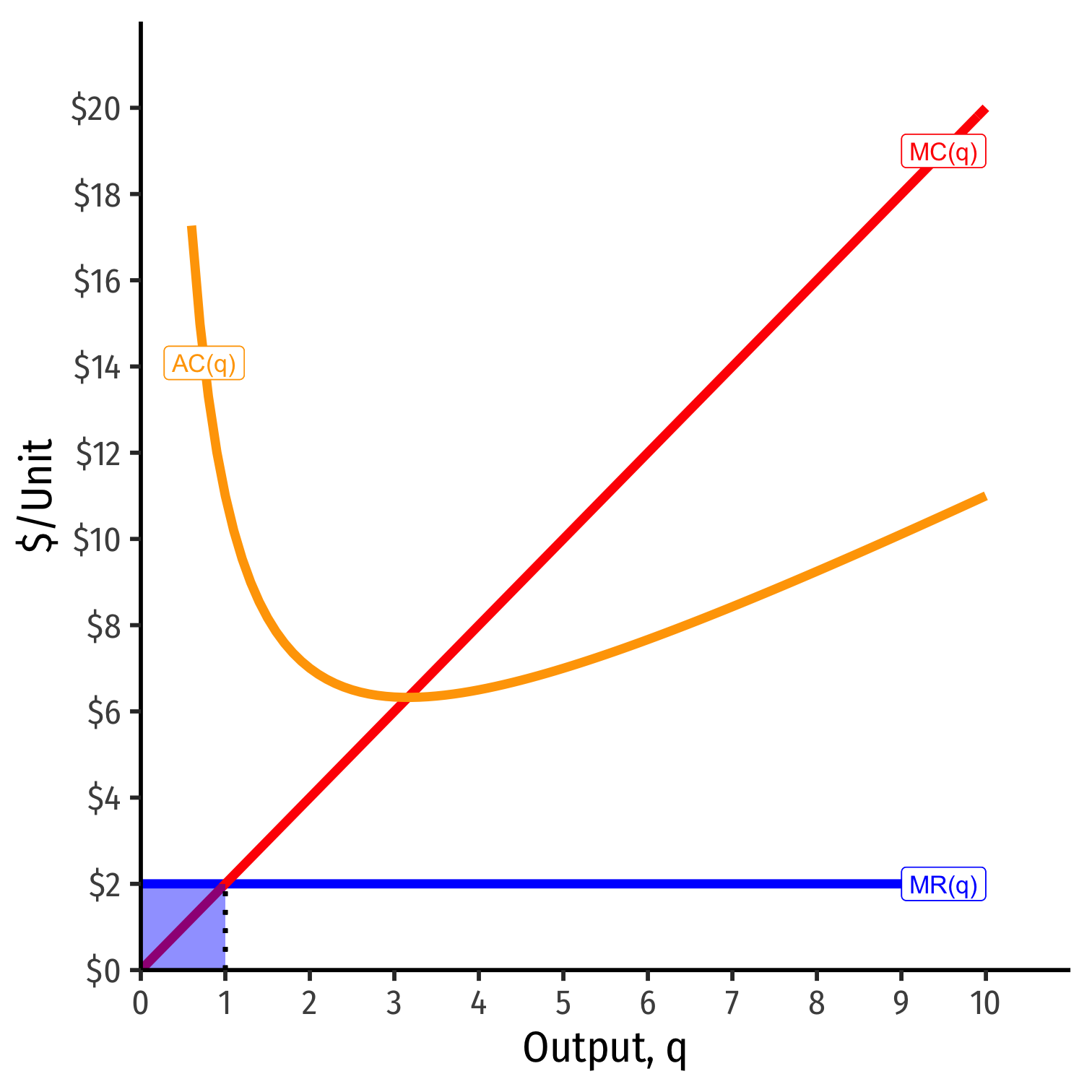

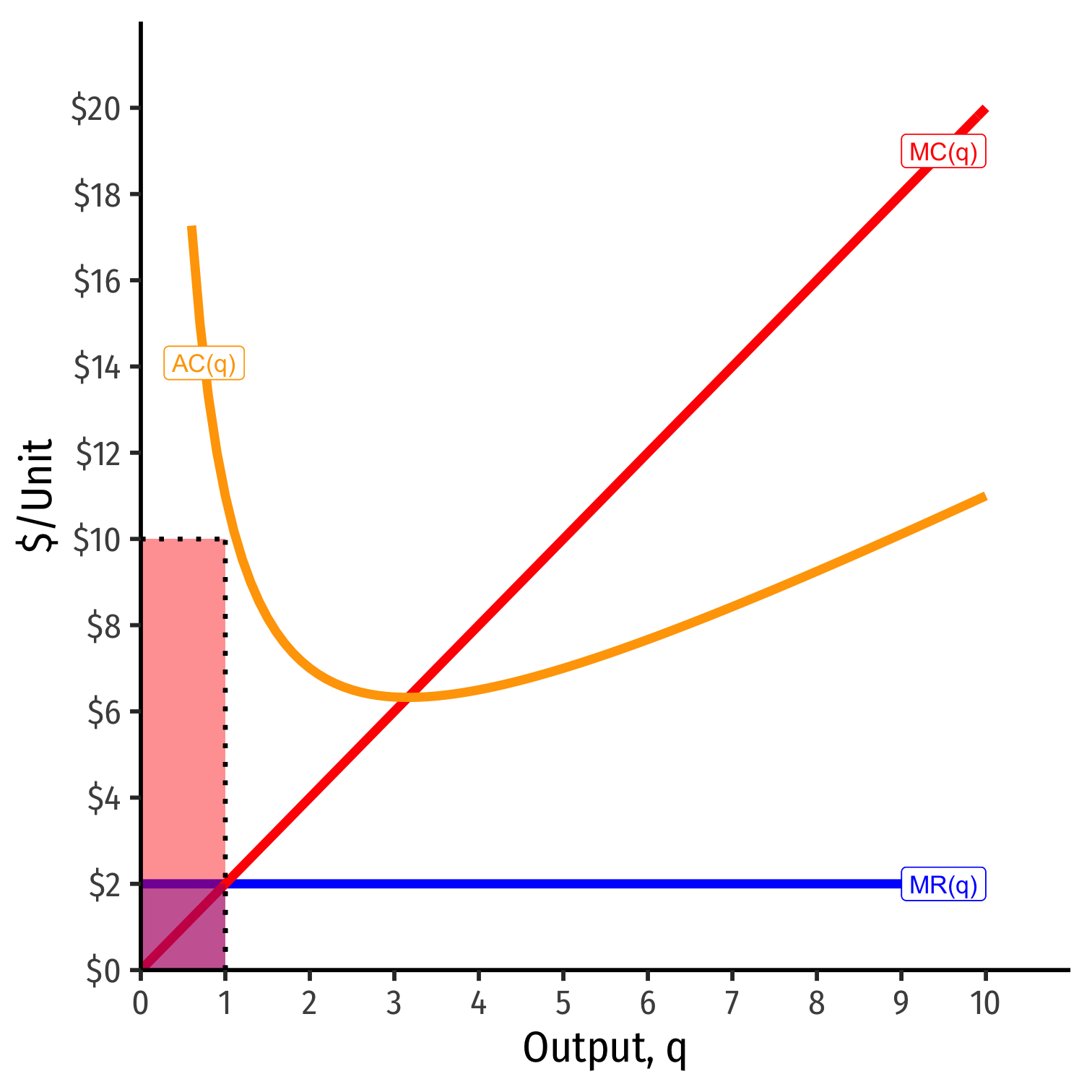

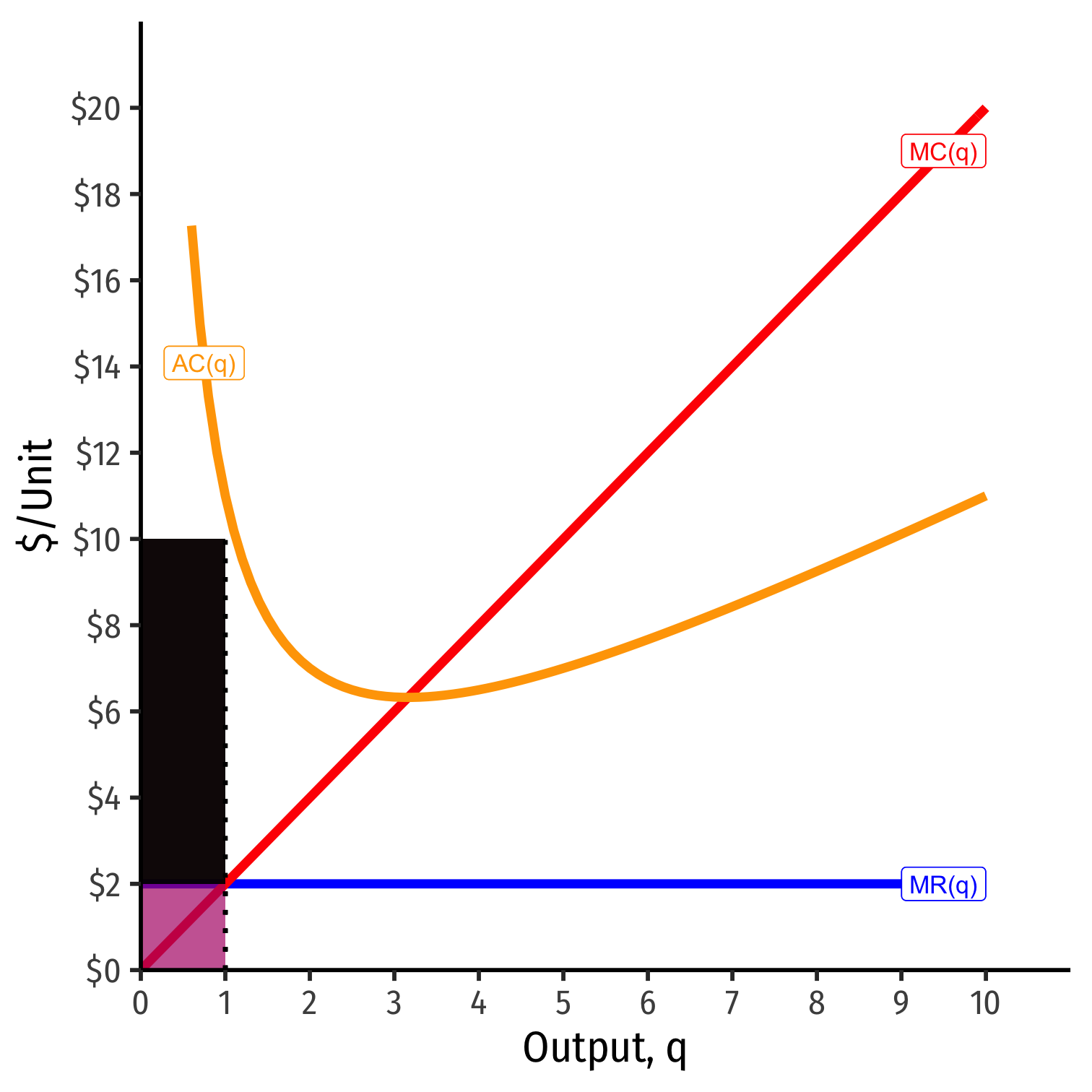

At market price of p∗= $2

At q∗=1 (per unit):

At q∗=1 (totals):

Calculating Average Profit as AR(q)−AC(q)

At market price of p∗= $2

At q∗=1 (per unit):

- AR(1)= $2/unit

At q∗=5 (totals):

- R(1)= $2

Calculating Average Profit as AR(q)−AC(q)

At market price of p∗= $2

At q∗=5 (per unit):

- AR(1)= $2/unit

- AC(1)= $7/unit

At q∗=5 (totals):

- R(1)= $2

- C(5)= $35

Calculating Average Profit as AR(q)−AC(q)

At market price of p∗= $2

At q∗=5 (per unit):

- AR(1)= $2/unit

- AC(1)= $10/unit

- Aπ(1)= -$8/unit

At q∗=5 (totals):

- R(1)= $2

- C(1)= $10

- π(1)= -$8

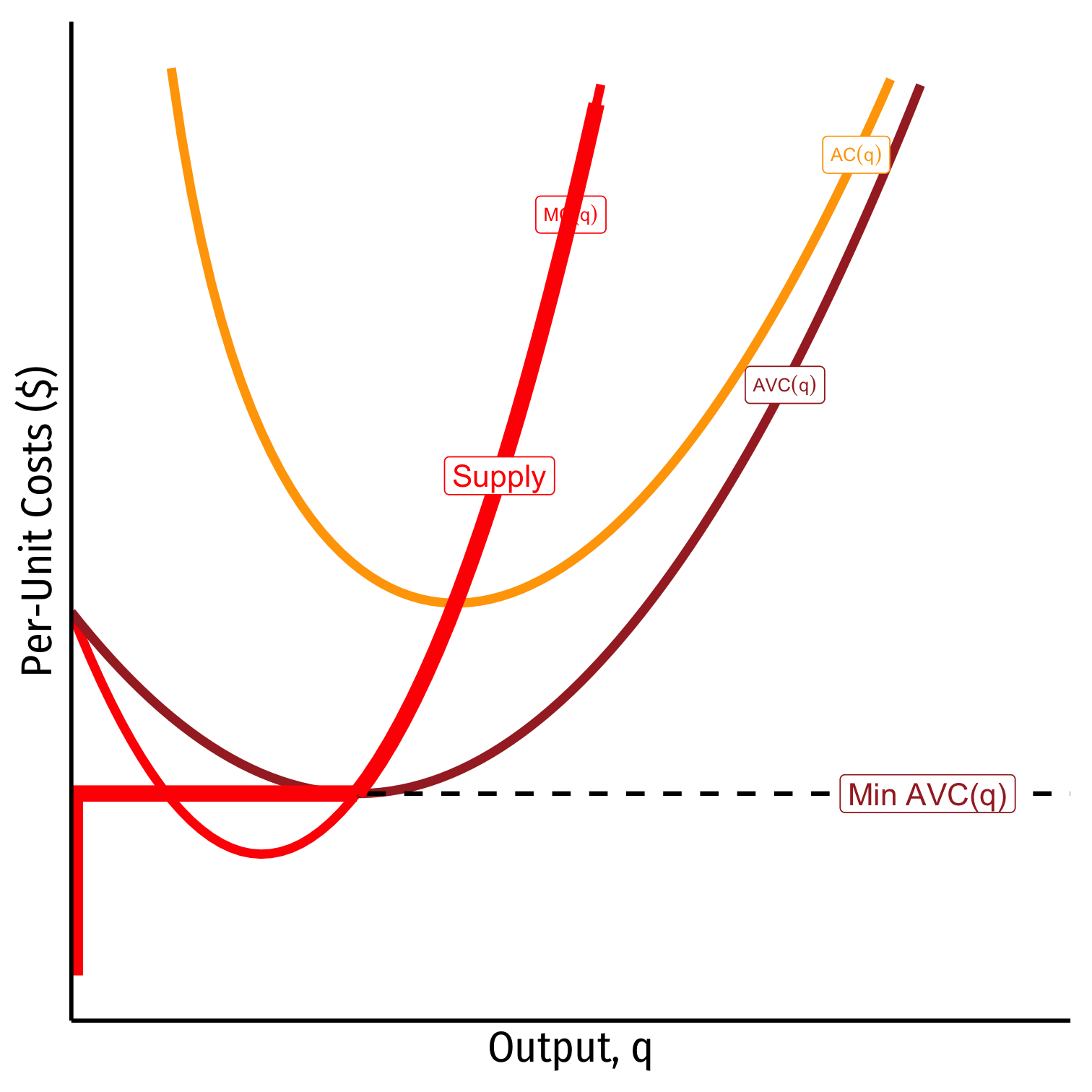

Short-Run Shut-Down Decisions

Short-Run Shut-Down Decisions

What if a firm's profits at q∗ are negative (i.e. it earns losses)?

Should it produce at all?

Short-Run Shut-Down Decisions

Suppose firm chooses to produce nothing (q=0):

If it has fixed costs, its profits are:

π(q)=pq−C(q)

Short-Run Shut-Down Decisions

Suppose firm chooses to produce nothing (q=0):

If it has fixed costs, its profits are:

π(q)=pq−C(q)π(q)=pq−f−VC(q)

Short-Run Shut-Down Decisions

Suppose firm chooses to produce nothing (q=0):

If it has fixed costs, its profits are:

π(q)=pq−C(q)π(q)=pq−f−VC(q)π(0)=−f

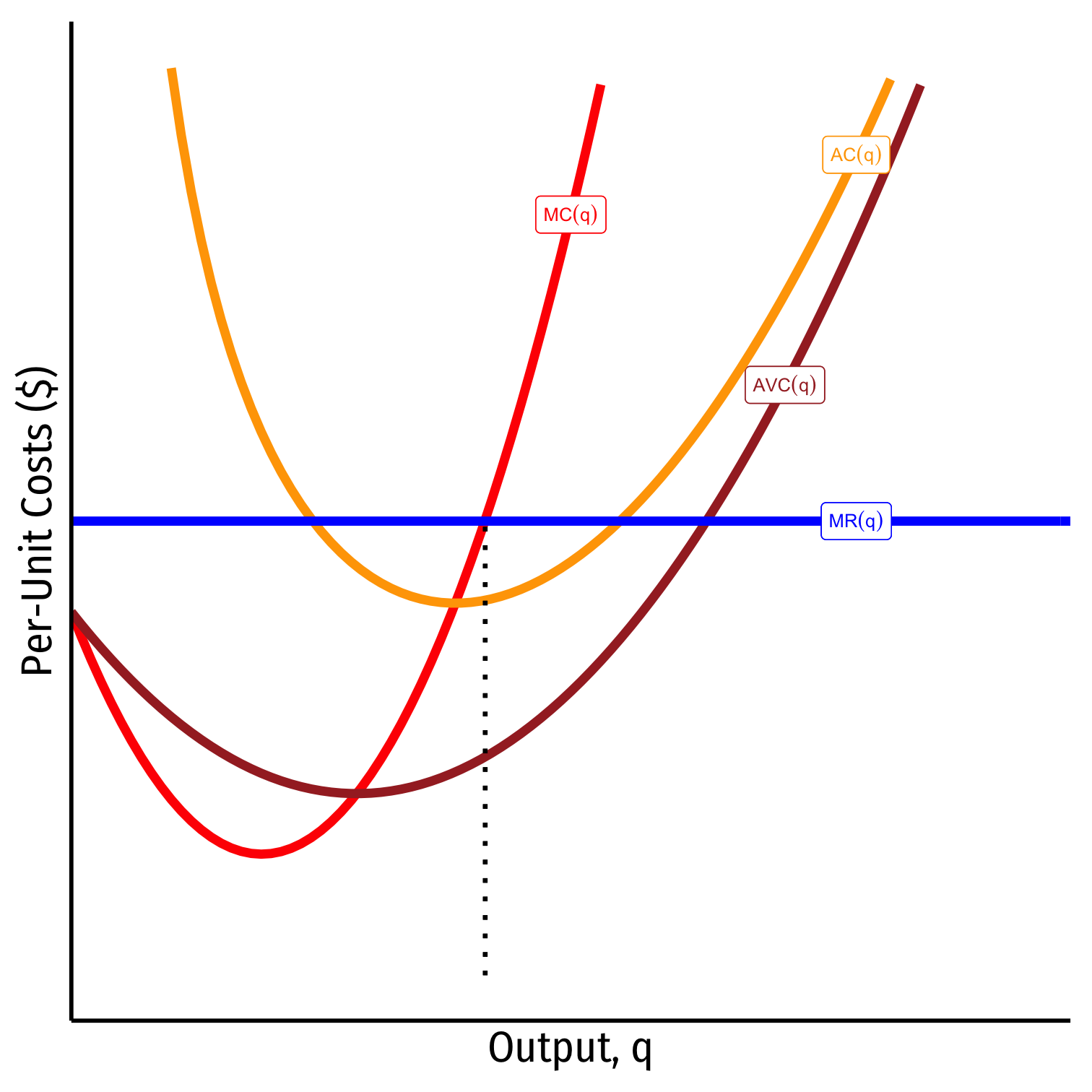

Short-Run Shut-Down Decisions

- A firm should choose to produce nothing (q=0) only when:

π from producing<π from not producing

Short-Run Shut-Down Decisions

- A firm should choose to produce nothing (q=0) only when:

π from producing<π from not producingπ(q)<−f

Short-Run Shut-Down Decisions

- A firm should choose to produce nothing (q=0) only when:

π from producing<π from not producingπ(q)<−fpq−VC(q)−f<−f

Short-Run Shut-Down Decisions

- A firm should choose to produce nothing (q=0) only when:

π from producing<π from not producingπ(q)<−fpq−VC(q)−f<−fpq−VC(q)<0

Short-Run Shut-Down Decisions

- A firm should choose to produce nothing (q=0) only when:

π from producing<π from not producingπ(q)<−fpq−VC(q)−f<−fpq−VC(q)<0pq<VC(q)

Short-Run Shut-Down Decisions

- A firm should choose to produce nothing (q=0) only when:

π from producing<π from not producingπ(q)<−fpq−VC(q)−f<−fpq−VC(q)<0pq<VC(q)p<AVC(q)

Short-Run Shut-Down Decisions

- Shut down price: firm will shut down production in the short run when p<AVC(q)

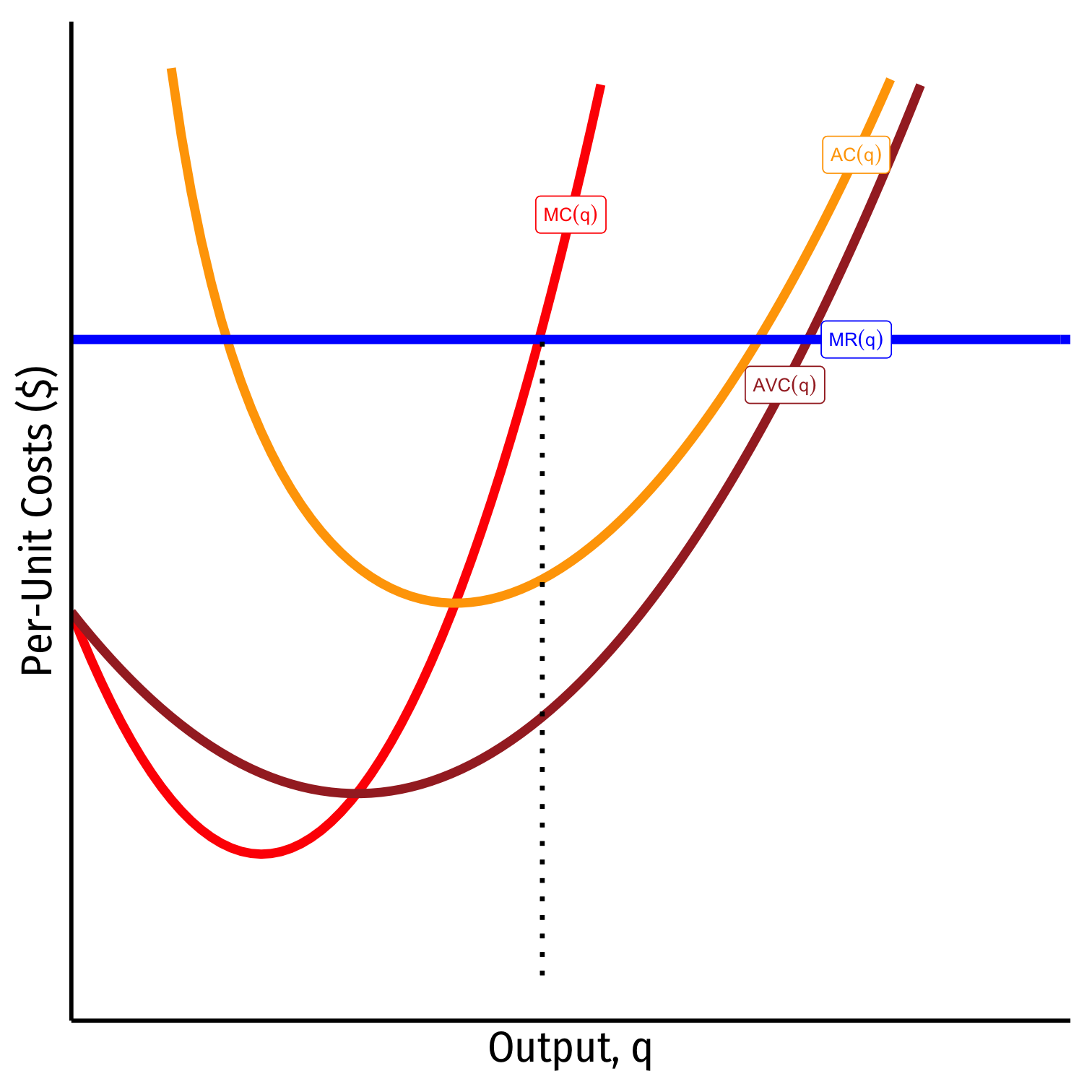

The Firm's Short Run Supply Decision

The Firm's Short Run Supply Decision

The Firm's Short Run Supply Decision

The Firm's Short Run Supply Decision

The Firm's Short Run Supply Decision

The Firm's Short Run Supply Decision

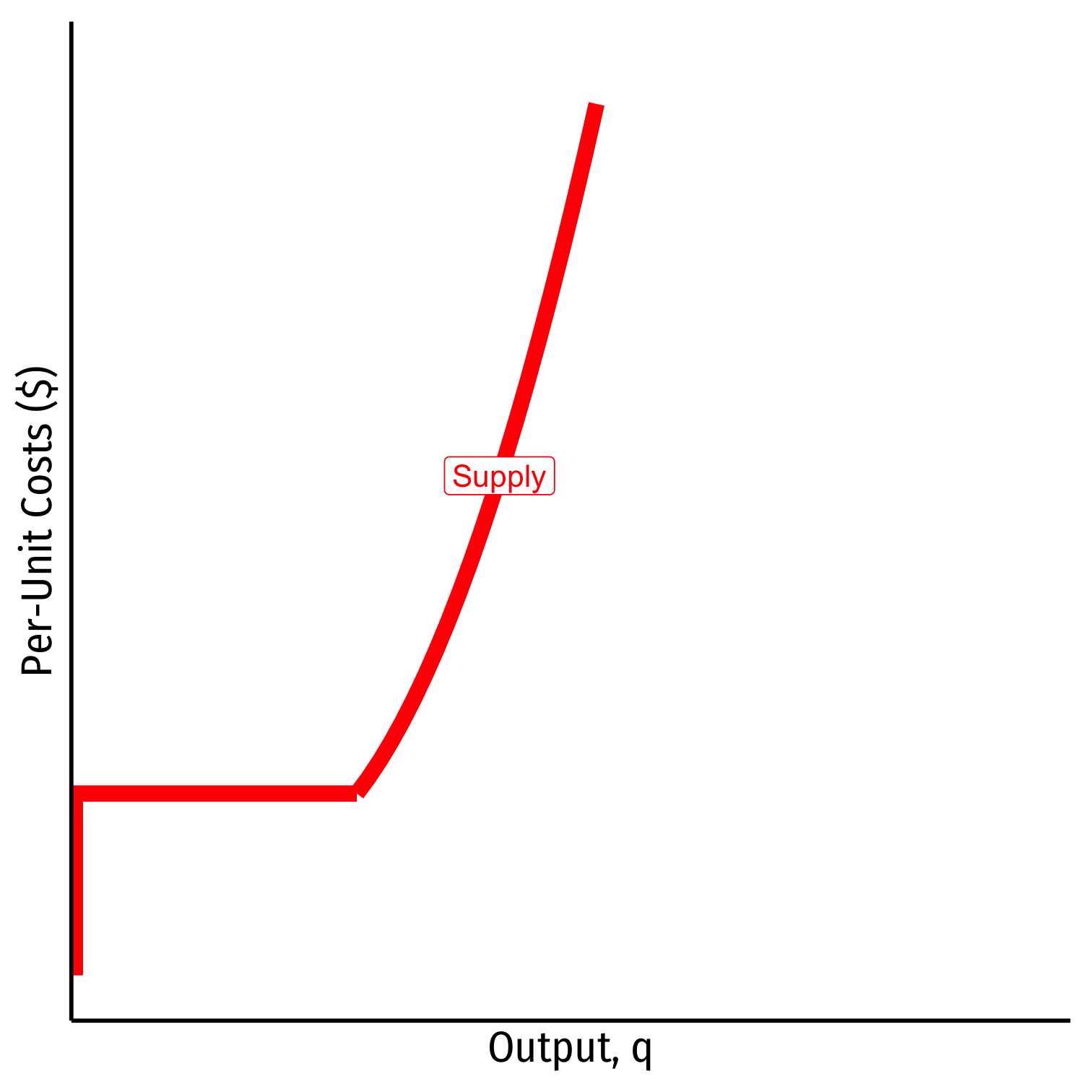

Firm's short run (inverse) supply:

The Firm's Short Run Supply Decision

Firm's short run (inverse) supply:

Summary:

1. Choose q∗ such that MR(q)=MC(q)

Summary:

1. Choose q∗ such that MR(q)=MC(q)

2. Profit π=q[p−AC(q)]

Summary:

1. Choose q∗ such that MR(q)=MC(q)

2. Profit π=q[p−AC(q)]

3. Shut down if p<AVC(q)

Summary:

1. Choose q∗ such that MR(q)=MC(q)

2. Profit π=q[p−AC(q)]

3. Shut down if p<AVC(q)

Firm's short run (inverse) supply:

{p=MC(q)if p≥AVCq=0If p<AVC

Choosing the Profit-Maximizing Output q∗: Example I

Example: Bob's barbershop gives haircuts in a very competitive market, where barbers cannot differentiate their haircuts. The current market price of a haircut is $15. Bob's daily short run costs are given by:

C(q)=0.5q2MC(q)=q

How many haircuts per day would maximize Bob's profits?

How much profit will Bob earn per day?

Find Bob's shut down price.

Choosing the Profit-Maximizing Output q∗: Example II

Example: A firm has short-run costs given by: C(q)=q2+1MC(q)=2q

Write equations for fixed costs, variable costs, average fixed costs, average variable costs, and for average (total) costs.

Suppose the firm is in a competitive market, and the current market price is $4, how many units of output maximize profits?

How much profit will this firm earn?

At what market price would the firm break even (π=0)?

Below what market price would the firm shut down in the short run if it were earning losses?